Thursday - February 19, 2009

Thursday - February 19, 2009

When the ‘Standard Deduction’ is no longer ‘Standard’

Today I finally broke down and did my tax returns, Federal and State. And I found that the ‘standard deduction’ isn’t… uh… standard anymore.

Thought I would bring this to your attention. Just in case I’m entirely crazy, maybe some BMEWS’d accountant would set me straight. Before I file a false return… ![]()

A little background: I’ve always done my own taxes since my parents cut me lose as a college freshman in ‘78. And indeed, I’ve screwed up before and paid dearly. Not that the tax owed was too onerous, but the penalties and interest after three years? (which is how long the IRS took to catch my oversight) Whew!

I used to be able to itemize deductions. This was back when the youngest child was still at home. He moved out on his own in ‘94. Since then, while I always check, the standard deduction has been better. (I’d like to thank Ronald Reagan. He indexed the tax tables to inflation. Though I’m now getting too close to the Alternative Minimum Tax, which I also check every year. The AMT has NEVER been indexed for inflation.)

For those that don’t know, you can take the ‘standard deduction’, which differs for single, married, qualified widow(er)s, etc. Or you can ‘itemize’ if that is more beneficial. When itemizing, you can deduct things like mortgage interest, property taxes, other state and local taxes, union dues, healthcare costs that exceed a certain floor, etc. The point is that the ‘itemized deductions’ should exceed the ‘standard deduction’. Otherwise, what’s the point? You have to keep records of expenditures… etc.

The standard deduction, I’ve always assumed, included all of the above. Just makes things easier.

There’s a new line on my 1040: Line 39c says,

Check if standard deduction includes real estate taxes or disaster loss (see page 34)

Huh? What is this? I’ve paid attention to these things since I took that H&R Block tax course back in ‘87. Of course I turned to page 34. There’s a worksheet to fill out…

The bottom line is this: The ‘standard deduction’ is no longer standard. You can now add a portion of your property taxes paid during the last year ($500 if single, $1000 if married filing jointly) to the so-called ‘standard deduction’. Remember what I stated above: The standard deduction assumes a certain amount of property taxes. This is supposed to make things simpler.

Now I have a worksheet to find out what my ‘standard deduction’ is.

I benefited this time around. Instead of the normal $400-$500 I usually owe in April, this year I owe a whopping $45 and some change.

I’m not really complaining about the result this year. But, I’m sure some Democrats will try to raise taxes on ‘the rich’ like me. They’ll say I ‘only paid’ $45.00 last year. And their idiot constituency will believe it!

Remember, What Congress giveth, B. Hussein Obama can taketh away… with interest!

Posted by Christopher

Filed Under: • Democrats-Liberals-Moonbat Leftists • Taxes •

• Comments (2)

Saturday - February 14, 2009

Saturday - February 14, 2009

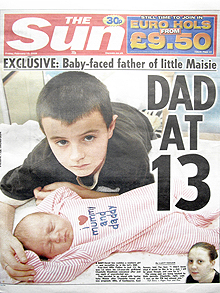

Boy who became father at 13 raises ‘worrying’ questions. NOT TO WORRY. TAXPAYER WILL COVER THE COST

He’s a daddy at age 13, asks “what’s financially?” and some adult is saying ....

”We hope they will be good parents, but parenthood is not what they should have been thinking about.”

and she’s 15. Oh right. Great parents. He comes from a family of 9 and she almost as many.

They live in “COUNCIL HOUSING” friends. Council housing. Has a ring to it huh? For Americans who may not know, but I suspect you do know, “council housing” is the same as our “low income” housing. As in no income except welfare income. And mommies and some daddies here get PAID SO MUCH FOR EACH KIDDIE!

And I suspect again that soon as these kiddies are no longer kiddies but late teens, well ,, I remember an old movie called Cheaper By the Dozen.

Except for the taxpayer.

Hey that’s almost funny when you think about it.

There are working parents who CAN NOT AFFORD more then one or two children at most. But ... you see this one coming right?

They’re supporting thousands (I don’t really know the exact figure) of welfare families with multiple kids and more on the way.

OH BTW .... I ALMOST FORGOT. THIS ISN’T EXACTLY THE END OF THIS STORY.

HERE’S THE FUN PART.

Teenage sister of boy who became a father at 13 had baby when she was the same age

By Daily Mail Reporter

Last updated at 4:40 PM on 14th February 2009

Family can claim £30,000 benefts

Chantelle Stedman can claim no benefits until she reaches 16, her next birthday.

But state benefits to support her and her baby will be paid to her mother Penny until then.

At a minimum, the family can expect to receive around £30,000 a year - close to £600 a week.

Penny, 38, will claim benefits to support herself and her four children including Chantelle.

She will also claim on behalf of new-born Maisie.

The family may claim benefits on the basis that Penny’s unemployed partner Steve is a live-in member of the household.

If so, their claims may look like this:

* Child Benefit: Paid automatically for each child - £72.80 a week.

* Council Tax Benefit: Likely to cover the full bill - £30 a week.

* Child Tax Credit: Now the main payment to support children of out-of-work or low income mothers. Possible payment for the five Stedman children - £221 a week.

* Income Support: If paid to Penny and Steve as a live-in couple - £94.95 a week.

* Housing Benefit: Likely to cover the full rent of their council house, together with any service charges. This may be - £150 a week.

* Total: £568.75 a week, or £29,575 a year.

A schoolboy who became a father at the age of 13 has raised disturbing questions about society, leading politicians said yesterday.

By John Bingham

Last Updated: 5:02PM GMT 13 Feb 2009But police and social services said no one would be prosecuted over the case of Alfie Patten whose 15-year-old girlfriend Chantelle Stedman gave birth to a daughter earlier this week.

Pro-life campaigners praised the two children as courageous for deciding to go ahead with the pregnancy but the Conservative leader David Cameron said the case raised “worrying” questions about modern Britain

Alfie, who is just over 4ft tall and looks younger even than his 13 years, was only 12 years old when he got Chantelle - who was then 14 - pregnant.

The schoolboy from Hailsham, East Sussex, was allowed to stay over at Chantelle’s house after originally meeting through their mothers. He was often seen emerging in the morning in his school uniform.

Neighbours claimed that Chantelle’s mother Penny, 38, had been Alfie’s babysitter and cared for him at weekends to give his mother a break.

But the two young people soon became “inseparable” and were, it was claimed, allowed to sleep in the same bed.They discovered Chantelle was pregnant when she visited a GP complaining of stomach pains but initially tried to keep it a secret even from their parents.

Mrs Stedman soon became suspicious after noticing her daughter putting on weight.

The young couple decided against having an abortion and Chantelle gave birth to their daughter, Maisie Roxanne, at Eastbourne District General Hospital earlier this week.

Despite his age, Alfie - who is himself one of nine children - has spoken of his intention to care for the child.Asked in an interview for The Sun newspaper what he would do financially, he replied: “What’s financially?”

He told the paper: “I didn’t think about how we would afford it. I don’t really get pocket money, my dad sometimes gives me £10.”

The couple claimed that they slept together only once when Chantelle, who lives with her five brothers and sisters in a council house in Eastbourne, became pregnant but friends said that Alfie regularly slept at her house.

Neighbours said that until Chantelle became pregnant, the Stedman home was a popular local hangout with people calling in to smoke cannabis. Others said there had been fights with neighbours.

“Before she got pregnant there were people going in and out every day but as soon as she got pregnant she was just in there all the time,” said one.

“We hope they will be good parents, but parenthood is not what they should have been thinking about.”

Posted by peiper

Filed Under: • Miscellaneous • Outsourcing • Taxes • UK •

• Comments (7)

Tuesday - February 03, 2009

Tuesday - February 03, 2009

It’s a Balance Thing

Tom Daschle withdrew his nomination for health and human services secretary Tuesday, after fielding mounting criticism over his failure to pay more than $130,000 in taxes.

The move marked a stunning turnaround from the day before, when Daschle mounted a campaign to retain allies on Capitol Hill and President Obama told reporters he “absolutely” stands by the former South Dakota senator.

But the president accepted Daschle’s withdrawal with “sadness and regret” Tuesday morning, according to a White House statement.

Yadda yadda, support the president, yadda yadda, don’t want to be a distraction. In other words, he is too big a crook. Too much of a tax cheat. Ok, I can accept that.

But Geithner, who owed $34,000 in unpaid taxes, went through the nomination process like effluent through the proverbial waterfowl. He’s in. So $34,000 worth of tax cheating is Ok.

Does this mean that the right number is ($34,000+$146,000)/2 = $90,000? Is that the upper cheater limit allowable? Because these jobs all come with a nice paycheck. And I can forget to pay my taxes if that’s what it takes to get in the front door.

Bill Richardson had to pull his name out of the hat too, because his dirty money problems weren’t tax liabilities, they were somehow connected to improper campaign donations. Works for me; I haven’t had a thing to do with any donations to anyone. Ok, $20 to Fred Thompson, and $50 to Sarah Palin Juan McAmnesty. But I will promise to run up some tax debt if that can get me one of those $200,000 a year cabinet jobs.

The confusing part is that I also hear that Nancy Killefer also withdrew her name. She was in the running for White House Performance Officer (now there’s a position Clinton would have appreciated!!) but she had her own tax problems: DC fined her $946 for not paying $298 in unemployment compensation for her household help. I guess that $298 either goes back a long long time, or her fine was so large because she was abusing the hired (illegal?) help. So her under $300 problem might have been more important than Geithner’s $34,000. It’s all the look of the thing after all.

Posted by Drew458

Filed Under: • Crime • Democrats-Liberals-Moonbat Leftists • Taxes •

• Comments (1)

Friday - December 26, 2008

Friday - December 26, 2008

Thousands of foreign prisoners freed early – with compensation !!!!!!!!! What? No Kisses and

Dear BMEWS Diary,

Today is the day after Christmas, Dec.26th.

I was a reasonably good boy yesterday and did not swear and cuss once or use lord’s name in vain the whoooooole day.

Well, not within the hearing of the grownups I didn’t.

I did overeat however. I committed gluttony but it wasn’t my fault. I was not responsible for my piggish behavior. It was the cook’s fault. And the turkey for allowing itself to become a meal. I think I may sue the farmer from whence that dumb turkey originated.

I wasn’t feeling too well last night. I kept hearing this gobble noise in the middle of the night.

But today is Monday, whoops. I mean Friday and the start of brand new day.

And dear Bmews Diary, we know what that means. Don’t we?

I AM SEEING RED AGAIN! If this lunacy is happening here, then it has to be the same in my homeland.

Here I was minding my own own business and that of my sore tummy which thank you was improved after breakfast.

I made a nice calming cup of tea as suggested by my nurse/wife/psychiatrist, opened the morning paper and came upon this on the other side of the first page.

Thousands of foreign prisoners have been released from jail before the end of their sentence and given cash to compensate for the loss of food and board.

By Rosa Prince, Political Correspondent

Last Updated: 8:04AM GMT 26 Dec 2008Figures released by the Conservatives show that 2,196 foreign offenders have been invited to take part in the early release scheme, called End of Custody Licence, since its introduction 15 months ago in response to prison overcrowding.

As well as walking free having served less than half of their sentence, each released prisoner is entitled to around £7 a day in compensation to make up for missing out on the state-provided food and lodging they would have received had they remained in jail.

Offenders released on End of Custody Licence receive an initial discharge payment of £46, followed by the subsistence allowance of £47.12 a week, up to a cap of £168.24.

If all those eligible received the full allowance, the taxpayer would by now have paid out £369,455 in compensation to foreign prisoners who had been released early.

The disclosure, in a written Parliamentary answer from the Ministry of Justice, follows recent pledges by Gordon Brown that foreign nationals who commit crimes in Britain “will be deported” and “will pay the price”.

Nick Herbert, the shadow justice secretary, said that for every three foreign prisoners the Home Office was now removing from the UK, two more were allowed to go free and six entered the prison system.

He added: “The Government want to create the impression that they’re successfully deporting foreign national criminals, but the truth is that for every three prisoners they remove, two more are released onto the streets.

“Far from paying the price as Gordon Brown promised, foreign national offenders are being rewarded by serving less than half of their jail sentence and with taxpayers’ cash in their back pockets.”

There are now around a thousand more foreign prisoners in British jails than in 2006 when Charles Clarke was forced to resign as Home Secretary amid accusations that the Home Office had failed to deport overseas offenders.

The number of foreigners in prison currently stands at 11,168, up 11 per cent since Mr Clarke’s departure, with offenders from Vietnam and Poland accounting for more than half of the increase. There are 460 Vietnamese in UK jails along with 452 Poles.

Such is the scale of offending by foreigners that there are now three jails reserved exclusively for prisoners from overseas: Canterbury in Kent, Bullwood Hall in Essex and Morton Hall in Lincoln. The equivalent of one more prison is taken up by offenders who have served their sentence and are awaiting deportation, at an average annual cost of £40,000 each – a total of £22 million.

It is possible to deport an offender only if an agreement exists with their country of origin to take them.

The Tories say that Government pledges to sign agreements with Jamaica, China and Nigeria have yet to be fulfilled.

David Hanson, the Justice Minister, said that the early release scheme would end as soon as work was completed to expand the number of prison places.

He added: “All prisoners are provided with basic subsistence to enable them to pay for accommodation, food and essentials following release.”

Meanwhile, separately the Home Office announced that a record number of foreign prisoners had been deported in the last 12 months.

The UK Border Agency sent 5,000 foreign offenders back to their country of origin, exceeding last year’s total of 4,200.

They included 50 killers and attempted killers, more than 200 sex offenders and more than 1,500 convicted of drug offenses.

Phil Woolas, the Immigration Minister, said: “Britain will not tolerate those that come here and break our rules.”

(YEAH, LIKE ANYONE BUYS INTO THAT. BAD GUYS DON’T)

Posted by peiper

Filed Under: • Crime • Insanity • Taxes • UK •

• Comments (3)

Saturday - December 13, 2008

Saturday - December 13, 2008

Pay £500,000? God help us, say couple forced by a medieval law to foot the bill for church repa

This is a very long but a MUST read! So I won’t add to this and besides, there isn’t anything I could add.

Learn something new every day.

INTERESTING!

Gail and Andrew Wallbank inherited their beautiful home. But it came with a hidden timebomb...

By Victoria Moore

Last updated at 1:03 AM on 13th December 2008This is a beautiful spot. The church of St John the Baptist stands in the Warwickshire village of Aston Cantlow, in a small churchyard scattered with gravestones and dotted with neatly trimmed yew and holly.

It’s here that Shakespeare’s parents are thought to have married, and if the walls look a little crumbly and uneven… well, perhaps that’s only to be expected of a building that dates back to the 13th century.

To Gail and Andrew Wallbank, however, the flaking masonry that surrounds the church’s stained-glass windows - and the suspiciously leaky-looking patches inside - are less a source of picturesque charm than one of stomach-gnawing anxiety.

This is because, due to a peculiar ancient law that goes back to the reign of Henry VIII, the Wallbanks, who own a nearby farmhouse, have found themselves saddled with the repair bill for the chancel - the eastern end of a church, in which the pulpit and choristers’ stalls are normally found. And it isn’t small.

At the last count, the sum owed was £186,989. Plus VAT. (They must, I think, be the only people in England feeling a real sense of relief about the 2.5per cent cut in VAT.) Oh, and then there’s the interest, which they say they are paying at 8per cent and which began accumulating in February 2007.

Add to that the £200,000 they have spent in legal fees fighting their case over the years, and the Wallbanks are looking at a figure close to half a million. ‘And it’s not as if that’s the end of it,’ says Gail, 60, fastening up a bobbly jacket that looks as if it has seen better days.

‘This could go on and on. We have to finance any repairs the chancel needs, which effectively means we’re in the position of providing an open cheque-book. We now have until February 16 to find the money and I just don’t know how we’re going to do it. We’re at our wits’ end.’

The Wallbanks are a warm, calm and attractively dishevelled couple who, as well as raising a family of seven, have been fighting the case for 18 stressful years.

So far, it has been to the High Court, the Court of Appeal and all the way to the House of Lords, which found in favour of the Parochial Church Councils (PCCs) in 2003, and in 2007 set the amount that the Wallbanks now have two months to pay.

A plague on unwitting homeownersHaving exhausted all their legal options, the couple understandably feel some degree of despair as the deadline approaches. Soon they may not be the only ones - indeed, there may be many thousands of other Britons who are unknowingly in the same position.

For the implications of what is effectively a test case could be wide-reaching: a blessing for the cash-strapped Church of England, which has many dilapidated buildings in urgent need of repair, but a plague on homeowners who may unwittingly own land - a garden, field, allotment or even the plot on which their house is built - that carries a chancel repair liability.

This, as Andrew Wallbank drily puts it, can be ‘a bit like winning the Lottery in reverse’. In other words, it can suck hundreds of thousands of pounds from the unfortunate loser’s bank account.

Such chancel repair liabilities are thought to apply to some 5,200 pre-Reformation parishes in England and Wales - though nobody knows for sure how many properties might be affected, as the legal documents are, in some cases, both ancient and in poor condition. That’s if they can be traced at all. The law in question dates back to medieval times, when the parishioners had a duty to repair the nave - the part of a church in which the congregation sits to worship - while the rector had a responsibility to repair the chancel end. A rector would pay for his share of the repairs using income from land attached to his rectory - ‘glebe land’ - as well as from tithes.

After the dissolution of the monasteries, that land was dispersed but never separated from the obligation to pay for chancel repairs, making the new landowners ‘lay rectors’.

In successive years, some of this land has been sold and re-sold, divided up, developed on and changed hands many times so that its history of liability has sometimes been forgotten. Nor is it always found in rural parishes: one case is known of in Fulham, South-West London.

Fast-forward to recent times, and the cash-strapped Church has been busy encouraging its PCCs to seek out any lay rectors it can find - and quickly, because chancel repair liabilities will become unenforceable unless they are registered at HM Land Registry by 2013. For some people, their happy ignorance may be about to come to a halt, as it did for the Wallbanks.

‘I inherited Glebe Farm, which is about half a mile away from the church, from my father,’ explains Gail. ‘We were actually married in the church, in September 1973, but moved away from Aston Cantlow a few years later to live on a sheep farm in Wales.

‘After my father died, rather than sell the farmhouse or move back, we rented it out. At first, my mother and brother lived here; afterwards we had other tenants.’

And then, out of the blue one day at the beginning of 1990, a letter arrived from the church wardens of St John the Baptist.

‘We hope that you are well and are enjoying your life in that beautiful part of Wales in which you now live,’ it began with ominous good cheer. But it then continued: ‘As the owner of Glebe Farm, you know that there is a charge. . . for the maintenance and the repair of the Chancel of St John the Baptist.’

It went on to detail the outcome of an architect’s report, which suggested that a large amount of expensive work needed to be done to the Grade I listed church - among which were three windows that needed repairing at a cost of £2,000 each - and concluded that, ‘if a large job is necessary, we are obliged to ask for your financial support’.

The ever-increasing demands for cash

To Gail and her husband Andrew, far more alarming than this polite request for money was its open-ended nature. As Mrs Wallbank puts it: ‘We didn’t mind making a voluntary donation to its upkeep - someone, after all, has to pay for these beautiful old buildings and we’d got married in this church - but the fear was that this would go on and on. If we paid one year, how much the next, and the next? How much would it end up costing us?’

The answer to that we now know to be about £200,000. But back then the Wallbanks were merely at the start of a protracted legal odyssey that has consumed their lives for almost two decades since.

They have had to become experts in tithe law, and spend days poring over the minutes of PCC committee meetings. They have even commissioned experts to transcribe an 18th-century Enclosures Award document written on vellum - fine parchment made from calfskin - so fragile it can be handled only by someone wearing gloves and whose script is so faint it must be examined under ultraviolet light.

Mrs Wallbank’s father bought Glebe Farm at auction in 1970 (a year when the average house price was £4,950) for the sum of £41,500. The sale documents do include a clear reference to the chancel repair liability, which it notes ‘is still subsisting and capable of being enforced’.

Gail, however, says her father had made inquiries, including with the vicar at the time, and was confident this clause was a mere anachronism with no legal force. Thus, on inheriting the farm, she too felt reassured that this amounted to nothing more than a gentleman’s agreement.

With the benefit of hindsight, this assumption sounds naive. But the Wallbanks point to the handwritten minutes of an extraordinary meeting of the PCC in July 1968 which was concerned with raising funds for work on the chancel roof. In these, it is noted: ‘Vicar said that while he would approach Mr Terry [the then owner of Glebe farm] he had been informed by Diocesean lawyers that this [obligation] had no weight in law.’

The Wallbanks also say they have been unable to find any case in which any owner of Glebe Farm has, over the centuries, been required to foot any bill for the chancel, though some have done so voluntarily.

‘My father had also made a contribution to the church repairs,’ says Gail. ‘He paid for some of the ornamentation on the church tower to be replaced, and that wasn’t connected at all to the chancel.’

The church fights back

SEE CHURCH FIGHTS BACK for all the photos and the rest of the story. Yes, there’s more.

Posted by peiper

Filed Under: • Economics • Religion • Taxes • UK •

• Comments (2)

Friday - November 07, 2008

Friday - November 07, 2008

NYC Suburban Tax Bite

Back in Sept. the U. S. Census bureau data from last year shows the highest property taxes paid by property owners in the country. The 2007 American Community Survey put together a list of the twenty counties with the highest property taxes. The data is online at The Tax Foundation..

| The 20 counties with the highest property taxes in America, and their median tax bill. | |

| 1 ) Westchester County, NY: $8,422. | 11) Putnam county, NY: $6,860 |

| 2 ) Hunterdon County, NJ: $8,224. | 12) Suffolk County, NY: $6,763

|

| 3 ) Nassau County, NY: $8,153. | 13) Monmouth, NJ: $6,494 |

| 4 ) Bergen County, NJ: $7,797. | 14) Lake county, IL,: $6,089.

|

| 5 ) Somerset County, NJ: $7,597. | 15) Hudson county, NJ: $6,007. |

| 6 ) Rockland County, NY: $7,535. | 16) Fairfield County, CT: $5,962. |

| 7 ) Essex County, NJ: $7,281. | 18) Sussex county, NJ: $5,803. |

| 9 ) Union county, NJ: $7,007 | 19) Mercer county, NJ: $5,734. |

| 10) Passaic County, NJ: $6,928 | 20) Warren County, NJ: $5,673. |

Nationwide, the median tax bill is $1838.

This little map outlines those counties in red. 19 of the highest taxed counties in the country are in the Tri-State counties outside of New York City. The counties outlined in blue are in the Top 50 counties with the highest property taxes. A similar situation exists around Chicago.

Interesting that it the suburban areas outside the cities, the bedroom communities of New York City, Chicago and perhaps Philadelphia, that pay the highest property taxes, but not the cities themselves. Looks to me like the Wealth is already well Spread Around.

Posted by Drew458

Filed Under: • Taxes •

• Comments (6)

Sunday - November 02, 2008

Sunday - November 02, 2008

Sounds fair to me!

From His Rottiness Emperor Misha I

Dear Fellow Business Owners,

As a business owner who employs 30 people, I have resigned myself to the fact that Barack Obama will be our next president, and that my taxes and fees will go up in a BIG way.

To compensate for these increases, I figure that the Customer will have to see an increase in my fees to them of about 8 to 10%. I will also have to lay off six of my employees. This really bothered me as I believe we are family here and didn’t know how to choose who will have to go. So, this is what I did.

I strolled thru the parking lot and found eight Obama bumper stickers on my employees’ cars. I have decided these folks will be the first to be laid off.

I can’t think of another fair way to approach this problem. If you have a better idea, let me know.

Posted by Christopher

Filed Under: • Taxes • work and the workplace •

• Comments (7)

Wednesday - October 15, 2008

Wednesday - October 15, 2008

JOBLESS COUPLE WITH 10 KIDS ON THE DOLE, UNHAPPY. THEY WANT MORE BENEFITS!

Can’t find the words to fit the story here. Pretty certain bet that the offspring will follow in parents footsteps.

The jobless couple with 10 children who rake in £32,000 a year in benefits.. and who STILL aren’t happy

By NEIL SEARS

Last updated at 5:41 PM on 14th October 2008Tracey Crompton has never had a job, and her husband Harry has been out of work for 15 years.

Yet the couple live for free in a seven bedroom house with their ten children and receive £32,656 in benefits a year.

They even have their own vineyard in their 270ft long garden.

In fact, they receive so much in handouts that they have already bought and wrapped £3,000 worth of Christmas presents, and plan to buy more.

The couple say they are enjoying the credit crunch because it has forced down the price of luxury goods like TVs and computer games, but do have two gripes.

Firstly, they want even more benefits.Secondly, that their neighbours have nicknamed them ‘Britain’s Biggest Freeloaders’.

Mrs Crompton, 40, moaned: ‘I’m not satisfied with the benefits we get - I want more. I haven’t been able to work because I’ve had to bring up the kids and Harry’s got health problems.’

Fortunately their benefits do stretch to a £250 weekly shop which usually includes 50 packs of crisps and ten litres of fizzy drinks.

Mrs Crompton went on: ‘If the kids need something I go and get it. I rarely go without things either. If I need something, like a new pair of shoes, then I’ll get it.’

The couple and their children Michael, 20, Robin, 19, Matthew, 17, Sarah, 16, Samantha, 14, Harry Andrew, 12, Alex, 11, Kristian, nine, Jesse Lee, seven, and Joshua, six - live in Hull in two semis knocked into one.

As both are unemployed, their weekly £120 rent is paid by housing benefit and they receive another £628 a week in income support, disability and carer’s allowance and other payments. Mr Crompton, 50, says he is unable to work due to angina and irritable bowel syndrome.

Mrs Crompton said: ‘We don’t have money worries. We don’t go without things and I think that’s because we are self-sufficient. We grow our own food. I don’t see why others should have money worries.’

Sadly, others do not always understand. ‘Every time I walk down the street, people shout “scroungers”,’ said Mrs Crompton.

And it seems that she does not have the time for housework.

The walls of her home are dirty and peeling and the floor is covered in videos and magazines.

‘I don’t have much time for cleaning since I started a college course in catering,’ said Mrs Crompton.

‘I’m really nervous about what will happen at the end of my course. I’ve never worked and so it would be scary to think I would have to get a job. It would have to be very well-paid to pay more than the benefits.’

Posted by Drew458

Filed Under: • Miscellaneous • Outrageous • Taxes • UK •

• Comments (9)

Tuesday - October 07, 2008

Tuesday - October 07, 2008

Apologies to Dr. Suess

That Uncle Sam!

That Congress-man!

We do not like your bailout plan!

We do not like your taxing plan!

Should we pay so stocks don’t tank?

Should we pay for Barney Frank?

We should not pay so stocks won’t tank.

We should not pay for greedy banks.

We do not like your bailout plan,

We should not pay it, Congress-man.

Mr. Paulson made a call

For a plan to soak us all.

Could you, would you Mr. Bush,

Could you, would you push, push, push?

We should not pay you, Mr. Bush,

So Mae won’t fall upon her tush.

We should not pay you, AIG,

Though you ask on bended knee.

We should not pay you, Freddie Mac,

Just to lighten up your pack.

We should not pay for any bank,

Even one that’s in the tank.

We should not pay for umpteen years

Just because the market fears.

We do not like your bailout plan.

We do not like it, Uncle Sam.

We should not pay you, Mr. Raines,

You, the source of all our pains.

Franklin Raines don’t give a hoot,

He got a golden parachute.

This bailout plan sure is working well. The Dow closed under 10,000 yesterday. Thanks Congress.

Posted by Christopher

Filed Under: • Economics • Finance and Investing • Satire • Taxes •

• Comments (1)

Tuesday - September 30, 2008

Tuesday - September 30, 2008

Bureaucrats in an Italian town are trying to impose a new ‘rain tax’ on residents.

At first I was going to ignore this story but .... I got to thinking about it.

Hang on there I thinks ....

Back Date Taxes three years? That doesn’t look right. And so here’s the very short story.

Wet Italian town imposes ‘rain tax’

Bureaucrats in an Italian town are trying to impose a new ‘rain tax’ on residents.

By Urmee Khan

Last Updated: 11:16AM BST 30 Sep 2008Authorities in Ravenna in the Emilia Romagna region have added 3 per cent to water bills to maintain and improve drainage systems by arguing that heavy rain causes severe damage to infrastructure, buildings and agriculture in the Po valley.

The local water board, which wants to backdate the new tax three years, claims that the payments will save it €1 million (£800,000) a year.

Gianluca Dradi, head of environmental policy for Ravenna city council, likened the proposal to a “utility service”, similar to paying taxes for streets to be cleaned.

“Including the cost in water bills is more equitable,” he told the Repubblica newspaper.

“Those who pay more for their water use, such as factories, will pay proportionately more than households, which by comparison will pay relatively little,” he added.

However consumer organisations in Ravenna are urging householders not to pay up.

“This is just another tax in disguise,” said Roberto Passino, a spokesman for a protest group.

The case will continue until a final decision is reached.

Ravenna, in the North East of Italy, is connected to the Adriatic by a canal which was overwhelmed by floods in 1636. A network of canals was built to divert nearby rivers and drain marshland, creating a protective belt of agricultural land around the city.

The Po delta receives 750mm of rain a year, mostly in November, December and January.

Posted by Drew458

Filed Under: • Government • Taxes •

• Comments (1)

Thursday - July 31, 2008

Thursday - July 31, 2008

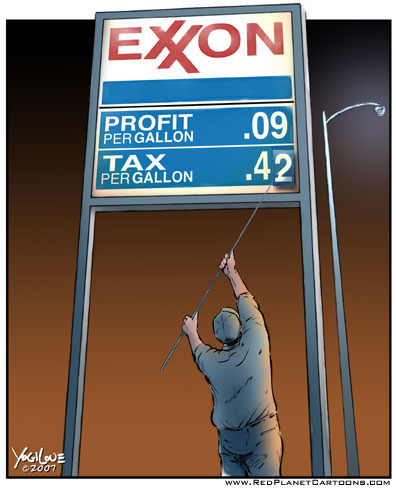

Another Inconvenient Fact

You’ll certainly hear this story a few hundred billion times* in the next couple of days:

However, what might be most interesting about Exxon’s 2008 2Q earnings report was its effective tax rate of 49%, up from a rate of 44% in the 2Q of 2007.

That’s right: ExxonMobil paid taxes of almost 50% on its $11.7 billion earnings.

I bet that took a big bite out of the money available for dividends to the tens of millions of stockholders! Go read the rest at The New Editor.

* I’m wondering, since “billions and billions” is a quantity known as a Sagan, should a “hundred billion” be called a Mugabe?

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices • Taxes •

• Comments (2)

Saturday - July 19, 2008

Saturday - July 19, 2008

Right of households to rubbish bin collection by councils to be abolished

THIS IS THE ANTI-SOCIAL ACT OF A LEFT WING LABOR GOVT.

I can’t imagine the town or city councils telling homeowners to drop dead BUT ...

I suppose that they could tell homeowners to contract out for trash pick up the same way we did in California.

Thing is tho, in our particular situation, the household is currently paying out £1700 a year to the city council. We have no street lights or sidewalks on this street. I’m not at all certain what the payments do cover, outside trash pick ups. They did provide rat control (outside the house fortunately) two years in a row. That was interesting btw. Someone came out and put poison down this hole and spent the time to come back for something like three weeks treating the area. They could have done it in one day with gas. But they aren’t allowed to use it here. ?? It’s thought they come from the field across the road which is a farm and grows rape seed, among other things.

By Christopher Hope, Home Affairs Editor

Last Updated: 11:30AM BST 19/07/2008The legal right of all householders to have their bins emptied by their local council is to be abolished, the Daily Telegraph can disclose.

The government is to give councils the power to refuse to collect rubbish if home owners fail to abide by draconian rules which may include leaving bins in the right place, sticking to weight restrictions and following strict recycling policies.

Labour is quietly pushing the new rules through parliament without any debate after it proposed amendments to a 130-year-old law which has, until now, made it a statutory duty of local authorities to collect household waste.

There are fears that the changes to the law will lead to large increases in fly-tipping, bonfires of noxious substances and rat infestations around uncollected waste. Despite this, there will no reduction in council tax for home owners.

The Conservatives described the plans as “disgraceful”, adding that bin men will now be able to use “any excuse not to empty your bin”.

Many Labour MPs fear the changes will add to a growing backlash against the government which has seen them slump in the polls.

Ian Gibson, a Labour MP who sits on the parliamentary committee which is scrutinising the changes, said: “It is a British way of life to have your bins emptied once a week. Taking that away is like losing your birthright.”

Phil Woolas, the environment minister, quietly added an amendment to section 46 of the Environmental Protection Act 1990 earlier this month which now states: “A waste collection authority is not obliged to collect household waste that is placed for collection in contravention of a requirement under this section.”

Town halls will be free to set their own rules on what constitutes a “contravention” of waste collection policies.

Councils could refuse to empty bins that are too far from a curb, are not placed directly outside a gate or are put out on the street too early.

The proposed changes amount to a reversal of the basic right of all households to have their rubbish collected, which was enshrined in law by the Public Health Act 1875.

The measures have already passed through two parts of a three-stage scrutiny process in parliament and will become law later this year if they are approved by the standing committee on climate change, which is dominated by Labour MPs.

It comes at a time when the government is already under fire over controversial fortnightly rubbish collections, which affect almost 20 million people, and “pay as you throw” schemes being trialled by some councils, in which bins are weighed and penalties imposed on people whose rubbish exceeds set limits.

Eric Pickles, the shadow local government secretary, said: “It is disgraceful that these new laws are being rushed through Parliament with no debate and no vote.

“People genuinely want to improve recycling and go green, but Labour’s policy of bin cuts and bin taxes will fuel fly-tipping, backyard burning and harm public health.

“These changes will fuel the public backlash at the Government’s rubbish policy. Under Gordon Brown, local residents are paying exorbitant levels of council tax, but are failing to get decent public services in return.”

Currently councils must collect rubbish from home owners unless it breaches one of two policies – “a closed lid” policy where the bin is not shut properly or a “side waste” policy meaning bin bags cannot be left alongside wheelie bins.

Whitehall sources said that the change in the law was proposed by central government and was not requested by councils.

A spokesman for the Local Government Association said: “It is in no way in councils’ interests to use tactics that would alienate local people. It would be wholly counterproductive for town halls to approach this issue in a heavy-handed way that could put people off dealing with their rubbish responsibly.

“Councils always provide people with straightforward information about what to do with their rubbish and work with residents to reduce the amount they produce and to encourage them to recycle.

“Britain is the dustbin of Europe, throwing away more per household than any other country in the EU. We have to change radically the way that we get rid of our rubbish and the days of tipping everything into a hole in the ground are long gone.”

Joan Ruddock, the minister for climate change, biodiversity and waste, said: “There is still a general duty to collect rubbish free from households. All that has changed is that when a household is given a formal notice, if they don’t abide by it then the council no longer has a duty to collect.”

(Free? What Free? Isn’t that one of the things taxes pay for? Or are taxes only paid to support the lifestyles of politicians? oh. right. forgot. )Government targets are for 40 per cent of household waste to be recycled by 2010, rising to 50 per cent by 2020. Policy papers show that officials want to limit rubbish collections in a bid “to compel householders to reduce their waste”.

Last month ministers also revealed that householders will face fines of £50 for failing to recycle their rubbish.

Councils will refuse to collect rubbish if homeowners break recycling rules

Posted by Drew458

Filed Under: • Government • Taxes • UK •

• Comments (3)

Thursday - June 05, 2008

Thursday - June 05, 2008

Today’s economics lesson

Posted by Christopher

Filed Under: • Economics • Taxes •

• Comments (4)

Saturday - May 10, 2008

Saturday - May 10, 2008

UK drivers pay highest fuel taxes in Europe, and probably the world!

For my compatriots back home who may not know ... simply double the prices mentioned here and you get US Dollars.

So the £900 mentioned here converts to $1,800. And btw, I believe that might be a tad on the low side. Anyway ... even tho the Brit gal. is somewhat larger then ours, it isn’t so large that what Brits are being screwed for as to make it reasonable. And Brits have been paying way,way more then Americans could imagine, and have been doing it for a very long,long time. It’s an island that has to import many items, and Brits are paying dear for it all.

I think you’re now paying about $3 and change back home. Is that right? Brits paying over $8.

UK drivers pay highest fuel taxes in Europe

By Robert Winnett, Deputy Political EditorLast Updated: 2:34AM BST 10/05/2008

British motorists are paying the highest fuel taxes in Europe – and probably the world – a study has disclosed.

About 57p of the cost of a litre of petrol in Britain is tax, compared with 31p in Spain, 45p in Italy, 48p in France and 52p in Germany.The Telegraph launched a campaign this week calling on Gordon Brown to scrap plans to increase road tax and a planned 2p per litre rise in fuel duty.

The average Briton pays almost £900 in petrol taxes annually.

The study, by the Association of European Automobile Manufacturers, shows that Britain has the highest fuel taxes of 27 European countries surveyed.

The tax is also higher than in America, Canada and Australia.

Edmund King, the president of the AA, which is supporting the Telegraph’s campaign, said: “We may be pleased that we have two English teams in the Uefa Champions League final but it is more worrying that we are top of the European fuel taxation league in terms of unleaded petrol and diesel.”

Mr Brown is under growing pressure from Conservatives and his own MPs to help motorists.

A study from accountants Grant Thornton shows that the rise in oil prices will see the Treasury take over £1 billion extra in VAT on petrol – more than would have been garnered from the 2p duty rise.

A Treasury spokesman said yesterday: “The Government understands that families are feeling the pressure from high fuel prices. To respond to short-term pressures, we announced in the Budget that the 2 pence per litre increase, scheduled for April 1, will be deferred until October 1.

“Our immediate priority, however, is to encourage international pressure on the oil-producing countries in Opec to bring down high oil prices.”

Posted by Drew458

Filed Under: • Miscellaneous • Taxes •

• Comments (2)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.