Monday - August 01, 2011

Monday - August 01, 2011

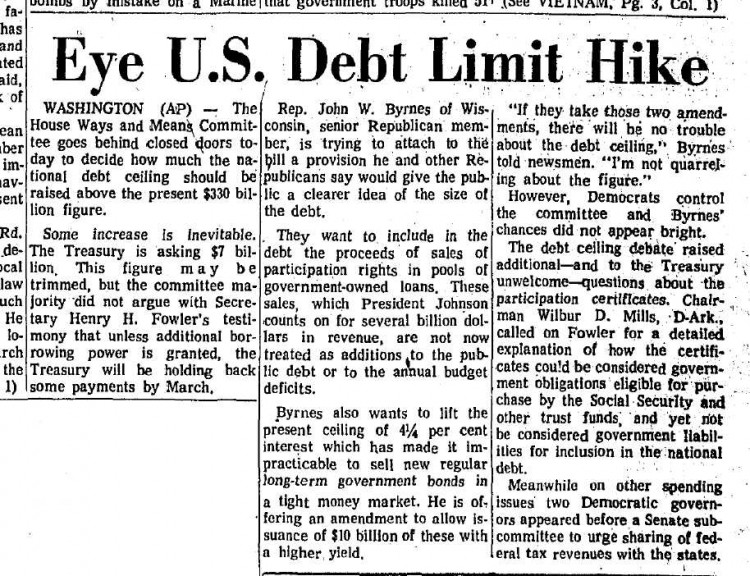

Nothing Ever Changes

1967:

graphic from Ed Thelen’s web page, home to more Nike missile info than you ever thought possible.

Posted by Drew458

Filed Under: • Government • Taxes •

• Comments (0)

Monday - July 25, 2011

Monday - July 25, 2011

Fire Them All And Start Over

No, I’m not posting much at all on this self-inflicted “budget crisis” / “debt ceiling crisis” crap going on in DC. It never had to happen. It never should have happened. But the idiots in charge have to play their power games, and neither side is on our side, although one side is less not on our side than the other group. It’s confusing, it’s annoying, it’s a 24-7 bullshit fest. It has given us the darkest kind of humor, made even more ironic because these jokes are not at all funny; they’re true!

How bad is the budget crisis? The budget crisis is sooooo bad that Obama has stopped playing golf. It’s so bad that he’s stopped going to his own campaign fundraisers; it’s so bad that he’s sending Joe Biden to them instead!

Harry Reid thinks he’s immune from the First Law of Holes ( when you get to the bottom, stop digging! ) Did you see him on TV today, splatzing his verbal diarrhea? As far as Harry is concerned, me, you, and anyone else who believes in the TEA Party is a right wing extremist. Seriously, those were his actual words. The TEA Party people are right wing extremists. Extremists. Crazy people. Dangerous radicals. Because they believe the We The People are Taxed Enough Already, nickle and dimed to death and beyond, and that the government should be able to run itself on the vast mountains of tax revenue they already bring in without borrowing more. The nerve of us peons.

Tax cheat Timothy Geitner threatened yesterday that if Lord Obama’s plan wasn’t approved, then 80 million government checks wouldn’t go out. Aside from being a complete lie, Turbo-Tax Timmy glazed right over that 80 million part. The government is sending out 80 million checks a month? There are only 300 million people in the whole damn country!! That’s more than 26% of the country, more than 1 person in 4, who is getting some kind of monthly payment from the feds. Who the hell is left to pay the bills???

And to make it even worse, here comes the news we all saw coming months ago ... when everyone who mentioned it (Beck et al) was instantly labeled a racist crazy person willfully trying to destroy the recovery ...

U.S. Credit Rating Now Cut As Boehner Fights Back

It’s official.

The credit rating of the United States government—for the first time in American history—has been cut.

Lost in the headlines generated by Obama press conferences, Reuters reported that the credit rating agency Egan-Jones has in fact become the first rating agency to downgrade the U.S. rating. Egan-Jones, says Reuters:

..has cut the United States’ top credit ranking, citing concerns over the country’s high debt load and the difficulty the government faces in significantly reducing spending.

And what else is being reported about Egan-Jones’ reasoning for doing this?

The agency said the action, which cut U.S. sovereign debt to the second-highest rating, was not based on fears over the country not raising its debt ceiling.

Instead, the cut is due the U.S. debt load standing at more than 100 percent of its gross domestic product. This compares with Canada, for example, which has a debt-to-GDP ratio of 35 percent, Egan-Jones said in a report sent on Saturday.

The startling news, dug out by our friend and talk radio host Mark Levin, comes as House Speaker John Boehner walked out of talks to resolve the issue because President Obama “insisted on raising taxes.”

So this means that the government will now have to pay even higher interest rates on any future money it borrows. Which will push us even further into never ending debt.

But let’s listen to Harry and Oboner and the Gang of Thieves, and pile on more and more programs to ... promote social justice or whatever ... and borrow even more money at even higher rates to pay for them. And the best Crybaby Boehnhead on our side of the aisle can do is come up with a “temporary" plan to allow more borrowing? Followed probably by some more “temporary” taxes to increase revenue by taking even more money from the paychecks of the people lucky enough to still have jobs?

“Temporary”? That’s another punchline. No such thing. Alabama is still collecting money from it’s “temporary” tax they put in more than a century ago to pay the pensions of Civil War veterans. And their last veteran died in 1939!!

And we’re the extremists? We’re the crazy people? Horry Clap. I just can’t face this insanity. That’s why I’m trying to avoid posting on it.

PS - this world ending August 2nd deadline may also be fake. It looks like the real deadline might actually be August 10th. Not that it matters. The world stock markets are already trembling because these jerks in DC can’t work together.

On the other hand, good. Bring the government to a standstill. Don’t send out those checks. Let come what may. Families will take care of each other. It might not be so bad for a couple months. But if one side of the aisle is preaching fiscal sanity, and the other side wants to spend spend spend spend spend with no brakes and no limits ever, then bringing things to a standstill is what I want, and I want my guys to not give an inch. It’s what has to be done. The cupboard is bare; that poor dog has no bone. Stop the spending. At the very very least, do your damn jobs and develop and pass a budget that runs on 90% of the expected revenue. And that means HUGE CUTS across the board. Do it. Cut hundreds of billions in spending, right now, this year, and every year thereafter. Cut a trillion. Cut two trillion. And pass a law to make sure it stays cut. For that, these assclowns can argue till they’re blue in the face and everybody in government is out of a job. Fine by me. Do it. Might as well act like an extremist if I’m going to be labeled one again.

Posted by Drew458

Filed Under: • Economics • Government • Taxes •

• Comments (4)

Sunday - July 24, 2011

Sunday - July 24, 2011

Buy Your Tickets Now?

Airlines are tossing consumers aside and grabbing the benefit of lower federal taxes on travel tickets.

By Saturday night, nearly all the major U.S. airlines had raised fares to offset taxes that expired the night before.

That means instead of passing along the savings, the airlines are pocketing the money while customers pay the same amount as before.

American, United, Continental, Delta, US Airways, Southwest, AirTran and JetBlue all raised fares, although details sometimes differed. Most of the increases were around 7.5 percent.

For consumers who wanted to shop around, only a few airlines were still passing the tax break on to passengers Saturday night, including Virgin America, Frontier Airlines and Alaska Airlines.

The expiring taxes can total $25 or more on a typical $300 round-trip ticket. They died after midnight Friday night when Congress failed to pass legislation to keep the Federal Aviation Administration running.

That gave airlines a choice: They could do nothing — and pass the savings to customers — or grab some of the money themselves.

“We adjusted prices so the bottom-line price of a ticket remains the same as it was before … expiration of federal excise taxes,” said American spokesman Tim Smith. US Airways spokesman John McDonald said much the same thing — passengers will pay the same amount for a ticket as they did before the taxes expired.

They declined to say whether the increases would be rescinded if Congress revives the travel taxes.

Several federal airline-ticket taxes expired when Congress adjourned for the weekend without passing FAA legislation. Lawmakers couldn’t break a stalemate over a Republican proposal to make it harder for airline and railroad workers to unionize.

Air traffic controllers stayed on the job, but thousands of other FAA employees were likely to be furloughed.

Airlines stopped collecting a 7.5 percent ticket tax, a separate excise tax of $3.70 per takeoff and landing, and other taxes. Those add up to about $32 on a round-trip itinerary with base fare of $240 and one stop in each direction.

Other government fees for security and local airport projects are still being collected. They boost the final cost of that $240 base-fare ticket to $300.

Passengers who bought tickets before this weekend but travel during the FAA shutdown could be entitled to a refund of the taxes that they paid, said Treasury Department spokeswoman Sandra Salstrom. She said it’s unclear whether the government can keep taxes for travel at a time when it doesn’t have authority to collect the money.

Some airlines that didn’t raise fares sought to turn the controversy to their advantage. Spirit Airlines said it would pass tax savings on to consumers while rivals “have not been so generous.” It warned travelers that Congress could end the tax holiday at any time, so book a flight quickly.

Virgin America hawked tickets with the slogan, “Evade taxes. Take flight.” For a September trip between Dallas and San Francisco, Virgin America was $7 to $24 cheaper than United, Continental and American.

Meanwhile, the airlines - those gigantic business enterprises that you would think were “too big to fail” but are forever declaring one kind of bankruptcy or another - are raking it in.

The Transportation Department says it will lose $200 million a week until Congress restores the taxes. J.P. Morgan analyst Jamie Baker said airlines could take in an extra $25 million a day by raising fares during the tax holiday. That’s a tempting sum for airlines that have struggled against high jet fuel costs for most of the last three years.

Airline tickets have had several price increases so far this year, pretty much across the boards. For a deregulated industry that competes so hard that many airlines have gone out of business in the past 3 decades since deregulation, they sure seem to be able to march in lockstep at a moment’s notice when they feel like it. Go figure.

The last time one of these air travel taxes expired, most airlines passed the savings on to the customers. This time, nada. Whatever happened to that trickle down economic theory? I think it’s leaving a yellow puddle on the floor.

Personally, this gives me incentive to hope that a budget impasse continues in DC for months. I just bought tickets for a late fall vacation, and I wouldn’t mind being able to get a refund of some of the tax money.

Posted by Drew458

Filed Under: • planes, trains, tanks, ships, machines, automobiles • Taxes •

• Comments (0)

Friday - July 01, 2011

Friday - July 01, 2011

California Ignores The Law, Suffers

What part of “you can’t do that” does CA not understand? Businesses Go Gault to avoid this tyranny.

California tells online retailers to start collecting sales taxes

Beginning Friday, Amazon.com and other large out-of-state retailers will be required to collect sales taxes on purchases that their California customers make online.

Beginning Friday, a new state law will require large out-of-state retailers to collect sales taxes on purchases that their California customers make on the Internet — a prospect eased only slightly by a 1-percentage-point drop in the tax that also takes effect at the same time.

Getting the taxes, which consumers typically don’t pay to the state if online merchants don’t charge them, is “a common-sense idea,” said Gov. Jerry Brown, who signed the legislation into law Wednesday

But those taxes may come with a price. Amazon and online retailer Overstock.com Inc. told thousands of California Internet marketing affiliates that they will stop paying commissions for referrals of so-called click-through customers.

That’s because the new requirement applies only to online sellers based out of state that have some connection to California, such as workers, warehouses or offices here.

Both Amazon in Seattle and Overstock in Salt Lake City have told affiliates that they would have to move to another state if they wanted to continue earning commissions for referring customers.

“We oppose this bill because it is unconstitutional and counterproductive,” Amazon wrote its California business partners Wednesday. Amazon has not indicated what further actions it might take to challenge the California law.

Amazon ends deal with 25,000 California websites

Gov. Jerry Brown has signed into law California’s tax on Internet sales through affiliate advertising which will immediately cut small-business website revenue 20% to 30%, experts say.

The bill, AB 28X, takes effect immediately. The state Board of Equalization says the tax will raise $200 million a year, but critics claim it will raise nothing because online retailers will end their affiliate programs rather than collect the tax.

Amazon has already emailed its termination of its affiliate advertising program with 25,000 websites.

Click a link on some blog that takes you to an online retailer - say one that sells crossbows perhaps? - and the blogger in California “owns” or “roots” the sale in that state, so the retailer then owes sales tax to that state? As in: you live in New Mexico, you click on a link at a blog run by some guy in New Jersey that takes you to a crossbow selling online retailer in Indiana, and now New Jersey has the power to collect sales tax from a transaction between Indiana and New Mexico? Is there a diplomatic way to say “Blow it out your ass, fuckface!”??

This is a Use Tax, plain and simple. And use taxes are the biggest loser idea that ever was. While the laws may require citizens to add up the things that they buy out of state and then pay the proper amount of sales tax to their home state, other than my mother nobody in the entire country does this. Nobody. Because deep down we all know that what we buy somewhere else is no business of the state we live in, so they can sod off.

Amazon was quick to turn the tables. Calling the new law unconstitutional, Amazon sent an email Wednesday to California affiliates immediately severing ties with them—and putting those businesses in the crosshairs.

“Unfortunately, Governor Brown has signed into law the bill that we emailed you about earlier today. As a result of this, contracts with all California residents participating in the Amazon Associates Program are terminated effective today, June 29, 2011,” the company wrote in an email to affiliates obtained by FoxNews.com.

By ending these local affiliate programs, Amazon and Overstock should largely exempt themselves from the law—meaning California shoppers probably won’t see taxes on books and other goods from them.

The States are just as out of control and out of their minds as the federal government when it comes to taxes. Neither group has been able to spend responsibly for the past 80 years or more, and both are now mired in debt. But neither will face the music and put their budgets under the chopper. The post I didn’t run: Obama wants to raise taxes hugely to attempt to balance the budget. Which will once again KILL any slight bit of growth the economy may have been showing. It’s like he’s doing this shit on purpose. Nobody could be that stupid by accident. Guess I was wrong: Jerry Brown is that stupid. And so is California, for re-electing this wasted old hippie 20 years past his sell-by date.

The internet is a duty free port. Just make sure that whatever you buy online comes from some other state. If it comes from your state, just go buy it locally instead. Personally, if I ran a web business I’d set it up off shore if I could. Failing that I’d set it up in Delaware, or another state that has no sales tax. Failing that, I’d make it abundantly clear that no sales would be made to the state the business resided in. And thus the taxman can go to hell. Because that’s what America is all about.

Posted by Drew458

Filed Under: • Government • Stoopid-People • Taxes •

• Comments (3)

Wednesday - May 18, 2011

Wednesday - May 18, 2011

Fifty Seven And One Half Percent

Fox News runs the story and misses the real point.

A Michigan man who won $2 million from a state lottery is reportedly still eligible to receive food stamps.

Leroy Fick of Bay County, Mich., said in an interview with WNEM-TV that he still uses his bridge card at stores despite winning a jackpot on “Make Me Rich!” last June.

“I even called them and asked about the bridge card and (the Department of Human Services) said you can go ahead and keep it if you want to,” Fick reportedly told the station.

Fick claims he paid more than half of his winnings in taxes—leaving him about $850,000—according to the station.

State Department of Human Services spokeswoman Gisgie Gendreau told MyFoxDetroit.com that under federal guidelines, lottery winnings are not counted as income if a person receives a lump-sum payment.

This is just another one of those not-really-news articles designed to keep people riled up, and it works quite well that way. The comments are immediately hate filled and racist (the guy is white, doncha know). The point that the vast majority of commentators miss is that Mr. Fick is completely following the law. He was aware that it didn’t seem right, so he checked it out and that’s what the authorities told him to do.

The real news in the story that no one is reacting to is the part that should really get people riled up. Large lump sum distributions get taxed 57 1/2 percent. Far more than half. That’s highway robbery. I don’t know how Michigan does it, but in many states the lottery winnings are exempt from state tax. So that 57.5% is all the federal bite. “Tax the rich” indeed. Outrageous.

On the other hand, 850 grand in my pocket sure would soften my life up a great deal. Yours too. But I’d like to see some “truth in advertising” applied to the lottery payouts. Calling this one a $2M prize doesn’t seem very forthright. Hey, how about a new numbers game called Forty Two Five? That’s your slice when all is said and done. Make TV ads to push the game that stress how your winnings help pay down the federal deficit by taking huge amounts of money out of your state and sending it to DC. You could also call the game Fair Share. Everybody would be eager to play, right? Win big, and live like the rich folks do: pay more taxes in one shot than you otherwise will your entire life combined.

Posted by Drew458

Filed Under: • Taxes •

• Comments (3)

Wednesday - December 08, 2010

Wednesday - December 08, 2010

tax cuts USA/UK .. term limits … morons in DC and a flat tax ….

I saw an article in our morning paper with regard to Obama’s U-turn on tax cuts, and the result that apparently the very wealthy will retain their tax cuts.

Hey, I’m ok with tax cuts and I am certainly entirely pro the wealthy class as it’s something we mostly all aspire to. Isn’t it? But I confess again as I’ve done in the past, I am not at all sophisticated where serious economics are concerned.

Heaven knows I am not a Socialist. Good grief I can’t imagine that. Drew wouldn’t speak to me or help with tech things, Wardmom might shoot me. Or would that be Vilmar? I would at the least be Persona non Grata in my very own house, and that’s a certainty. But ....

I am confused by the idea of cutting taxes for the the very wealthy, instead of the middle class who I think need the leg up more. Isn’t the middle class and small/med business the engine that runs things? And don’t think for a minute I want to suggest squeezing the rich. Not at all. I’m just not very knowledgeable about economics and taxes beyond the superficial. And isn’t Wardmom correct about a flat tax?

Some of you in the states won’t know, but Kraft bought an English icon when they bought Cadburys. Cadbury makes chocolates. Cadbury also bought out the very best (imho)when they bought Black and Green Chocolate. Well ... many here are very upset at the news that Kraft is shutting down the Cadbury UK plant and moving operations away from England.

Cadbury goes Swiss to avoid British tax: Move by U.S. bosses will cost Treasury £60 million a year

The plan has been hatched by food giant Kraft, which took over the iconic British chocolate manufacturer earlier this year after a bitter £11 billion bid battle.

It will see ownership of much-loved Cadbury brands including Dairy Milk, Crunchie and Twirl handed to a holding company in Zürich, where Kraft already has a major base.

So my question is, why can’t a tax deal be made where the UK can still hold on to some of that tax dollar and save Brit jobs and tax income?

Then I looked at Drew’s post this early morning and found Wardmom’s comment on things in the USA which I thought belonged here.

What happened with this current ‘deal’ IS the problem with DC - Every issue must be stand alone. And no more ‘deals’ to get the work done. What is best is what makes America safer, smarter, and more prosperous - anything else is just a waste of money.

Pick a percent and everything - spending is cut by that - and pick a percent under 20% and every single person who works in America pays that percent in tax (i.e. morons in DC - a FLAT TAX that is the most fair, most just and most equal for all.

And then TERM LIMITS and 2 TWO WEEK SESSIONS A YEAR - Make these jobs PUBLIC SERVANTS again rather than a boondoggling , money grabbing, benefits creating, stealing, cheating, lying extravaganza funded by the only working people in the country.

CUT AND BALANCE and then get the he!! out of our business, private life, kitchen, playroom and garden.

Posted by wardmama4

Posted by peiper

Filed Under: • Economics • Taxes • UK • USA •

• Comments (5)

Monday - November 29, 2010

Monday - November 29, 2010

John Galt Leaves Paradise

Faced with a new law that singles them out for massive tax hikes, Fiji Water puts a cap on operations and walks away from the well.

Fiji Water on Monday closed its operations in the South Pacific country that gives the popular bottled drink its name, saying it was being singled out by the military appointed government for a massive tax increase.

A company statement announcing the decision did not say whether the company was shutting down permanently in Fiji, where an acquifer deep underground has been the source of one of the world’s most popular bottled water brands. The company, owned by California entrepreneurs Lynda and Stewart Resnick, said it was closing its facility in Fiji, canceling orders from suppliers and putting on hold several construction contracts in the country.

But the company wanted to keep operating in Fiji and was willing to hold discussions with the government about that, said the statement, issued from the company’s headquarters in Los Angeles. In the statement, Fiji Water president John Cochran said Fiji’s government announced last week that it was imposing a new tax rate of 15 cents per liter on companies extracting more than 3.5 million liters (920,000 gallons) of water a month — up from the current one-third of one percent rate. Fiji Water is the only company extracting that much water.

“This new tax is untenable and as a consequence, Fiji Water is left with no choice but to close our facility in Fiji,” the company, which sells its bottled water in more than 40 countries, said.

The tax rise comes amid a deep downturn in Fiji’s economy that is blamed on political instability following a coup in 2006 by armed forces chief Commodore Frank Bainimarama — Fiji’s fourth coup since 1987. Key trading partners have imposed various sanctions on the government, including European Union restrictions on the vital sugar industry.

Bainimarama’s government has also taken a hard line with foreign companies. Rupert Murdoch’s News Ltd. in September sold its controlling stake in Fiji’s main daily newspaper after the government imposed strict new foreign ownership limits on media companies. Bainimarama did not immediately comment on Fiji Water’s statement.

Cochran said Fiji Water was the only company that would be affected by the tax increase.

Funny how some businesses are. Even ones like this one with what I assume are fairly low overhead and high profit margins. Hit them up with massive tax increases that put them on the far side of the Laffer curve, and they say to heck with it. Even if they could eat that new tax rate and still show a fat profit, or if they could jack up the price of their product to offset it and not impact sales.

Yes, this is perhaps a bit of gamesmanship. And I doubt that Fiji Water employs tens of thousands of locals. Probably only a hundred or even less. And the owners are raking it in. But you have to stand up to tyrants of all stripes. So I hope they take their pumping and bottling machinery with them and sail away. I wasn’t aware that sleepy little Fiji was ruled by a junta either. Screw that. Guess I’ll be crossing Fiji off my list of dream vacation spots.

Posted by Drew458

Filed Under: • Taxes • Tyrants and Dictators •

• Comments (3)

Monday - September 20, 2010

Monday - September 20, 2010

Let me put this bluntly: virtually no one in America gives a damn what Barack Obama says.

H/T HOT AIR Via RichK with thanks ...

Checking my mail today and found this from RichK. WOW. Read the whole thing folks. This is really worth the time and isn’t that long either.

Now then, something the fellow wrote .....

If you want to criticize someone for reveling in culture wars, I suggest you take a look at the power-drunk clowns tossing around gigantic bills that “control the people” right down to the menus at fast-food restaurants. Just wait until they start rolling out the class-war arguments for higher taxes to sustain their frenzied spending. That will be some serious revelry.

Absolutely tied in with something here in Britain with regard to the class thing. It may not be on the same level but look at this.

Middle-class families could be forced to undergo lie detector tests as part of a major crackdown on tax avoidance being spearheaded by Nick Clegg. (Deputy Prime Minister)

Tens of thousands will face intrusive new tax investigations under the plans unveiled by the Deputy Prime Minister yesterday.

As part of a two-pronged attack on the better-off, millions more will face cuts in benefits, such as winter fuel payments, child benefit and free bus passes.

The moves, unveiled at the Liberal Democrat conference, were designed to guarantee Mr Clegg’s popularity with mutinous grassroots members, but were described by critics as ‘bully boy tactics’.

I don’t think anyone will argue against people paying their fair share on things. And nobody I know likes paying a lifetime of taxes to support those who just will not work and live off the rest. But .... in his effort to sooth the more left wing ppl in his party, (my take on that) the deputy PM who heads the other half of this coalition govt. says, “Legal tax avoidance and illegal evasion are ‘just as bad’ as falsely claiming benefits, adding: ‘Both come down to stealing money from your neighbours.”

And just so we are clear on this, he went even further and spelled it out. People who go to an accountant to have their taxes reduced are just as guilty of cheating on taxes as people who try to hide income and cheat. I could not make that up. In a speech to be made today, Mr Clegg will accuse middle class earners who pay accountants to minimize their tax bills are behaving like ‘benefit cheats.’ He will say that legal tax avoidance is as bad as claiming benefits and is the very same as stealing. How ‘bout them apples? So then, the rich who nobody feels sorry for anyway because we all know they all have what’s really ours, and the middle class who aspire to riches, will be scrutinized very closely. It is expected that some 150,000 taxpayers a year will be checked. That’s up from 5,000 now, I have read. His crackdown will surely affect small business who try and get every legal tax break they can. Oh, have I mentioned that lie detectors will be used? The good news is that Mr Clegg says he will be happy to stop getting some £2,400 a year in child tax rebate. He earns something like £134,000 a year as DPM and his wife is described as a “high flying” lawyer. We are not talking about poor folk here. If legal exemptions are like cheating, then how does he square what he and wife have already received? Or doesn’t that count? His party is the Lib/Dems which is short for, Liberal Democrats.

So anyway .... I really got off my original topic which is the fine link given us by Rich and all about our Divine Sarah. I got caught up in that class thing.

The Palin Card

by Doctor ZeroMarc Ambinder of The Atlantic thinks it’s time for the Obama Administration to play the “Palin Card,” setting the former governor of Alaska up as the target for some Alinsky-style frozen personal polarizing. He dismisses fears that such Presidential attention will elevate Palin to greater national prominence:

Elevate Sarah Palin? How much higher can she go? Everyone knows her. Some of Obama’s advisers have argued in the past that the attention paid to Palin by Americans in the last stages of the 2008 campaign is one reason why Obama was able to win so cleanly.Palin and the Tea Party movement are not the same thing. The movement, evolving out of movement conservatism, is principally about government and the economy. Palin revels in the culture wars. But when that part of the Tea Party that does care about social issues becomes the story, linking the two in the public’s mind is easier.

Yes, the election is about control of Congress. But at a larger level, it’s about competing visions of the world. John Boehner v. the Democratic agenda is a boring contrast. Many Democrats couldn’t tell a Boehner from a Cantor. But everyone knows who Sarah Palin is.He’s right that low-key, largely unknown politicians like Boehner and Cantor don’t make very good targets for the politics of personal destruction. The effort to inflate stuff Boehner into a Darth Vader costume over the past few weeks was comical. If the Democrats want to run some more plays out of Alinsky’s faded old handbook, they’ll need to focus on someone exciting.

Palin is linked to other high-profile female candidates, like Sharon Angle and Christine O’Donnell, so she looks like an inviting target. The subtext of the media narrative Democrats are trying to spin is that outspoken female conservatives are somehow unnatural. Comfortable, maternal leftism is the natural philosophy of caring women, you see, and the State is their only ally in the quest to shatter those increasingly transparent glass ceilings. A woman who would enlist in the heavy infantry of the regressive fundamentalist Republicans must be crazy.

I hope the White House takes Ambinder’s advice, because it would be suicidal. His crack about Palin’s “reveling in the culture wars” betrays his ignorance. He is confused by the details of her biography, and the sincere affection she earns from her admirers. His Palin Card is drawn from the wrong suit. She’s the Queen of Diamonds, not the Queen of Hearts. Her most impressive statements over the last two years have been on matters of economics, policy, and politics. She has shredded the Administration over health care, the Gulf oil spill, and unrestrained government spending. She’s endorsed dozens of primary candidates, with something like a 70% success rate. Her most notable clashes with “culture” have involved asking it to stop making rape jokes about her daughters.

If you want to criticize someone for reveling in culture wars, I suggest you take a look at the power-drunk clowns tossing around gigantic bills that “control the people” right down to the menus at fast-food restaurants. Just wait until they start rolling out the class-war arguments for higher taxes to sustain their frenzied spending. That will be some serious revelry.

Let me put this bluntly: virtually no one in America gives a damn what Barack Obama says about anything at this point. What could be more predictable, and less interesting, than Obama’s opinion on any given subject? Who wants to contemplate the economic wisdom of a guy who looted the Treasury for a trillion dollars, with less benefit than we could have achieved by stuffing hundred dollar bills into random cereal boxes? Who’s excited to hear about the next plan to convert taxpayer dollars into Democrat campaign funds? Who’s hungry for another hour of tedious excuses about permanently broken markets and the titanic dead hand of George W. Bush? Who wants a lecture on ethical business practices from the titular head of the party that gave us Charlie Rangel and Maxine Waters? What use is another hollow foreign-policy speech from a man who sees no global adversary to rival the menace of Arizona? Even Obama’s supporters don’t hear anything he says any more. There’s nothing left to hear.

Posted by peiper

Filed Under: • Taxes • UK •

• Comments (1)

Wednesday - August 11, 2010

Wednesday - August 11, 2010

EU taxation without representation: but has Britain got what it takes to fight?

Just to show ya how fragile sovereignty can become, an article I skipped over yesterday in both our papers, is a plan in Brussels to have the EU impose taxes on countries and of special interest here quite naturally, Britain.

Under the EU budget commy-sar (italic mine of course), he is going to lobby the capitals of Europe to be given the power to levy it’s own taxes. Like this place isn’t expensive enough already, or doesn’t have enough red tape now.

The EU already has it’s own courts, currency, laws, and it’s expected a foreign policy.

Whatever …. if the other member countries go along with it, it’s their business.

But I surely do hope that should this newest sovereignty nullifying act become law here, the Brits will refuse to go along and tell Brussels to shove it.

EU taxation without representation: but has Britain got what it takes to fight?This could be yet another moment of national British humiliation. Brussels has made its move in the dead days of August, of course, in the hope it would pass unnoticed.

But some of us have noticed. And the British had better take notice. The European Commission has decided to fire up the powers of taxation given to the EU by the Lisbon Treaty. Thanks to David Cameron’s refusal to fight the transfer of sovereignty the treaty makes, the British people can now be subject to taxation direct from Brussels, with the Commons—indeed, with the Chancellor—having no control over over the tax at all.

Today Janusz Lewandowski, the commissioner in charge of the EU’s £116bn budget, announced he intends to press for a new EU tax. The euro-elite want to be able to get their hands on your money without having to ask your Government even for a perfunctory agreement. All this talk about belt-tightening around Europe is making the euro-elite edgy: they have their luxurious pay and pensions and travel allowances, and all their empire-building to protect, after all.

Britain and every other member state is going through terrible budget turmoil, with spending cuts and citizens furious about increases in taxation—yet now Brussels is getting ready to activate Art 311 of the Treaty on the Functioning of the European Union (part of the Lisbon bundle—the euro-elite don’t want to make it easy for you to find it).

It says, ‘The Union shall provide itself with the means necessary to attain its objectives and carry through its policies.’

The ‘means.’ That means money. Your money. Taken away by an unelected single party government (the commission) enabled by politicians over whom the British voters have no political control (the council). The British will have to pay the tax these people demand, but can never vote them out. The commission wants to start with a tax on all bank transactions, or perhaps air travel. It doesn’t really matter which. Their point now is to establish the power of Brussels to tax the populations of the countries of the EU without any control by national parliaments. Once that power is in place, the taxes can be ratcheted up.

There you have it, people forced to pay taxes by people they did not vote into office, and whom they cannot vote out of office, and over whom they have no control.

George Washington, Thomas Jefferson, Paul Revere, a lot a determined men on board a tea ship in Boston Harbour, a lot of other brave men at a green in Lexington, and plenty other men with much to lose, all decided long ago they would not tolerate such a thing. They could not tolerate taxation without representation.Question: will the British tolerate it? Or will they let themselves be humiliated in a way that even the small ragtag population of 13 British colonies would not allow in 1776?

Posted by peiper

Filed Under: • EUro-peons • Taxes • UK •

• Comments (3)

Friday - July 09, 2010

Friday - July 09, 2010

Countdown To Impoverishment

For 9 solid years we’ve heard the BS but had the benefit. Soon, no more. The eviiil genius moron Shrub Chimpy McHilterburton’s unfair tax cuts only for the rich are going to expire. And there is pretty much no way that Congress can renew them, or make them permanent, or come up with any kind of similar tax breaks for anyone. The government is dead broke, and needs 1000 times more tax revenue than they can find. So don’t expect any Omiracle. Or any kind of Orescue. Pay up.

- The 35% bracket rises to 39.6%, an increase of 13%

- The 33% bracket rises to 36%, an increase of 9%

- The 28% bracket rises to 31%, an increase of 10.7%

- The 25% bracket rises to 28%, and increase of 12%

- The 10% bracket rises to an expanded 15%, an increase of 50%

- I’m not sure where the current 15% bracket goes. Do they get a break and get no tax hike? Don’t bet on it.

The Marriage Penalty will be back, Death Taxes will be back, Capital Gains Tax goes from 15% to 20% in 2011, the Dividends Tax more than doubles from 15% now to 39.6% in 2011. You think the market is bad now? You ain’t seen nothing yet baby.

And then we get to the 20 or more taxes hidden within Obamacare, which we have to start paying years before that plan comes online. Free Dunce Hats and a Time Out to everyone who thinks that money is going into one of those famous lockboxes for 4 years until the plan kicks in.

And your old friend the Alternative Minimum Tax is still around, sharpening his teeth. Since Congress hasn’t bothered to index the beast to inflation, the categories that once were only supposed to force “the rich” to “pay their fair share” will now start impacting the lower middle class. So those much higher tax rates above will seem like a cool dip in the pool on a sweltering hot day compared with the rates they will wind up paying. The Tax Policy Center calculates that more than 7 times as many families will be subject to it next year then are in it’s claws this year.

So, remember that campaign promise? The one about not a cent more taxes of any form for any family making under $250,000 $200,000 $125,000 $75,000 $50,000? It’s a lie. And you know what will happen? BO will blame Bush. Yup, it’s Bush’s fault the tax rates will skyrocket in 2011, because he only made his tax cuts short term. And when the Republicans controlled both houses, they never moved to make those cuts permanent. Don be blamin da new messiah! And the MFM lapdogs will repeat this endlessly.

Next up will be the VAT, and the Cap & Trade hits that get levied against us all. And since your state is likely bankrupt, expect your state taxes to double as well.

See lots more at Americans for Tax Reform.

Posted by Drew458

Filed Under: • Taxes •

• Comments (4)

Monday - April 12, 2010

Monday - April 12, 2010

Last Second Tax Tips

New for 2009, Schedule M is a tax credit for the low and middle class. If you have an adjusted gross income between $6,451 and $75,000, it will give you a $400 tax credit. If you earn between $75,000.01 and $95,000 it will give you a pro-rated credit.

There is no “marriage penalty” on Schedule M; taxpayers married filing jointly can double these amounts: if your combined adjusted gross is between $12,903 and $150,000 you get an $800 credit, and if together you earn more than $150,000 and up to $300,000 you get a pro-rated credit.

The nice thing is that Schedule M gives you a direct credit. Cash money baby, as if you had paid this much more taxes the whole time. This means it can increase your refund if you are eligible for one.

An income of $6451 is what you would earn working part-time at minimum wage for 17.5 hours a week.

Hmmm ... thinking. Ignoring all the various credits, etc., a childless single person with a full-time minimum wage ($7.15/hr) job earns $14,872 per year. Given the standard deduction of $5700 and standard exemption of $3500, her taxable income is only $5672, and the tax table amount on that is $568. Even with the $400 Schedule M credit, they still have a net tax liability of $168. So they are contributing to the system, albeit minimally.

It takes a bottom line taxable income amount of under $4000 to get off with less than $400 in tax liability, which would be covered by the Schedule M credit. That means ... $4000 + $3650 + $5700 = $13, 350 adjusted gross income. Which is 36 hours per week at minimum wage, or 26 hours per week at $10/hour. Which is a basic part-time job.

This kind of musing makes me wonder just who we’re talking about when we hear that 47% of the population isn’t paying any federal taxes at all.

Posted by Drew458

Filed Under: • Taxes •

• Comments (8)

Thursday - April 08, 2010

Thursday - April 08, 2010

Another Cup of Tea

First, a message from Bill Whittle: attend a Tea Party in your area, rise up, speak out!

One way to find your local event: the Tax Day Tea Party website.

Need an idea for a protest sign? How about making a copy of one of these bumper stickers?

I think I’ll be timely, and go with this one. No VAT. That’s Value Added Tax for you Americans, a 10% federal sales tax that Obama’s goons are now considering.

If Tea Parties even make the news this year, the story will be that the attendance is down nationwide. Duh, yeah, because they are all scheduled for 2 hours starting at noon on Thursday. Most folks with jobs can’t take that long a lunch break.

Posted by Drew458

Filed Under: • Government • Taxes •

• Comments (3)

Wednesday - April 07, 2010

Wednesday - April 07, 2010

That Wasn’t So Taxing

Yay, I got the taxes all done.

Boo, I owe the feds more money than I get back from the state.

Yay, it’s only a little bit of money. Much less than I spend on beer in a year.

Yay, having high speed internet makes it so easy to download forms and instructions. No more running to the library or Post Office hunting for paper copies. Plus it’s all neat and tidy.

Boo, New Jersey built their digital tax form exactly like their paper form, which means each digit of each number goes in it’s own little box. Which means most of the time spent filling out the form is eaten up by hitting the tab key. At least the federal forms are two column entries: dollars and cents.

Boo, can’t you work macros into Acrobat forms? I was certain that you could. Digital tax forms should do the adding up for you. Heck, you should get the “forms kit” as a zip file that has one of everything, or an open source built-in relational mega-macro, so that you could select the forms you need, download them in one shot, and have the amounts automatically populate the other forms as you go.

3 Yays, 3 Boos. Looks like a draw. Which means I win. I think.

Until we meet again next year, tax forms!

And ... most importantly ... I have plenty of ink in my printer, black and color. And enough paper. No more frantic trips to Staples at the last second either! I think we even have stamps.

Posted by Drew458

Filed Under: • Taxes •

• Comments (3)

Sunday - November 08, 2009

Sunday - November 08, 2009

Get me a rope before Mandelson wipes us all out. A RANT against the lord of darkness

It’s one of those literary like bleak English winters and I love it. Dark sky, not a hint of blue anywhere and bitterly, bitterly COLD.

Since my first Sunday post earlier today, I have been ensconed in another room with comfortable chairs, three Sunday newspapers and all the magazines that go with them, and an electric fire as the Brits call the floor heater. So lots to read and lots to ponder and I of course have to break away from that place, and come back to my puter to share things with BMEWS of what I always hope is of some interest.

Like this rant by Jeremy Clarkson on a man named Peter Mandelson. Someone Americans won’t know or will not heard much of if anything at all.

I am therefore putting some information on this twice resigned under a cloud Labourite (LEFT) individual who has come back into govt., in our extended text.

Oh yes ... just so you people reading this know (Brits already do), Mr. (Lord actually) Mandelson is generally known as .....

THE LORD OF DARKNESS

Having resigned twice under a cloud and losing his seat as an MP, Labour made him a Lord so they could bring him back into the govt.

LyndonB will correct me where I may have it wrong.

So then .... Clarkson is on a serious rant today. He’s really angry. Here’s an example.

Get out of this stupid, Fairtrade, Brown-stained, Mandelson-skewed, equal-opportunities, multicultural, carbon-neutral, trendily left, regionally assembled, big-government, trilingual, mosque-drenched, all-the-pigs-are-equal, property-is-theft hellhole and set up shop somewhere else. But where?

Now I’m guessing here but those could be a few of the reasons that LyndonB and Chris have left old Blighty for other shores. There might well be other reason as well, but that’s a good start.

So then, without further ado ..... Heeeeeeeerrrrrssssss Clarkson.

Get me a rope before Mandelson wipes us all out

Jeremy Clarkson

Sunday Times

I’ve given the matter a great deal of thought all week, and I’m afraid I’ve decided that it’s no good putting Peter Mandelson in a prison. I’m afraid he will have to be tied to the front of a van and driven round the country until he isn’t alive any more.

He announced last week that middle-class children will simply not be allowed into the country’s top universities even if they have 4,000 A-levels, because all the places will be taken by Albanians and guillemots and whatever other stupid bandwagon the conniving idiot has leapt onto in the meantime.

I hate Peter Mandelson. I hate his fondness for extremely pale blue jeans and I hate that preposterous moustache he used to sport in the days when he didn’t bother trying to cover up his left-wing fanaticism. I hate the way he quite literally lords it over us even though he’s resigned in disgrace twice, and now holds an important decision-making job for which he was not elected. Mostly, though, I hate him because his one-man war on the bright and the witty and the successful means that half my friends now seem to be taking leave of their senses.

There’s talk of emigration in the air. It’s everywhere I go. Parties. Work. In the supermarket. My daughter is working herself half to death to get good grades at GSCE and can’t see the point because she won’t be going to university, because she doesn’t have a beak or flippers or a qualification in washing windscreens at the lights. She wonders, often, why we don’t live in America.

Then you have the chaps and chapesses who can’t stand the constant raids on their wallets and their privacy. They can’t understand why they are taxed at 50% on their income and then taxed again for driving into the nation’s capital. They can’t understand what happened to the hunt for the weapons of mass destruction. They can’t understand anything. They see the Highway Wombles in those brand new 4x4s that they paid for, and they see the M4 bus lane and they see the speed cameras and the community support officers and they see the Albanians stealing their wheelbarrows and nothing can be done because it’s racist.

And they see Alistair Darling handing over £4,350 of their money to not sort out the banking crisis that he doesn’t understand because he’s a small-town solicitor, and they see the stupid war on drugs and the war on drink and the war on smoking and the war on hunting and the war on fun and the war on scientists and the obsession with the climate and the price of train fares soaring past £1,000 and the Guardian power-brokers getting uppity about one shot baboon and not uppity at all about all the dead soldiers in Afghanistan, and how they got rid of Blair only to find the lying twerp is now going to come back even more powerful than ever, and they think, “I’ve had enough of this. I’m off.”

It’s a lovely idea, to get out of this stupid, Fairtrade, Brown-stained, Mandelson-skewed, equal-opportunities, multicultural, carbon-neutral, trendily left, regionally assembled, big-government, trilingual, mosque-drenched, all-the-pigs-are-equal, property-is-theft hellhole and set up shop somewhere else. But where?

You can’t go to France because you need to complete 17 forms in triplicate every time you want to build a greenhouse, and you can’t go to Switzerland because you will be reported to your neighbours by the police and subsequently shot in the head if you don’t sweep your lawn properly, and you can’t go to Italy because you’ll soon tire of waking up in the morning to find a horse’s head in your bed because you forgot to give a man called Don a bundle of used notes for “organising” a plumber.

You can’t go to Australia because it’s full of things that will eat you, you can’t go to New Zealand because they don’t accept anyone who is more than 40 and you can’t go to Monte Carlo because they don’t accept anyone who has less than 40 mill. And you can’t go to Spain because you’re not called Del and you weren’t involved in the Walthamstow blag. And you can’t go to Germany ... because you just can’t.

The Caribbean sounds tempting, but there is no work, which means that one day, whether you like it or not, you’ll end up like all the other expats, with a nose like a burst beetroot, wondering if it’s okay to have a small sharpener at 10 in the morning. And, as I keep explaining to my daughter, we can’t go to America because if you catch a cold over there, the health system is designed in such a way that you end up without a house. Or dead.

Canada’s full of people pretending to be French, South Africa’s too risky, Russia’s worse and everywhere else is too full of snow, too full of flies or too full of people who want to cut your head off on the internet. So you can dream all you like about upping sticks and moving to a country that doesn’t help itself to half of everything you earn and then spend the money it gets on bus lanes and advertisements about the dangers of salt. But wherever you go you’ll wind up an alcoholic or dead or bored or in a cellar, in an orange jumpsuit, gently wetting yourself on the web. All of these things are worse than being persecuted for eating a sandwich at the wheel.

I see no reason to be miserable. Yes, Britain now is worse than it’s been for decades, but the lunatics who’ve made it so ghastly are on their way out. Soon, they will be back in Hackney with their South African nuclear-free peace polenta. And instead the show will be run by a bloke whose dad has a wallpaper shop and possibly, terrifyingly, a twerp in Belgium whose fruitless game of hunt-the-WMD has netted him £15m on the lecture circuit.

So actually I do see a reason to be miserable. Which is why I think it’s a good idea to tie Peter Mandelson to a van. Such an act would be cruel and barbaric and inhuman. But it would at least cheer everyone up a bit.

Posted by peiper

Filed Under: • Editorials • Politics • Taxes • UK •

• Comments (9)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.