Sunday - September 13, 2009

Sunday - September 13, 2009

The snooper’s handbook: Guide that will ensure no home improvement escapes the Council Tax

I can’t believe we’ve allowed this to happen. Why does it cost more to police, empty bins etc from a large house with en suites, conservatory etc, Gordon already gets his cut from stamp duty and eventually from death duty. We need an uprising against local and central government. Thereis no reason to work hard- earn more pay more tax, spend more pay more tax via vat, spend it on your house pay more tax. I’m no francophile but they wouldn’t stand for it.

- john, manchester, 13/9/2009

If the Councils could spend there time improving the services that we pay for instead of this snooping around on people might be a better idea.They keep telling us they have no money for this no money for that and cutting services , then they pay these people to snoop on us. I think its about time we the people who pay their salaries tell them what we want our money spent on.

- jacqui weems, southampton, 13/9/2009

Those are just two of some 121 comments made on the website of the Sunday Mail. What are they banging on about?

‘Families face being taxed for their sash windows and en suite bathrooms. There is nothing that Gordon Brown won’t tax. These inspectors have alarming powers to enter people’s homes – and there is clear evidence that they now intend to exercise them.’

The snooper’s handbook: Guide that will ensure no home improvement escapes the Council Tax inspectorsBy Glen Owen

Last updated at 2:58 AM on 13th September 2009If you have just proudly added an en suite bathroom to your house or laid a tiled floor in your conservatory, then beware.

As part of secret plans for a council tax hike on the middle classes, inspectors have been armed with a new ‘snoopers handbook’ to ensure that no home improvement – however discreet – escapes their scrutiny.

THE BIG BROTHER MANUAL trains valuation experts how to follow up leads from ‘informants’ by undertaking ‘detective work’, including photographing properties, plundering estate agents’ details and room-by-room inspections.

Loft extensionThe handbook informs inspectors how to find homeowners who have so-called ‘value significant’ features

In July, The Mail on Sunday revealed that the Valuation Office Agency is compiling a database that will give all 23million homes in England one of 100 ‘dwelling house codes’, which are expected to form the basis of a council tax revaluation if Labour wins the next Election.

Middle-income families are likely to bear the brunt of any tax increases as the Government struggles to fill the black hole on its balance sheet caused by the recession.

The handbook, complete with audio commentary, sets out how inspectors can catch homeowners who have so-called ‘value significant’ features.

One exercise reads: ‘Your office has been informed the roofspace has been converted into a fourth bedroom. Your task is to establish whether existing details [for the house] require amendment.’

Another states that ‘information has been obtained’ about a house that has been ‘extended to include another living room and two new bedrooms with en suites. It also emerges that the house has a partial view of the mountains’.

DIY Repair Replace Garden Fence PanelsWithin the guide, inspectors are urged to ‘use to detective work’ to spot value-adding features on a home

The trainee inspectors then have to change their valuation to place the home in a higher bracket.

A further exercise trains inspectors to look out for ‘a garage large enough for two cars and a drive large enough for three’, a ‘hardwood conservatory with single glazing and tiled floor’, a ‘full sea view’ and recent modernisation.

The language in the manual will strike homeowners who have carried out improvements as positively Orwellian.

Alongside pictures of homes and their value-adding features – including in some cases a Sherlock Holmes-style magnifying glass on the pictures for inspecting building features – inspectors are urged to ‘use detective work’.

They are told: ‘The guide is effectively a glossary of the different types of dwellings within the country. You could even say that it’s a kind of illustrated social history.’ They are even wished ‘good luck’ on their missions.

Last night, Conservative Local Government spokeswoman Caroline Spelman said: ‘Labour Ministers have been caught red-handed training a cadre of State snoopers for a council tax revaluation.

Posted by peiper

Filed Under: • Jack Booted Thugs • Taxes • UK •

• Comments (4)

Tuesday - August 25, 2009

Tuesday - August 25, 2009

TAXED FOR HAVING NO DOUBLE GLAZING? TAXED IF YOU DO! That’s so more MPs can take longer vacations.

The first part of this will read quite familiar to BMEWS regulars. However, it’s an excerpted update and a close look at the whole thing will make you appreciate more, what you folks at home in the USA have. Not purr-fect to be sure but nowhere near as fracked up and tax mad as this place. I find it hard to describe (without four letter words but will try) just how frustrating this place is.

While the govt. tells the ppl how dire things are financially, they somehow ALWAYS manage to find money to waste in many ways. Not least of which are the junkets made by pols on, “fact finding tours.” Then there’s the kazillions spent on immigrants both legal and otherwise and the money for the newest racial group to these shores, gypsies/travelers and god only knows what else they spend our money on.

Take a look at this and be thankful Americans. At least there you have referendums and often can decide on things that have a bearing on you and your family.

You’ll still grumble and bitch about things but even so, you really can often get things done that folks here can’t even imagine.

California’s prop 13 is one example that comes to mind and I know there are others.

When I came here with my wife back in 2004, one of the first things I asked ppl was, how can the Brits afford to live here?

Since 2004, it’s only gotten worse. And to be very honest, I don’t really think it will get any better under the Tories (Conservatives) when they win power in the next election. If they win. The pox dear friends will be upon the taxpayer’s house. The MPs have theirs all paid for by the people being poxed.

Secret Labour tax on having a patio: Millions of homes assessed for charge which hammers middle classes

By Simon Walters

Shocking new details of a stealth tax of up to £600 for householders with views of any kind, patios, conservatories and even a nearby bus stop are revealed.

Millions of homes have already been secretly assessed by Labour in preparation for council tax hikes expected to target the middle class after the Election.

Homes have been given ‘value significant codes’ which will make virtually every desirable feature taxable.

Although not every home has been assessed, so far nearly 100,000 householders face being penalised simply for having a scenic view from their windows.Even those who have a mere glimpse of a river, hill or park - or any other pleasing outlook - stand to pay more under a special category for ‘partial scenic views’.

People with garages, conservatories and patios - and even parking spaces - are also in the firing line.

While the list is by no means complete, the figures indicate the chilling detail with which the inspectors are examining Britain’s homes.

The documents also reveal the sheer pettiness of the new rules. Balconies are divided into those up to three square metres, three to five square metres and so on. The ‘Conservatories’ category even covers lean-tos and differentiates between single and double-glazed.The 115,610 with double-glazed conservatories will be hit harder than the 43,821 with single glazing.

“The 115,610 with double-glazed conservatories will be hit harder than the 43,821 with single glazing.”

Oh yeah? Well, seems someone has had a change of heart. A bold headline in yesterday’s paper had this to say.

“TAXED FOR HAVING NO DOUBLE GLAZING”

Home owners failing green targets to pay more Council Tax

Home owners who fail to introduce green measures could be forced to pay more Council Tax.

By Myra Butterworth, Personal Finance Correspondent

Under the new proposals, the Government would increase Council Tax and Stamp Duty for millions of homes that are not energy efficient.

It could also mean families are unable to sell their home unless they spend tens of thousands of pounds on getting their properties insulated and double-glazed.

The measures are widely expected to come into force this autumn.

Politicians and housing experts attacked the measures saying it was yet another stealth tax, but this time dressed up as an environmentally-friendly initiative.

Grant Shapps, shadow housing minister, said: “The Government seems intent on giving green taxes a bad name. Rather than penalizing families who happen to live in homes which are harder to insulate they should introduce genuine help for people to reduce the carbon footprint of their property.

“Ministers now seem to believe that any problem can be fixed by simply extracting more tax from hard-pressed families, when what is really required is genuine innovation to green up the nation’s homes.”

Since last October, all homes put on the market for sale or rent have had to have an energy performance certificate, which rate the energy efficiency of a property, giving a rank form A to G.

The energy performance certificates include a report recommending improvements to save money and carbon.

It is understood that Government advisers The Energy Savings Trust wants it to becomes illegal from 2015 to put a home up for sale, which has a rating lower than band E.

An example of a Band F property would be a three-bedroom Victorian terrace property with solid brick walls (no insulation). It would have no double glazing, a standard gas firing boiler with room thermostat, a hot water jacket and energy saving light bulbs.

Measures needed for the property to be pushed up into band D would include installing a condensing boiler, insulating solid walls and double glazing.

A home’s energy ratings is contained in the controversial Home Information Packs, which home sellers must have in place before they begin to market a property. The packs cost £300 on average, but can go up to £500 depending on the provider.

Katie Tucker, of mortgage brokers Mortgageforce, said: “HIPS are an absolute waste of money. It was always known that the packs were of no other use except to help boost government revenues. Now they are using the EPC as a way of boost council tax.”

The Energy Savings Trust said high energy prices means it is more important than ever to have an efficient home. It suggested loft insulation could save a household £155 a year on energy bills, while cavity wall insulation could save around £120 a year.

Let me say a word about insulation inside these very old brick walls in our house. Built in the days before planet saving came into vogue (1924), the windows are ALL original complete with BADLY rusted frames which we clean and paint every year. Or almost. The council some three years ago offered free between the wall insulation for older houses and so we took up the offer. A crew came out and putting very small holes in the outside walls, blew in some sort of fiber or maybe it was foam. I don’t recall which. But they filled in the spaces. They also went up into the attic and blew stuff in there as well. (Now I think about it, I wonder if that’s when my cough started. ??)

Fast forward .... wasn’t too long before we found the walls inside the house very damn at the bottom and running up from the floor about 10 or 12 inches on the walls. Not in every room but worse in one or two then say the one I am in now. What isn’t wet is damp, and it DOES NOT DRY OUT! And there’s nothing we can do that we are aware of.

So, we’ll be taxed I guess because we have a rather large back garden (yard) on a fairly quiet street 2 miles outside Winchester, in an area that is regarded as a wealthy community. Ppl do pay a premium to come to this village and it isn’t even the top of the list. But its close. And I guess we’ll also be taxed due to single glaze windows.

It isn’t economically feasible to spend THOUSANDS on double glazed new windows for a house that will be sold and torn down in a couple of years.

Stay Tuned

Posted by peiper

Filed Under: • Daily Life • Government • Taxes • UK •

• Comments (5)

Friday - August 07, 2009

Friday - August 07, 2009

TAX AND SPENDING AND LOTS OF BOTH

Check this site daily. This fellow is good.

By Alan Caruba

We sometimes forget that the primary reason we live in the United States of America and not some British Commonwealth nation is that the people who fought our Revolution got fed up with all the taxes that King George and Parliament kept imposing on them. No taxation without representation was the rallying cry.

Now all we seem to have, whether at the federal, state or local level is endless taxation on virtually everything we purchase, use or own. In many cases those taxes have risen obscenely in recent days.

The new tax on tobacco products is, we’re told, intended for our own good, making them so expensive we will give up smoking. Other proposed taxes on “fast food” and even soda are passed off as being an incentive to eat in a more healthy fashion. Our personal health is our business, not the government’s and surely not an excuse to tax us!

There have always been “sin” taxes on things like tobacco and alcoholic beverages, but thanks to the profligate spending of all legislatures everywhere, these taxes are rising to obscene levels, unrelated to anything than a desperate effort to fill gaps in the budget.

Neither the states, nor the federal government seem to understand the need to STOP SPENDING. Every new “entitlement” program, like the proposed healthcare “reform” just imposes more and more taxation, and creates larger debt.

Here’s a list of just some of the taxes we pay:

Accounts Receivable Tax

Building Permit Tax

CDL license Tax

Cigarette Tax

Corporate Income Tax

Dog License Tax

Excise Taxes

Federal Income Tax

Federal Unemployment Tax (FUTA)

Fishing License Tax

Food License Tax

Fuel Permit Tax

Gasoline TaxGross Receipts Tax

Hunting License Tax

Inheritance Tax

Inventory Tax

IRS Interest Charges re IRS Penalties

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Property TaxService Charge Tax

Social Security Tax

Road Usage Tax

Sales Tax

Recreational Vehicle Tax

School Tax

State Income Tax

Telephone Federal Excise Tax

Telephone Federal Universal Service Fee Tax

Telephone Federal, State and Local Surcharge Taxes

Telephone Minimum Usage Surcharge Tax

Telephone Recurring and Non-recurring Charges Tax

Telephone State and Local Tax

Telephone Usage Charge Tax

Utility Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Watercraft Registration Tax

Well Permit Tax

Workers Compensation TaxIn my home state of New Jersey, the tax per gallon of wine and spirits increased 25% this month. That’s about $5.50 for liquor and 87.5 cents per gallon of wine. New Jerseyeans are famous for being among the most taxed citizens in the nation. No wonder some of us drink! We have exorbitantly high property taxes, along with income and sales taxes. Born and bred here, I remain mostly out of inertia and old age.

Now, in President Obama’s words, “we’re broke” and the answer he and Congress propose is to raise taxes while increasing the national debt by trillions so that your children’s children will be born having to pay it off.

The history of the Great Depression and sheer common sense argue against this.

At the same time, the federal government is taking ownership of a large piece of the automotive industry, owns a majority interest in a huge insurance company and is owed billions in TARP money by banks, investment houses, and AIG.

The Democrats want to take over healthcare in America.

The Democrats want to put a tax on all energy use.

The Democrats are even proposing to set how much executives can be paid.

There is a word for this. It’s communism.

There has long been talk of “a flat tax” and a “value-added tax.” The former is advocated by Steve Forbes and, if he’s for it, it is probably a good idea. The latter is favored by European nations and is a form of sales tax.

The great problem with all taxes is that, once imposed, they are rarely, if ever, repealed. The profligate spending by state and federal legislatures is the problem.

What is wrong with this picture? EVERYTHING!

Posted by peiper

Filed Under: • Economics • Editorials • Taxes •

• Comments (1)

Friday - July 31, 2009

Friday - July 31, 2009

Here’s the story. Woman has child, state takes it away. She has 13 more, state takes, she having #14

Unbelievable, isn’t it?

This one really does leave me speechless. Almost. The state keeps taking away her kids due to neglect, she says the state was right to do that but wants another chance. But she’s had 13 chances with 13 babies. Good Grief!

Now she says screw the state, I’m gonna have another and let the state keep picking up the tab. Which they have been doing. She now carrying number 14.

Earlier today a letter arrived from our probate attorney informing us that the the Inland Revenue, Brit version of our IRS, is questioning the value of the house the wife inherited from her mother. We got the value appraisal in writing from a real estate agent. Quite honestly, I wish the place were worth a ka-zillion dollars as that might be something to look forward to. In any event, we had to to come up with a LOT of money a few months ago to pay the tax ppl on the value given us at the time. BUT ... if the Inland Rev. folks believe this place is worth more, then we’re gonna have to scramble for the extra money. Fine.

But it sorely pisses me off knowing where the money goes. MPs on vacation “fact finding” trips to warm waters and couples like the ones here.

Both on the dole and no surprise.

Stay Tuned.

‘I’ll go abroad to keep my baby’: Pregnant again mother of 13 vows to save new baby as sister calls for her to be sterilisedBy Emily Andrews, Julie Moult, David Wilkes and Beth Hale

Last updated at 11:26 AM on 31st July 2009A pregnant woman who has had all 13 of her previous children taken into care has vowed to flee abroad to prevent social workers taking away her 14th.

Theresa Winters, 36, says leaving the country could be the only way she and partner Tony Housden will be allowed to keep the child.

It comes as her sister Louise Walls said she was ashamed of her own sibling and called for her to be sterilised.

Miss Winters, a heavy smoker who was herself taken into care as a teenager, accused social workers of failing to help her achieve her deepest wish of having a family and she would keep giving birth until she is allowed to keep one.

She told the Sun: ‘Leaving the country would be the easiest thing to do. If we had the money we would go tomorrow.

‘Then these people wouldn’t be able to touch us.

‘People think we’re bad parents but we’re not. We have changed - since we had the first five babies anyway.

‘No one has given us a chance since then.’

Miss Winters has now spent more than 10 years of her life pregnant and is four months from giving birth to her 14th child.

Mr Housden, 36, said: ‘We don’t want to scrounge off taxpayers’ money. We want to work and do the right thing but we don’t feel we’re being given a chance.

‘If we could leave the country we would. Then we would grow up like a real family and keep our baby.’

The couple, who live on £1,100 in benefits, believe they could save enough money to move abroad.

Louise Walls, 37, accused her sister of having more children out of ‘pure spite’.

The mother-of-three told the Daily Mirror: ‘She should be sterilised. She’s going to end up with 20 kids taken into care.

‘It has to be stopped. I’m ashamed to be her sister.

TIMELINE TO THERESA WINTERS’ CHILDREN

August 1992 - Girl

January 1994 - Boy

January 1995 - Boy

September 1996 - Boy

September 1997 - Boy

May 1999 - Girl

June 2000 - Girl

June 2001 - Boy

September 2002 - Girl

November 2003 - Boy

January 2006 - Girl

March 2007 - Girl

March 2008 - Boy

photos and the rest of this article click here.

Posted by peiper

Filed Under: • Daily Life • Outrageous • Personal • Taxes • UK •

• Comments (4)

Wednesday - July 29, 2009

Wednesday - July 29, 2009

Local Councils in England getting out of hand? A spark of hope…

Maybe BUT ....

First .. H/T to BMEWS ArgentiumTiger, who gave me a heads up on this story. Here I am living in this place and never saw this. But then again, it isn’t being much covered. In fact, we had four newspapers to read yesterday, Tuesday is a big paper day as a rule, and not one word about this guy.

So thanks Tiger.

I like this site btw and have checked it from time to time but I guess I’m going to have to do better.

Story is from Free Market Fairy Tales. http://www.fmft.net/

Sadly however (Sorry Tiger and Sorrier for England ) His good work will be undone by guess who? Of course. The damn government.

It is frustrating.

OK, here’s the story and a good one it is ..... more at the link below.

Rejoice: Suddenly it’s not so grim up North!

I am man enough to admit when I am wrong & hands up, I retract everything I have said about the Dreaded North because tonight dear readers we celebrate one Peter Davies, retired schoolmaster & now, the newly elected Mayor of Doncaster. Set aside if you can the catastrophic failure of Westminster , the extent of which has become apparent of the last twelve months & let’s review what new Mr Mayor chappie has been up to since the chains of office were placed on his surprisingly broad shoulders

On his first morning as Mayor of Doncaster in South Yorkshire , Peter Davies cut his salary from £73,000 to £30,000 then closed the Council’s newspaper for “peddling politics on the rates”. (on the rates, on the taxpayer)

Now three weeks into his job, Mr Davies is pressing ahead with plans he hopes will see the number of town councillors cut from 63 to just 21, saving taxpayers £800,000. Mr Davies said: “If 100 Senators can run the United States of America , I can’t see how 63 councillors are needed to run Doncaster “.

Now I know that many of you on the left hand side of the pond might hold strident views about that particular comment but taking a knife to the size of the political class, if not literally (shame) then figuratively has to be a step in the right direction in the lamentable absence of mass public executions.

He has withdrawn Doncaster from the Local Government Association and the Local Government Information Unit, saving another £200,000. Mr Davies said, “They are just talking shops”

...as well as…

“ Doncaster is in for some serious untwinning. We are twinned with nine other cities around the world and they are just for people to fly off and have a binge at the Council’s expense”.

He has promised to end council funding for Doncaster ‘s International Women’s Day, Black History Month and the Lesbian, Gay, Bisexual and Transgender History Month.

For all the rest please click on to >> http://www.fmft.net/

SO WE CAN ALL AGREE HIZ HONOR IS CERTAINLY ON THE RIGHT TRACK AND THE TXPAYER SHOULD BE PLEASED. BUT WAIT.

There’s a skunk in the bush just waiting to spray the taxpayer. The leader of the Conservative party is suggesting a possible road toll on one of the major roads but just as bad and maybe worse ..... is ‘The Works and Pension Secretary’ in the person of Comrade Commissar YeVette Cooper. She’s married to Comrade Ed Balls, who is ‘Secretary of State for Children, Schools and Families.’ Mrs Balls is the witch responsible (my Brit friends tell me) for the infamous and unwanted and unloved Home Information Packs. Or, H.I.P.s as they are called. They are un-necessary and are a wrench in the machinery and costly. But the Comrades Balls don’t have to pay the bills as the workers do that but I must not get too far off the subject.

Under glorious Comrade Commissar Mrs. Balls, the govt. is going to spend ONE BILLION £s, or almost 2 billion dollars, creating soft jobs that will be funded by, glorious comrades in the trenches with no say in the matter which is as it should be in this state.

People will be paid to become dance assistants, tourism ambassadors and solar panel engineers.

For our American readers, an engineer over here is NOT what you think of when you see and hear that term in the USA. Or at least, not always.

Here’s the story from the morning Telegraph. Part of it anyway.

£1bn scheme to create ‘soft jobs’

A billion pounds is to be spent on creating tens of thousands of “soft” public sector jobs for unemployed people including dance assistants, tourism ambassadors and solar panel engineers.

By Jon Swaine

Published: 10:00PM BST 28 Jul 2009The taxpayer-funded jobs are being created by councils, quangos and charities under a Government scheme to remove 150,000 people from the unemployment register over the next two years.

The first 47,000 jobs in the scheme, costing about £300 million, are to be announced on Wednesday by Yvette Cooper, the Work and Pensions Secretary.

The list of new vacancies - most of which will be filled by 18-24 year olds - will include sports coaches, classroom assistants and social carers, department sources said last night.

However, in a move that attracted claims that public money is being wasted on “soft jobs”, others include positions for forestry workers, loft laggers and child carers.Jobs based around refurbishing council houses and in local recycling projects are also to be created.

Miss Cooper is expected to say: “Many young people were denied the help they needed in the recessions of 80s and 90s and ended up out of work for months and years.“Too many never got a start in the jobs market. We are determined not to let that happen again. This is why we are announcing 47,000 new jobs for young people today.”

However, critics have accused the Government of swelling the state to an even more unaffordable level.

Susie Squire of the Taxpayers’ Alliance said: “The public sector has failed to cut back in the recession. Expanding it further is unrealistic and shortsighted because it will plunge us further into debt.“Soft jobs like these would be indulgent even in good economic times let alone in the current climate.”

The 47,000 jobs are the first to be created under the Government’s “Future Jobs Fund”.

The £1 billion fund is open to local councils, charities and other voluntary organisations.The bodies bid for the public money from the Government in order to create “socially useful jobs”.

A total of 100,000 jobs are due to be created for 18-24 year olds while the remaining 50,000 are for older unemployed people in unemployment “hotspots”.From January, young adults who have been unemployed for a year will be forced to take one of the new jobs - or a place on another government training scheme - or have their benefits cut.

The jobless total rose to 2.38m in the three months to the end of May, with 726,000 of those aged between 18 and 24.

The rate of unemployment among 18-24 year-olds has jumped from 12 per cent to more than 17 per cent over the past year.

You might ask, what’s wrong with that. What’s wrong with putting younger ppl to work. Problem is, there are private companies providing services that will charge the councils for things done on their behalf now. BUT .... if these folks are going to be working on a govt. project which this looks to be, they will naturally become eligible for pensions at some point. I really think I need Lyndon to lay it out in full as he knows a great deal about this sort of thing.

As well I have to confess that ANYTHING Ms Cooper has her hand in, I tend to be very wary of. I also don’t grasp the funding including charities.

I think it’s another big govt. spending program on top of all the other monies that the politicians have already glommed from the ratepayers.

Posted by peiper

Filed Under: • Economics • Government • Taxes • UK •

• Comments (3)

Tuesday - June 09, 2009

Tuesday - June 09, 2009

Minister’s ‘tax dodge’: MP avoided paying £1.5m bill on sale of ‘main home’.

Yeah. Meanwhile the rest of us have to pay up and pay when told or else. And no damn excuses either. And I sure do not believe his lawyer. Anyway, point is that these folks get away easy with things the rest of the little ppl would be put away for.

And no damn excuses either. And I sure do not believe his lawyer. Anyway, point is that these folks get away easy with things the rest of the little ppl would be put away for.

By Dan Newling

Last updated at 2:38 AM on 08th June 2009Millionaire Cabinet minister Shaun Woodward has been accused of avoiding £1.5million in capital gains tax by simultaneously claiming that two properties were his ‘main residence’.

In 2003 the Northern Ireland Secretary - the only Cabinet member with his own butler - made a £3.7million profit when he sold his central London townhouse to the singer Sting.

By telling the taxman that the property was his main residence, he avoided paying capital gains tax of 40 per cent on the sale, a saving of almost £1.5million.

Two years earlier he had told the Commons Fees Office that he, his wife and four children lived in Sarsden House, a mansion set in 458 acres in rural Oxfordshire near where his children went to school.

All published parliamentary records at the time of the townhouse sale suggest he lived in Oxfordshire rather than London.

Mr Woodward, 50, has categorically denied deliberately ‘flipping’ his main home designation in order to avoid capital gains tax.

Yesterday, however, he failed to clarify whether, in 2003, he declared two different ‘main residences’, one to the Commons authorities and another to the taxman.

‘Flipping’ is the now-condemned practice of MPs changing which home they designate their main residence in order to avoid tax and benefit from generous parliamentary second home allowances.

Mr Woodward bought his Georgian townhouse in Westminster in 1997 for £2million and sold it to Sting in 2003 for £5.7million.

Capital gains tax normally applies to any profit made on the sale of a second home and Mr Woodward would have been expected to pay 40 per cent on the £3.7million profit.

However, by saying the home was his main residence, he avoided the tax.

Further evidence that he actually lived in Oxfordshire was provided when Mr Woodward sold Sarsden House in 2006 for £24million.

At the time his spokesman said: ‘They have enjoyed family life there but feel it is now time to move on.’

Mr Woodward, MP for St Helens South, is married to Camilla Sainsbury of the supermarket dynasty and is said to be worth £15million.

His lawyer John Rosenheim said that in 2003 the MP was living ‘between the two properties’ in Oxfordshire and Westminster.

Asked which was designated as his main home, he said: ‘He hasn’t got the records from 2003 and neither does the Fees Office.’

Mr Rosenheim pointed out that far from avoiding capital gains tax, Mr Woodward’s claim that he lived in London meant he ended up paying more in tax when he eventually sold his Oxfordshire mansion.

He denied that the MP either ‘flipped’ his home or ‘took steps to avoid CGT’.

He said Mr Woodward has ‘complied both with the letter and spirit of the law and regulations pertaining both to tax and the Additional Costs Allowance’.

Posted by peiper

Filed Under: • Taxes • UK •

• Comments (1)

Friday - May 29, 2009

Friday - May 29, 2009

MPs’ expenses: We need to make MPs’ lives more taxing. Yeah. Like ours. In the real world.

I feel very strongly about this subject. Why shouldn’t I? I pay taxes here in the UK.

But Drew’s most recent post with regard to the self appointed armed guards at a polling station really sent a shiver through me. That those guys could so casually show up where they did in their silly uniforms without a care in the world or a thought about how inappropriate their being where they were, is a signpost of exactly where we’ve arrived at in the USA today. Furthermore, those guys I am sure don’t think they have done anything wrong. They most likely believe there might be something wrong with us for believing they were out of line and off limits.

Which brings me to my own post which I suppose by comparison is very much a nothing to an American reading this. After all, you’ve got your own worries over there and Drew has sure put a chilling BMEWS spotlight on things. But since this is where I live (for now) and pay tax (for ... ?) I have to shine a light on things here, as I’ve been doing for so long.

I’ve been banging on about and posting stories of the various MPs who have been playing in the taxpayers sand box.

Not all they have done is illegal, please understand that. But it is mind boggling in it’s complexity and dishonesty. Dishonest? How about plain unethical?

No, it’s both. I may have it wrong but anything unethical IS dishonest. Is that not right?

This editorial appeared in the morning paper and the writer has put it so well and so plain I almost think nothing else need be written on the subject.

Take a look. This is interesting, even if you aren’t here in the UK.

Accountant Brian Friedman explains why parliamentary expenses are a law unto themselves.

Brian Friedman

Last Updated: 3:27PM BST 29 May 2009Here’s something to send shivers down the spines of a few MPs. Under normal expenses rules, if a company pays for a capital asset, then it remains the property of the employer. Put simply, all those plasma TVs and duck houses and elephant lamps ought to belong to us, not to our MPs: when they get kicked out, deselected or retire, they should hand them back to the new intake.

As a senior partner, recently retired, at one of the Big Four accountancy firms, I like to think I know a thing or two about expenses and tax. But clearly, I don’t know as much as I thought. In the case of Hazel Blears, I believed that, despite her kind offer to pay capital gains tax on the sale of her second home, the tax system didn’t work like that. The taxman doesn’t accept voluntary donations: if you try to pay tax where none is due, he will simply return your cheque. Either the minister submitted an incorrect tax return, in which case she should be liable for interest, and probably penalties, or the whole thing is a charade.

Then there are the other MPs who have offered to pay money back. If I robbed a bank, but handed over the loot when the police came knocking, they wouldn’t just say thank you and walk away. If an employee fiddles his expenses, he will be dismissed, and quite likely prosecuted.

Why do our MPs think repaying the money is sufficient compensation? And why do they then think they can hang on until the next election and claim their generous resettlement allowance?

From a tax perspective, any expenses incorrectly claimed and subsequently repaid represent a beneficial loan. If the total is over £5,000, the MPs should be subject to tax on the notional interest arising – so the taxman should be charging interest and penalties on all those incorrect tax returns.

When you or I send in our returns, we make a declaration that our return is “correct and complete”. We are warned that if we give false information, or conceal any part of our income or chargeable gains, we may be liable to penalties or prosecution.

In practice, what often happens when the taxman realises we have submitted an incorrect return is that HM Revenue & Customs gives us one last chance to come clean: our accountant must write a full report of anything else we would now like to declare, and we must sign a “Certificate of Full Disclosure”. If HMRC then finds anything else untoward it gets angry – so angry that it will usually prosecute. If MPs had to review their returns and sign such a certificate, it would certainly focus their minds. If they could not or would not sign, why should we trust them with our votes?

Then there is something else that has had tax professionals spluttering over their morning coffee – the fact that Alistair Darling, and many of his ministerial colleagues, used their office allowances to pay for preparing their tax returns.

The idea that tax doesn’t have to be taxing as long as you’re an MP is galling on so many levels. First, it is an inappropriate use of their office allowance. Second, there are no grounds in tax legislation for these sums to be treated as tax-free. If there are any MPs who have been reimbursed for the cost of employing accountants through their allowances, and have not declared the amount they received as a benefit in kind – as Darling and others say they have – they will have submitted an incorrect tax return, and should be investigated by the Revenue.

Finally, the only reason that tax is this complex is because successive Chancellors have made it so: if even Mr Darling can’t submit a tax return without specialist help, then perhaps now is the time for a radical simplification of our incoherent and archaic system.

You may be getting the sense by now that there is one law for them, and another for us. In fact, that’s truer than you realise. Members of Parliament have created a special section of the tax code – Section 292 – which effectively ensures they receive less scrutiny than the rest of us, by exempting their overnight expenses from consideration.

We are still just scratching the surface of the way MPs have abused their allowances – any expenses investigator knows that mileage allowances tend to involve some pretty murky goings-on, and resettlement allowances, winding-down allowances and, above all, MPs’ pensions seem to have been equally generous.

But while there are a host of ways to improve things in the medium term – the abolition of Section 292; receipts for all expenses; the establishment of serviced apartments for MPs near Westminster; the abolition of a second-home allowance; and no recruitment of relatives – the most important thing is to stop the rot.

First, MPs who fiddle their expenses should be fired, just as they would be if they worked for corporations. Second, all MPs should submit their tax returns to the fees office for scrutiny prior to submission, and should sign an annual declaration that their tax affairs are in order. Finally, all expenses claims should be suspended with immediate effect until a Certificate of Full Disclosure is submitted to the fees office. That is the simplest way of getting immediate results, and separating the rotten eggs from the rest.

Brian Friedman is a retired senior tax partner with Ernst & Young. He runs the Forum for Expatriate Management (totallyexpat.com).

SOURCE

Posted by peiper

Filed Under: • Editorials • Outrageous • Taxes • UK •

• Comments (2)

Friday - May 15, 2009

Friday - May 15, 2009

Shenanigans in the Sunshine State

From the NRA/ILA, courtesy of several BMEWS readers:

DATE: May 11, 2009

TO: USF & NRA Member and Friends

FROM: Marion P. Hammer

USF Executive Director

NRA Past PresidentIn a last minute sneak attack on gun owners, the Florida Legislature raided the concealed weapons and firearms licensing trust fund. This not only effects resident CCW license holders, but non-resident Florida license holders as well!

They took $6 million from the Division of Licensing Concealed Weapons and Firearm Trust Fund that is intended, by law, to be used solely for administering the concealed weapons and firearms licensing program. (Read background information below)

Please Call, Fax, or Email Governor Charlie Crist IMMEDIATELY, and ask him to veto the $6 Million trust fund sweep from the Department of Agriculture & Consumer Services Division of Licensing authorized under Section 59 of the Conference Report of SB-2600.

Please send your email today!!

And/or please contact the Governor’s office by phone or fax ASAP.

Phone number: (850) 488-4441 or (850) 488-7146

Fax number: (850) 487-0801Send your email to the Governor at this address: Charlie.Crist@MyFlorida.com

BACKGROUND:Right now, the concealed weapons and firearms licensing program is backlogged and overloaded, due in part, to the refusal of budget officials and the Legislature to allow the Division of Licensing to use its own trust fund money to hire more employees and expand/upgrade equipment.

Crates of unopened mail containing license and license renewal applications sit in storage. The backlog of mail sitting unopened, at times, has extended beyond 90 days while existing licenses are expiring because renewal applications haven’t been opened and processed.

Currently (although the Division of Licensing has been working weekend shifts to clear the backlog), it is taking 13-14 weeks to process a “perfect” application once it has been opened. That is an unequivocal violation of the law that requires issuance or denial of a license by a specific time –– a violation of law that legislative leaders are condoning by their actions.

THE LAW REQUIRES THE DIVISION OF LICENSING TO ISSUE A LICENSE WITHIN 90 DAYS OF RECEIPT OF THE APPLICATION—or deny the license “for cause”, based upon the criteria set forth in the law. Theft of operating funds by the Legislature is not “just cause” for failure to issue licenses or renewals within 90 days.

While applications sit gathering dust, legislative leaders took $6 million of approximately $8 million held in the trust fund. That $6 million is supposed to be used to pay employees, buy upgraded equipment, upgrade or replace computers or software and to otherwise administer the concealed weapons and firearms licensing program.

BUT, feigning a desperate need for funds for education and health care, legislative leaders recklessly and ruthlessly confiscated trust fund money. Why? Because they were building a so-called “working capital” fund for the 2010-12 legislative term, reported now to be in the neighborhood of $1.8 BILLION DOLLARS. This so-called “working capital fund” is for the use of future legislative leaders.

They didn’t take that money for education. They didn’t take that money for health care. They didn’t take that money to save jobs. They didn’t take that money to avoid pay cuts, or budget cuts—they took the money to help build their own fund.

While Senate leadership reportedly fought to stop the ruthless raids on trust funds, in the end, they simply caved and let the House of Representatives prevail.

The bad behavior doesn’t end there.

Obviously fearing the Governor would use his line-item veto to stop trust fund raids, proviso language was inserted in the bill in a clear attempt to intimidate the Governor.

The proviso language, states that if any portion of the moneys swept from this and other trust funds does not become law (meaning it is vetoed), that portion of the money shall be deducted from the EDUCATION BUDGET. This is clearly designed to keep the Governor from vetoing trust fund sweeps, and prevent trust fund money from being taken back out the House leadership’s so-called “working capital” fund.

Money in the concealed weapons trust fund came from gun owners. No money to administer and run the concealed weapons and firearms licensing program has ever come from general revenue, or any other state fund or revenue source. The taking of these gun owner user fees is an unauthorized tax on the exercise of the Second Amendment.

AGAIN, Please call, fax and email Governor Crist IMMEDIATELY, and ask him to veto the $6 Million raid on the Concealed Weapons & Firearms Trust Fund!

Send your email to the Governor at this address: Charlie.Crist@MyFlorida.com

Please send your email today!!!!!

You may also call the Executive Office of the Governor at: (850) 488-7146.

Florida is usually a very pro-2A state. I don’t understand how this could have happened. But I can see it from an anti-freedom (ie gun control) perspective: Let the people have their little laws that allow them to Bear Arms. Charge them for this right, in terms of requiring a permit. Then take away all the processing money for the permit, so that it will never be processed, and thus never issued. Ta da, we now have kept everything legal, and still have kept those nearly crazy psycho gun nuts from walking around armed, just looking for schools full of children to shoot up.

Plus we can use the money to line our own nests, and channel to funds set aside to re-elect the incumbents. And we’ve set up the bill to have a built in strong arm tactic. Sweet, huh?

If I were a citizen of Florida, I’d be on my bully pulpit calling for the recall of every last legislative maggot who put their names on this piece of crap. But hey, if you live in Florida, you know that this is just business as usual. “Trust Fund” monies set aside AREN’T. Florida raids the environmental cleanup trust fund all the time. Same goes for the Transportation trust fund. What the hell, why not? The federal government does the same thing with Social Security. [Al Gore and his famous “lock box”. It may have been the only smart idea he ever had!]

Meanwhile, Florida Governor Charlie Crist (R) has announced he is running for the 2010 Senate. So expect him to be focused on campaigning from now until November. Just what a state in perpetual fiscal crisis mode needs.

It’s no different anywhere else. I heard on the news last night that California may have to declare bankruptcy. Um, can a state even do that? I don’t think so. But not a single one of them ever cuts back on state run programs, the size of state government, or anything. They just tax and spend and borrow and tax and spend and borrow. And never pay the piper.

Posted by Drew458

Filed Under: • Government • Taxes •

• Comments (1)

Sunday - May 10, 2009

Sunday - May 10, 2009

POLITICAL PERKS AND THE SCREWING OF THE TAXPAYER. BUSINESS AS USUAL.

It’s very doubtful if any American reading this will care a hoot about the ppl in power here and what they are up to.

But I have a personal stake, in a manner of speaking, in the financial side of things as after all, I live here.

Humor me on this people, ok? Go on and read the article I copied from this morning’s paper. If you read it slow like, even if not familiar with Brit doings, you’ll catch on to what’s going on and this is just one person. There are a 100 others.

Very soon, in fact by the end of July, the wife and I must come up with a ton of money for the inheritance tax on the house left to wife by her late mother.

We have to pay the Inland Revenue (IRS in American terms) a sum of almost but not quite, $20,000.00 by July.

There isn’t any loophole to crawl through, as you guys know at home, when dealing with income tax etc. There are just some things that can not be fought and won. There are things that make us grit our teeth but we must simply move on. We can not make our own rules.

But seeing how govts. spend our money is always going to be a bit ulcer producing. And what really frosts us is the current scandal exposed by The Telegraph in an exclusive brought about by leaked papers. And this thing is BIG. As in HUGE.

Starting yesterday they have been publishing and have continued today, how the politicians here are claiming for expenses. And the sums are truly staggering. In many cases the expenses are not necessarily illegal at all.

THEY ARE MOSTLY ALL WITHIN THE LAW. AH ...HERE’S THE CATCH.

THE BASTARDS HAVE WRITTEN THEIR OWN RULES.

HERE’S JUST ONE EXAMPLE AND THERE’S WORSE YET. BOTH LEFT AND RIGHT ARE ENSNARED IN THIS NET. BUT THEY’LL FIND A WAY OUT. THEY ALWAYS DO.

Here are a few translations from Brit to American usage.

Flat: an apartment

MP: Member of Parliament

MEP: Member European Parliament

Inland Revenue : IRS

Commons (House of):

Actually, the House of Commons would be equivalent to the US House of Representatives, while the House of Lords’ counterpart would be the US Senate. H/T with thanks to Macker for correcting me re. Commons.

CGT: Capital Gains Tax

Politician: both countries. = lying, thieving,sneaky, conniving individuals working for themselves. Mostly. Might be exceptions but the sightings are rare indeed. Usually to be found in bloated condition after visit to public funds. Which is often.

The Communities Secretary, facing fresh questions over flat sale in row over MPs’ expenses

Hazel Blears is facing fresh questions over the tax arrangements surrounding the sale of a flat in South London she had designated as a “second

home.By Patrick Hennessy and Melissa Kite

Last Updated: 9:35AM BST 10 May 2009Miss Blears sold the property in Kennington, south London, in August 2004 for £200,000, making a profit of £45,000. She admitted last night that she did not pay capital gains tax (CGT) on the profit from the sale because “no liability” had arisen.

The admission suggested that Miss Blears declared the flat as her primary residence for tax purposes while at the same time telling the Commons authorities that it was her second home, a designation that enabled her to claim hundreds of pounds in parliamentary expenses.

See guys and ladies, here’s the trick. It’s perfectly legal under the rules THEY WRITE, to say one thing to the Commons and another to the tax ppl.

CGT is liable to be paid on the profit from the sale of any property that is not classified with HM Revenue & Customs as a “main residence”. At the time of the sale Miss Blears had informed the Commons authorities that the Kennington flat was her second home, enabling her to claim mortgage interest payments on it at £850 a month. The Telegraph’s investigation into MPs’ expenses established that Miss Blears had claimed for three properties in a single year at taxpayers’ expense.

In March 2004 she stated to the Commons that her second home was a property in her Salford constituency, which she has owned with her husband since June 1997. During March 2004 she bought an £850 television and video recorder and a £651 mattress for this home.

In April 2004 she redesignated the Kennington flat as her second home with the Commons. After selling it four months later she spent taxpayer-funded nights in hotels in London, including the Zetter in Clerkenwell, where rooms cost £211 a night.

In December 2004 she bought another London flat with a mortgage of more than £1,000 a month and claimed it as her second home. Over the next four months, she claimed for groceries, furniture worth £4,874, a bed at £899 and £913 for a new TV.

Miss Blears’s spokesman said last night: “Hazel has complied with the rules of the House authorities and the Inland Revenue. No liability for CGT arose on the sale of her flat in Kennington.”

Tax experts said it was possible for Miss Blears to have designated the flat differently for the Commons and for HM Revenue & Customs.

Mike Warburton, a tax accountant at Grant Thornton, said: “The Inland Revenue rules work entirely independently of the parliamentary arrangements. It is open to anybody to elect which of their homes is their principal residence for capital gains tax. They will then not pay tax on the profit.”

LOOSE EXPENSES RULES FOR MPs; TIGHT ONES FOR TAXPAYERS. TELEGRAPH WITH MORE ON SUBJECT

Posted by peiper

Filed Under: • Economics • Government • Corruption and Greed • Personal • Politics • Taxes • UK •

• Comments (4)

Thursday - April 16, 2009

Thursday - April 16, 2009

Even Fox News Missed The Big Picture

Nice headline, but ...

They are probably off by an order of magnitude. I went out to one “official” tea party site and counted more than 800 confirmed, registered events held across America. How many more happened that weren’t registered with this one site? How many happened on college campuses? How many more were impromptu happenings? Word of mouth get togethers that didn’t make it to Facebook? My guess is that there were easily a 1000 tea parties yesterday. Maybe a lot more than that. And only some of the bigger ones got press coverage. 3000 folks at this one, 8000 folks at that one, 2500 here, 4000 there. 300 at my own county courthouse, and not only was it a chilly wet day, I live in a rather sparsely populated county with almost no unemployment.

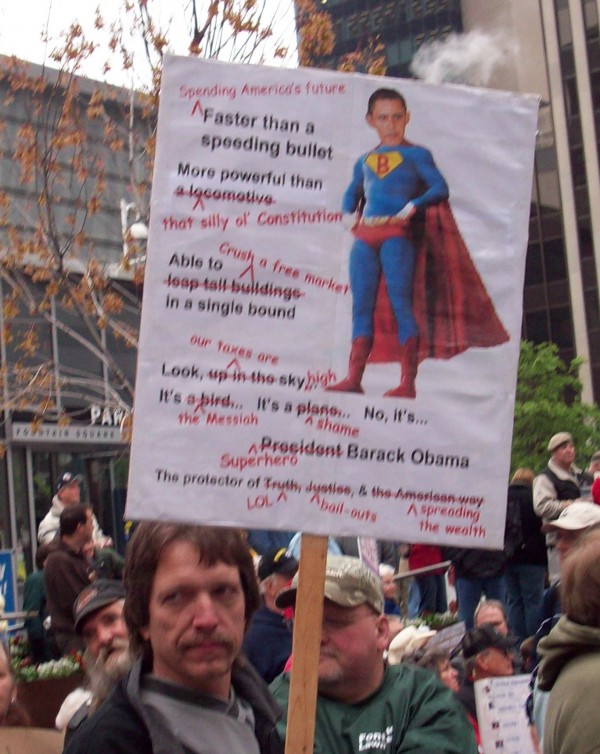

Chants like “Give me liberty, not debt” and “Our kids can’t afford you” were heard across several U.S. cities Wednesday as anti-tax “tea party” protesters took to the streets to voice their opposition to big government spending.

Thousands of protesters—some dressed in colonial wigs with tea bags hanging from their eyeglasses—showed up in states from California to Kentucky to Massachusetts, holding signs and reading speeches lambasting the Obama administration’s tax-and-spend policies.

“I have two little kids and I know we are mortgaging their futures away,” one protester at a rally in Austin, Texas told FOX News. “It makes me sick to my stomach.

In Lansing, Mich., outside the state Capitol, another 4,000 people waved signs exclaiming “Stop the Fiscal Madness,” “Read My Lipstick! No More Bailouts” and “The Pirates Are in D.C.”

More than 1,000 protesters gathered outside a downtown federal building in Salt Lake City despite the rain and snow. Kate Maloney held a cardboard sign that read “Pin the tail on the jacka$$” with a picture of Obama on a Democratic donkey.

Posted by Drew458

Filed Under: • Taxes •

• Comments (5)

I Will Not Bow But I Will Shrug

About 8000 people turned out for this one rally in Cicinnati yesterday, despite the chilly blustery weather. And one of our favorite BMEWS readers was there! I’m pretty sure another one of us went to the tea party in Clovis, New Mexico, but he hasn’t sent in any pictures. Good work by all involved. Keep talking, keep the pressure on, and don’t trust government an inch. That was Allan’s dictate, and I’m proud to see it being applied. BTW, I hear that BMEWS is now considered a “political activist” site and inaccessible from .mil computers. Kewl!!

I had Fox News on most of the day, and they gave these rallies extensive coverage. The other cable networks were sneeringly dismissive, and when I watched the New York City MSM news at 11 the entire nation-wide event - which probably attracted a million people all across the country, thus making it probably the biggest grass roots turn out in history - got exactly 4 seconds of air time. Bastards. So here’s some snips from Ann Coulter’s latest essay to serve as “background music” for the images.

I had no idea how important this week’s nationwide anti-tax tea parties were until hearing liberals denounce them with such ferocity. The New York Times’ Paul Krugman wrote a column attacking the tea parties, apologizing for making fun of “crazy people.” It’s OK, Paul, you’re allowed to do that for the same reason Jews can make fun of Jews.

On MSNBC, hosts Keith Olbermann and Rachel Maddow have been tittering over the similarity of the name “tea parties” to an obscure homosexual sexual practice known as “tea bagging.” Night after night, they sneer at Republicans for being so stupid as to call their rallies “tea bagging.”Every host on Air America and every unbathed, basement-dwelling loser on the left wing blogosphere has spent the last week making jokes about tea bagging, a practice they show a surprising degree of familiarity with. Except no one is calling the tea parties “tea bagging”—except Olbermann and Maddow. Republicans call them “tea parties.”

The point of the tea parties is to note the fact that the Democrats’ modus operandi is to lead voters to believe they are no more likely to raise taxes than Republicans, get elected and immediately raise taxes.

Apparently, the people who actually pay taxes consider this a bad idea.

The lie at the heart of liberals’ mantra on taxes—“tax increases only for the rich”—is the ineluctable fact that unless taxes are raised across the board, the government won’t get its money to fund layers and layers of useless government bureaucrats, none of whom can possibly be laid off.

How much would you have to raise taxes before any of Obama’s constituents noticed? They don’t pay taxes, they engage in “tax-reduction” strategies, they work for the government, or they’re too rich to care. (Or they have off-shore tax shelters, like George Soros.)

California tried the Obama soak-the-productive “stimulus” plan years ago and was hailed as the perfect exemplar of Democratic governance.

In June 2002, the liberal American Prospect magazine called California a “laboratory” for Democratic policies, noting that “California is the only one of the nation’s 10 largest states that is uniformly under Democratic control.”

They said this, mind you, as if it were a good thing. In California, the article proclaimed, “the next new deal is in tryouts.” As they say in show biz: “Thanks, we’ll call you. Next!”

In just a few years, Democrats had turned California into a state—or as it’s now known, a “job-free zone”—with a $41 billion deficit, a credit rating that was slashed to junk-bond status and a middle class now located in Arizona.

California was, in fact, a laboratory of Democratic policies. The rabbit died, so now Obama is trying it on a national level.

That’s what the tea parties are about.

RedStatesUSA has an excellent Tea Party speech posted. Read it, snag it, and use it, because I don’t think this is going to be a one-time thing.

Posted by Drew458

Filed Under: • Taxes •

• Comments (7)

Tuesday - April 14, 2009

Tuesday - April 14, 2009

A Bad Time To Call

So I’m sitting here at the computer, with half a dozen .pdf forms open, trying to get my taxes done, hoping that I can get my bottom line small enough so that the check I mail in won’t bounce.

And the phone rings. It’s this guy from the Republican Party, who wants me to send them some money. “Oooh, now we’ve got Michael Steele and how much they need my support what with the crazy budgets the Democrats have rammed through and ... “

I cut the mother off at the knees. Bad time to call dude.

I gave him both barrels, and told him everything that was wrong with the GOP going all the way back to Nixon. All the broken promises, from Reagan getting rid of the Department of Education, to the failed Contract With America (anybody remember term limits?) right up to weak foreign policy and through the greed, corruption, and pork barrel spending of the current crop. How today’s Republicans aren’t Conservatives by any stretch, and shut up already with the abortion issue you’re never going to overturn Roe, how they’re all actually Democrats who only appear conservative because all the Democrats are now Socialists. And so on and so on. I apologized to the guy, because he’s just doing a job, but I let him know that if the ‘pubs wanted another dime out of me that they’d better man up and git ‘er done. And then I told him just what “‘er” meant, from border security to lower taxes to a greatly smaller federal government that stayed within it’s constitutional bounds to overturning Kelo to thinning out the crazy amount of stupid laws to better tax policy to responsible spending and accounting practices to keeping the damn Democrats the hell out of our primaries, which is what gave us Juan Fucking McAmnesty (yes, I said exactly that) who isn’t even a Republican much less a Conservative, oooh, I’m a Maverick!, sure I’m proud of his military service but that was a long time ago and I won’t forget how he sold Sarah Palin down the river and ran the most limp dick campaign since Bob Dole. And, yippity fuckin yahoo, we’ve got Michael Steele, a black guy. Why is it that he’s almost the only black guy in the party, when it was the Republicans who were founded to eliminate slavery, it was the Republicans who got the 14th and 15th Amendment passed when every last Democrat voted against them, it was the Republicans who forced through the Civil Rights Act etc etc, right up to Bush and his No Child Left Behind which should have raised the education standards all over the country even in the ghettos but all we ever heard was that he didn’t fund it, even though he did even though funding education is none of the federal government’s damn business and the wishy washy GOP has allowed themselves to be demagogued as the party that only cares about big business and doesn’t like black people, hell it was said they even sabotaged the levies in the 9th Ward so they’d all drown, and not one of them had the guts to say what a crock that statement was?

He was laughing his ass off on the other end of the phone. I apologized again, and told him he was going to have an awful lot of responses like mine. He said that part of his job was to pass comments along. So I told him that when the Republican party got over being Upper East Side Gentlemen and started fighting fire with fire against the Democrats - who lie, cheat, steal, rig elections, plus the whole corrupt ACORN mess, AND the financial breakdown that is heavily their fault and thieves like Dodd are getting away with it scot-free, and they have brainwashed generations of technically savvy young people into mindless leftist minions - THEN maybe I’d think about it. But only after I saw some REAL PROGRESS against some of my outlined issues. And I’m not seeing any progress at all on any of them, AND I didn’t see any of it when Bush was in the White House, EVEN WHEN the GOP had control of the House and the Senate. Find me a stand up guy who can talk the talk and walk the walk and get things done, hey maybe Bobby Jindal?, then they’d see some money from me. Until then, save yourselves the cost of a phone call and don’t bother me.

Well, I feel better now.

Remember, Buy A Gun Day is tomorrow. If you can find one to buy. My wife did her taxes and can rationalize buying a nice piece. All I have left in my bank account is some of Obama’s loose Change.

Posted by Drew458

Filed Under: • Republicans • Taxes •

• Comments (3)

Monday - March 30, 2009

Monday - March 30, 2009

Time To Quit

Tobacco companies and public health advocates, longtime foes in the nicotine battles, are trying to turn the situation to their advantage. The major cigarette makers raised prices a couple of weeks ago, partly to offset any drop in profits once the per-pack tax climbs from 39 cents to $1.01.

Medical groups see a tax increase right in the middle of a recession as a great incentive to help persuade smokers to quit.

Tobacco taxes are soaring to finance a major expansion of health insurance for children. President Obama signed that health initiative soon after taking office.

Other tobacco products, from cigars to pipes and smokeless, will see similarly large tax increases, too. For example, the tax on chewing tobacco will go up from 19.5 cents per pound to 50 cents. The total expected to be raised over the 4 1/2 year-long health insurance expansion is nearly $33 billion.

Smokers are mulling their options.

The tax increase is only the first move in a recharged anti-smoking campaign. Congress also is considering legislation to empower the Food and Drug Administration to regulate tobacco. That could lead to reformulated cigarettes. Obama, who has agonized over his own cigarette habit, said he would sign such a bill.

Prospects for reducing the harm from smoking are better than they have been in years, said Dr. Timothy Gardner, president of the American Heart Association. The tax increase “is a terrific public health move by the federal government,” he said. “Every time that the tax on tobacco goes up, the use of cigarettes goes down.”

About one in five adults in the United States smokes cigarettes. That’s a gradually dwindling share, though it isn’t shrinking fast enough for public health advocates.

New Jersey, of course, has the highest state taxes in the nation on cigs. Right now it stands at $2.57 I think. And then they charge you the state 7% sales tax on top of that. In 2002 NJ tripled the tax on cigarettes. With the latest tax, on which they charge sales tax, they’ll make even more money from it.

On February 4, 2009, Congress enacted, and President Obama signed into law, a 62-cent increase in the federal cigarette tax, along with increases in other tobacco taxes, to fund expansion of the State Children’s Health Insurance Program (SCHIP). The federal cigarette tax will increase to $1.01 per pack on March 31, 2009.

Since January 1, 2002, 44 states and the District of Columbia have increased cigarette taxes, some more than once. The average state cigarette tax has increased from 43.4 cents to $1.21 a pack.

A few weeks ago a brand-name pack of cigarettes cost around $6.75 in NJ. Then overnight the price shot up to nearly $8. That was the manufacturers raising their prices in anticipation of this latest tax hitting. And the vendors got their extra margin in. And of course the sales tax bite increased because of all of that:

Philip Morris USA, the largest tobacco company and maker of Marlboro, is forecasting a drop, but spokesman Bill Phelps said he cannot predict how big. Philip Morris raised Marlboro prices by 71 cents a pack early this month, and prices on smaller brands by 81 cents a pack. Other major companies followed suit.

The pricing moves raised eyebrows. “That’s nothing more than greed,” said Kevin Altman, an industry consultant who advises small tobacco companies. “They weren’t required to charge that until April 1. They are just putting that into their pockets.”

Responded Phelps: “We raised our prices in direct response to the federal excise tax increase, and people who are upset about that should find out how their member of Congress voted, and contact him or her.”

35 years ago, when I was in high school and the minimum wage was $2.35 an hour, a pack of smokes cost 50¢. I think a cartoon went for $4. Maybe less. With this latest tax hike, cigarettes will cost nearly 50¢ each. Screw that. I think we should all give up the habit, just to hose the government. They make billions from the tobacco taxes, and yet have no appreciation at all of the people who give them this money. Nope, they’re all evil. Social pariahs. Unemployable health risks. And NOBODY takes their side. EVER.

It is unfortunate that anti-smoking groups are incapable of anything other than knee-jerk support for any and all cigarette taxes. They have never met a cigarette tax increase that they didn’t like, no matter who pays the tax, what the funds are used for, how regressive or unfair it is, how inappropriate the resulting fiscal dependence on smoking might be, and how sensible potential alternative funding sources, or alternative uses of the cigarette tax revenues might be.

The cigarette graphic is a little bit dated, but the slices are generally accurate. Without the insane taxes, cigarettes would cost about a quarter of what they do.

Posted by Drew458

Filed Under: • Miscellaneous • Taxes •

• Comments (2)

Monday - March 02, 2009

Monday - March 02, 2009

Pass the Pork Please

Here’s the link. Have fun seeing where all the money is going.

This post started out being a comment over at Vilmar’s, but it got so big I realized it was a post in itself. Sorry Vilmar. CJS is not the federal budget. It’s just the Criminal Justice System. But for some odd reason NOAA gets funded through them too. And it’s a whole gigantic poop pile of money, every single year.

Horry Clap, have you looked at some of this merde?

I noticed that almost all the pork money around my area is going to either the NOAA for fish hatcheries and flood control or to various police departments for COPS funding*. A huge part of that is for video surveillance cameras. Everywhere you look, money for video cameras. Britain, here we come.

Billings Montana, population 90,000, gets $269,000 to buy an armored security vehicle. And “tactical blankets”. WTF, are the Cheyenne going on the warpath or something?

Thunder Bay Marine Sanctuary in the Upper Peninsula gets half a million for “telepresence”. Say what?

A mere $100 Grand for the Seals As Sentinels program on the coast of Maine. “Save teh whales!!” “Um, sorry, we’re out of whales.” “Save the dolphins!!!” “Um, sorry, we don’t have any of them either.” “Save the seals!!!!1!!” “Ok, that we can do.”

$800 Grand for the University of Alabama to do weather research ... in the Gulf of Mexico.

A cool million for San Fwanswishco to get a Shot Spotter “gun location technology and policing project”, which actually means hidden microphones placed all over the ghetto. Like the SFPD is actually going to respond to a shooting in Oakland.

* COPS is an ongoing computerization effort I gather, that has absorbed more than TEN BILLION DOLLARS in the past 14 years; more than < ahref="http://www.cops.usdoj.gov/Default.asp?Item=572">3/4 million dollars per police department. You’d think every badge out there had a box of solid gold donuts by now, but no. They need ever more computers and technology to more effectively

fight crimegive out speeding tickets and beat up little girls in holding cells.For 2009 the CJS bill is for 57.9 BILLION

in 2008 the CJS bill was 51.8 BILLION

in 2007 the CJS bill was 54.6 BILLION

in 2006 the CJS bill was 52.3 BILLION

in 2005 the CJS bill was 43.4 BILLION

in 2005 the CJS bill was 41.4 BILLIONWikipedia says there are 138 million taxpayers. I doubt that. Certainly there are a lot less actual bottom line payers of federal income tax than that. I’d guess half that number, which means the annual bite out of the workingman’s pocket for just CJS alone is around $625. That’s a whole shitload of donuts and fish eggs.

I’m waiting for TQFU** to get out his magic crayon and slash each and every one of these earmarks.

** Obama: The Quicker Fucker-Upper. Love it. Taking it. Using it. Thank you OCM and Vilmar.

Posted by Drew458

Filed Under: • Democrats-Liberals-Moonbat Leftists • Taxes •

• Comments (5)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.