Saturday - February 05, 2005

Saturday - February 05, 2005

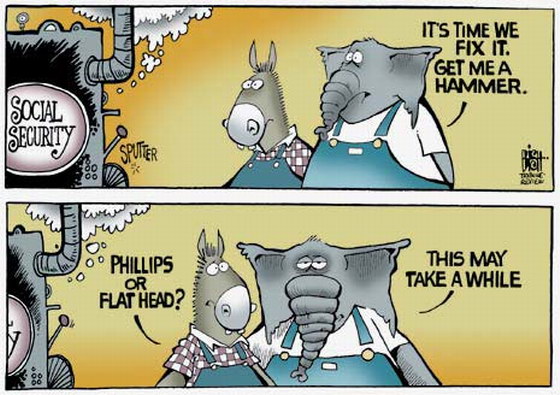

Not Funny

Randy Bish, Pittsburgh, PA—The Tribune-Review

Posted by The Skipper

Filed Under: • Social-Security •

• Comments (1)

Friday - February 04, 2005

Friday - February 04, 2005

Social Security Blog War

Several of you have asked me to collect and publish the recent Social Security Blog War links. Here they are. Feel free to choose your battleground and flail away at each other. Let no quarter be given. The last man (or woman) standing wins. WTF he or she wins remains to be seen. You already know which side of this Vilmar and I come down on. We both would prefer to manage our retirement ourselves. The Social Security boondoggle is nothing less than a very expensive lottery ticket and in order to win you have to (a) survive everything the world can throw at you for 65 years and (b) pray the government doesn’t change the rules at the last minute. Thanks to heart disease, cancer, terrorists, obesity, auto accidents, usafe drugs, pollution, global warming, genetics, etc. .... you have a better chance of Ed McMahon showing up at your door tomorrow with that check from Publishers Clearing House.

I’ll post a link to this on the right sidebar and will try to keep it updated with new post links and comment counts as best I can. If any of you have reference links you want to add to this, send them to me or Vilmar and we will add them at the bottom of this post.

OK, troops .... fire when ready .... and remember ....

“Government big enough to supply everything you need is big enough to take everything you have.”

-- Thomas Jefferson

Democrat, Thy Name Is Hypocrite ! Date: (02/04/05) Comments: (4)

Excerpt: Democrats who booed President Bush Wednesday night were also booing Franklin D. Roosevelt .... Franklin Roosevelt, the same man whom Bush quoted as saying that “each age is a dream that is dying, or one coming to birth”; the same man who gave birth to Social Security in the midst of…

Social Security Reform: Talking Points Memo Date: (02/04/05) Comments: (41)

Excerpt: OK, you asked for it and now you’re going to get it. The battlefield is here. I am deep in my bunker, about a mile beneath Cheyenne Mountain, prepared to withstand anything, including nuclear bombs. Below are the Republican Talking Points for Social Security Reform. I received these straight from the…

Do You Support Social Security Reform? Date: (02/04/05) Comments: (1)

Excerpt: If so, go here. Bookmark and check back frequently to stay on top of what is going on. Then click on this link to sign a petition directed at your senators to get the message out. I encourage you all to pass this along to your friends and family. Only when…

The Democratic Mantra Date: (02/04/05) Comments: (1)

Excerpt: Not a day goes by that the Democraps moan and groan about how bad the economy is. Yet in the same breath they will tell you noting is wrong with Social Security (I wonder where they were in the 90s when Clinton was saying SS was doomed? HMMMMM?) Anyway, it should…

Social Security For The Logic and Fact Challenged Date: (02/03/05) Comments: (8)

Excerpt: For those who can not understand the concept of why people should be given the option of getting out of the Ponzi scheme called sociali security, Mrs. duToit tries to explain why we want out and she uses pictures! Hopefully, now even the socialist nanny-state lefties incapable of grasping simple written…

You Know What’s Disgusting? Date: (02/03/05) Comments: (110)

Excerpt: The behavior of Democrats last night at the SOTU speech where they erupted into cries of “NO!” when the President mentioned overhauling the Ponzi scheme also known as Social Security. I understand that it was unprecedented. NPR, of course, loved it! The leftist America-haters loved it. The Democraps loved it. And…

Going Too Far Date: (02/03/05) Comments: (3)

Excerpt: If you ever wonder why Social Security is going broke or Medicare is going broke, you need only read something like this. When we have entitlement programs where we expand the list of eligibility to almost everyone and start giving benefits to them (and in a somewhat capricious way) the results…

Why Social Security Reform Will Fail Date: (01/24/05) Comments: (8)

Excerpt: Why Social Security Reform Will Fail Unless there is a concerted effort to undo decades of government brainwashing by campaigning to convince people their future belongs to them, any effort to privatize social security is doomed to failure. We can start with a VERY short letter to all our congress-critters: “I…

A $1000 Financial Class For Free Date: (01/20/05) Comments: (12)

Excerpt: Unless you’ve been living in a cave or refuse to acknowledge it, social security is big news right now. We’ve had quite a spirited discussion on this blog about it and even trapped us a moonbat in the process. Socialists and their fawning butt-boys, the media and AARP, are dead set…

More On Social Security Date: (01/20/05) Comments: (2)

Excerpt: If you think we pay too much for taxes and social security, read this article on the trials and tribulations the socialists in Germany are going through. It’s finally dawned on them that they MUST change their welfare system, unemployment compensation system and social security system. After all, when one of…

What Needs To Happen To Social Security Date: (01/18/05) Comments: (78)

Excerpt: This is a very complex issue but one the overhaul of which every American needs to consider. It just can not continue to operate the way it does. For the purists who will not tolerate talk of privatization, you have to think about this: there are fewer and fewer people working…

Reference Links:

The Washington Post Cries Foul

The CEA Predicts A Stock Market Crash

GOP: Preserving Social Security

Posted by The Skipper

Filed Under: • Social-Security •

• Comments (6)

Democrat, Thy Name Is Hypocrite !

Democrats who booed President Bush Wednesday night were also booing Franklin D. Roosevelt ....

Franklin Roosevelt, the same man whom Bush quoted as saying that “each age is a dream that is dying, or one coming to birth”; the same man who gave birth to Social Security in the midst of recession; also said, in his Message to Congress on Social Security on Jan. 17, 1935:

“In the important field of security for our old people, it seems necessary to adopt three principles: First, noncontributory old-age pensions for those who are now too old to build up their own insurance. It is, of course, clear that for perhaps 30 years to come funds will have to be provided by the States and the Federal Government to meet these pensions. Second, compulsory contributory annuities that in time will establish a self-supporting system for those now young and for future generations. Third, voluntary contributory annuities by which individual initiative can increase the annual amounts received in old age. It is proposed that the Federal Government assume one-half of the cost of the old-age pension plan, which ought ultimately to be supplanted by self-supporting annuity plans.”Those are the same principles Bush is upholding today, and those Democrats who booed Bush derided them with the same exhalation of breath.

Posted by The Skipper

Filed Under: • Social-Security •

• Comments (5)

Social Security Reform: Talking Points Memo

OK, you asked for it and now you’re going to get it. The battlefield is here. I am deep in my bunker, about a mile beneath Cheyenne Mountain, prepared to withstand anything, including nuclear bombs. Below are the Republican Talking Points for Social Security Reform. I received these straight from the RNC after the State Of The Union speech. Show me where they are wrong .... if you can. Try to use facts and logic and keep the name-calling to a dull roar.

1 ■ A Social Security System designed for a 1935 world does not fit the needs of the 21st Century. Social Security was designed in 1935 for a world that is very different from today. In 1935, most women did not work outside the home. Today, about 60% of women work outside the home. In 1935, the average American did not live long enough to collect retirement benefits. Today, life expectancy is 77 years. (2004 Report of the Social Security Trustees, p. 81).

2 ■ Social Security will not be changed for those 55 or older (born before 1950). Today, more than 45 million Americans receive Social Security benefits and millions more are nearing retirement. For these Americans, Social Security benefits are secure and will not change in any way.

3 ■ Social Security is making empty promises to our children and grandchildren. For our younger workers, Social Security has serious problems that will grow worse over time. Social Security cannot afford to pay promised benefits to future generations because it was designed for a 1935 world in which benefits were much lower, life-spans were shorter, there were more workers per retiree, and fewer retirees were drawing from the system.

4 ■ With each passing year, there are fewer workers paying ever-higher benefits to an ever-larger number of retirees. Social Security is a pay-as-you-go system, which means taxes on today’s workers pay the benefits for today’s retirees. A worker’s payroll taxes are not saved in an account with his or her name on it for the worker’s retirement.

5 ■ There are fewer workers to support our retirees. When Social Security was first created, there were 40 workers to support every one retiree, and most workers did not live long enough to collect retirement benefits from the system. Since then, the demographics of our society have changed dramatically. People are living longer and are having fewer children. As a result, we have seen a dramatic change in the number of workers supporting each retiree’s benefits. According to the 2004 Report of the Social Security Trustees (page 47):

6 ■ In 1950, there were 16 workers to support every one beneficiary of Social Security.

7 ■ Today, there are only 3.3 workers supporting every Social Security beneficiary.

8 ■ And, by the time our youngest workers turn 65, there will be only 2 workers supporting each beneficiary.

9 ■ Benefits are scheduled to rise dramatically over the next few decades. Because benefits are tied to wage growth rather than inflation, benefits are growing faster than the rest of the economy. This benefit formula was established in 1977. As a result, today’s 20-year old is promised benefits that are 40% higher, in real terms, than are paid to seniors who retire this year. But the current system does not have the money to pay these promised benefits.

10 ■ The retirement of the Baby Boomers will accelerate the problem. In just 3 years, the first of the Baby Boom generation will begin to retire, putting added strain on a system that was not designed to meet the needs of the 21st century. By 2031, there will be almost twice as many older Americans as there are today - from 37 million today to 71 million Americans in 2031. (http://www.ssa.gov/pressoffice/basicfact.htm).

11 ■ Social Security is heading toward bankruptcy. According to the Social Security Trustees, thirteen years from now, in 2018, Social Security will be paying out more than it takes in and every year afterward will bring a new shortfall, bigger than the year before. And, when today’s young workers begin to retire in 2042, the system will be exhausted and bankrupt. (Summary of the 2004 Annual Report of the Social Security Trustees, p. 1). If we do not act now to save it, the only solution will be drastically higher taxes, massive new borrowing, or sudden and severe cuts in Social Security benefits or other government programs.

12 ■ As of 2004, the cost of doing nothing to fix our Social Security system had hit an estimated $10.4 trillion, according to the Social Security Trustees. (2004 Report of the Social Security Trustees, p. 58). The longer we wait to take action, the more difficult and expensive the changes will be. · Every year we wait costs an additional $600 billion. (2004 Report of the Social Security Trustees, p. 58). · Today’s 30-year-old worker can expect a 27% benefit cut from the current system when he or she reaches normal retirement age. (2004 Report of the Social Security Trustees, p. 8). And, without action, these benefit cuts will only get worse.

13 ■ Increasing payroll taxes is a band-aid, not a permanent solution. Payroll taxes have been increased more than 20 times since 1935, and we still have not fixed the problem. The Social Security payroll tax, which was once 2%, is now 12.4%. To meet the needs of the 21st century, payroll taxes would have to be raised over and over and over again on American workers, stifling economic growth and job creation. Economists calculate that under the current system, the payroll tax would have to rise to more than 18% if our children and grandchildren are to receive their scheduled benefits. (2004 Report of the Social Security Trustees, p. 165).

14 ■ Under the President’s plan, personal retirement accounts would start gradually. Yearly contribution limits would be raised over time, eventually permitting all workers to set aside 4 percentage points of their payroll taxes in their accounts. Annual contributions to personal retirement accounts initially would be capped, at $1,000 per year in 2009. The cap would rise gradually over time, growing $100 per year, plus growth in average wages.

15 ■ Personal retirement accounts offer younger workers the opportunity to build a “nest egg” for retirement that the government cannot take away.

16 ■ Personal retirement accounts provide ownership and control. Personal retirement accounts give younger workers the opportunity to own an asset and watch it grow over time.

17 ■ Personal retirement accounts could be passed on to children and grandchildren. The money in these accounts would be available for retirement expenses. Any unused portion could be passed on to loved ones.

18 ■ Personal retirement accounts would be voluntary. At any time, a worker could “opt in” by making a one-time election to put a portion of his or her payroll taxes into a personal retirement account.

19 ■ Workers would have the flexibility to choose from several different low-cost, broad-based investment funds and would have the opportunity to adjust investment allocations periodically, but would not be allowed to move back and forth between personal retirement accounts and the traditional system. If, after workers choose the account, they decide they want only the benefits the current system would give them, they can leave their money invested in government bonds like those the Social Security system invests in now.

20 ■ Those workers who do not elect to create a personal retirement account would continue to draw benefits from the traditional Social Security system, reformed to be permanently sustainable.

21 ■ Personal retirement accounts would be protected from sudden market swings on the eve of retirement. To protect near-retirees from sudden market swings on the eve of retirement, personal retirement accounts would be automatically invested in the “life cycle portfolio” when a worker reaches age 47, unless the worker and his or her spouse specifically opted out by signing a waiver form stating they are aware of the risks involved. The waiver form would explain in clear, easily understandable terms the benefits of the life cycle portfolio and the risks of opting out. By shifting investment allocations from high growth funds to secure bonds as the individual nears retirement, the life cycle portfolio would provide greater protections from sudden market swings.

22 ■ Hidden Wall Street fees would not eat up personal retirement accounts. Personal retirement accounts would be low-cost. The Social Security Administration’s actuaries project that the ongoing administrative costs for a TSP-style personal account structure would be roughly 30 basis points or 0.3 percentage points, compared to an average of 125 basis points for investments in stock mutual funds and 88 basis points in bond mutual funds in 2003.

23 ■ Personal retirement accounts would be phased in. To ease the transition to a personal retirement account system, participation would be phased in according to the age of the worker. In the first year of implementation, workers currently between age 40 and 54 (born 1950 through 1965 inclusive) would have the option of establishing personal retirement accounts. In the second year, workers currently between age 26 and 54 (born 1950 through 1978 inclusive) would be given the option and by the end of the third year, all workers born in 1950 or later who want to participate in personal retirement accounts would be able to do so.

24 ■ Personal retirement accounts would not be accessible prior to retirement. American workers who choose personal retirement accounts would not be allowed to make withdrawals from, take loans from, or borrow against their accounts prior to retirement.

25 ■ Establishing personal retirement accounts does not add to the total costs that Social Security faces. Personal retirement accounts effectively pre-fund Social Security benefits already promised to today’s workers and do not represent a net increase in Federal obligations. The obligation to pay Social Security benefits is already there. While personal retirement accounts affect the timing of these costs, they do not add to the total amount obligated through Social Security.

Posted by The Skipper

Filed Under: • Social-Security •

• Comments (42)

Do You Support Social Security Reform?

If so, go here. Bookmark and check back frequently to stay on top of what is going on.

Then click on this link to sign a petition directed at your senators to get the message out.

I encourage you all to pass this along to your friends and family. Only when vast numbers of Americans contact their representatives will those pesky Democrats understand we are serious about this. We know they are poll driven. They know that to piss off the American public will likely get them “Daschled.”

This is your chance to do something and to do it now.

Posted by Ranting Right Wing Howler

Filed Under: • Social-Security •

• Comments (1)

The Democratic Mantra

Not a day goes by that the Democraps moan and groan about how bad the economy is. Yet in the same breath they will tell you noting is wrong with Social Security (I wonder where they were in the 90s when Clinton was saying SS was doomed? HMMMMM?)

Anyway, it should come as no surprise that our economy is in good shape notwithstanding the recent surge in oil prices. Airline travel is high; home building is high; consumer spending is high. None of these can occur in a period of bad economy regardless of what any leftist tells you.

Yet still the Duumycrats persist in their mantra.

I wonder if they’d have any vocal chords left from screaming about a bad economy if they lived in Germany, France, or Spain? Of course not! Those are models of perfect socialism to which they aspire.

Meanwhile, unemployment in Germany is 12.1% YIKES!!!

According to Bloomberg, the German numbers are 11.1% (adjusted) and Spain’s numbers are even higher with France coming in at 9.7%

Overall, in the EU the rate is 8.9%

GOOD! FUCK THEM! Maybe they will learn a lesson about taxation and free spending socialistic programs. But I doubt it.

OBTW, in the US it is 5.4% Better than when Clinton was running for re-election (without a war, without major corporate scandals which his administration swept under the carpet); without 9-11; without a doubling of oil prices. And still the Dummycraps call it AWFUL!

(hat tip to Political Vice Squad for the numbers)

Posted by Ranting Right Wing Howler

Filed Under: • Economics • Social-Security •

• Comments (1)

Thursday - February 03, 2005

Thursday - February 03, 2005

Social Security For The Logic and Fact Challenged

For those who can not understand the concept of why people should be given the option of getting out of the Ponzi scheme called sociali security, Mrs. duToit tries to explain why we want out and she uses pictures!

Hopefully, now even the socialist nanny-state lefties incapable of grasping simple written concepts will be able to understand.

Be advised that Kim and “The Mrs.” do not suffer fools gladly. You must register to comment as on this site but careful what you say and how you say it. You’ve been warned!!

Posted by Ranting Right Wing Howler

Filed Under: • Social-Security •

• Comments (8)

You Know What’s Disgusting?

The behavior of Democrats last night at the SOTU speech where they erupted into cries of “NO!” when the President mentioned overhauling the Ponzi scheme also known as Social Security. I understand that it was unprecedented.

NPR, of course, loved it! The leftist America-haters loved it. The Democraps loved it. And in so doing are further hardening the cement overshoes they will be wearing when they jump into the frigid waters of the next election.

I hope someone in the White House is now reviewing those tapes to find out exactly who it was that did so and from now on out, accord those people no civility, no favors, nothing.

Your thoughts?

P.S. I’ve been asked to retract these comments because Republicans booed Clinton during his S.O.T.U. address.

I refuse to do so simply because I think the actions of Democrats last night was reprehensible. I also think that it is just as equally reprehensible for Republicans to do similar to a Democratic President. It shows a lack of respect for the office. It is unprofessional. After all, this is not England and their Parliament of Whores (to steal from P.J. O’Rourke!)

Posted by Ranting Right Wing Howler

Filed Under: • Democrats-Liberals-Moonbat Leftists • Social-Security •

• Comments (104)

Going Too Far

If you ever wonder why Social Security is going broke or Medicare is going broke, you need only read something like this.

When we have entitlement programs where we expand the list of eligibility to almost everyone and start giving benefits to them (and in a somewhat capricious way) the results are predictable. We will either need to raise taxes or go broke because government programs will never get cut.

What’s got my knickers in a twist?

Medicare will now pay for impotence drugs.

Look, it’s wonderful to get your rocks off but I just do not see why it has to be at taxpayer expense. We do we have to pay for some old man to get his jollies? If he can’t, let him deal with it. It’s not like he will die from it.

I wrote a few days about how nature abhors a vacuum and that if the government throws money at something, that something will grow ever more.

Same concept applies here and is noted by an economist at the Heritage Foundation who said:

“But this should not be a shock…. Once you create a universal entitlement, the tendency is for the entitlement to expand.”

Sorry, this is just wrong. Our tax dollars should not be going to anyone so they can orgasm. If they are so desperate, let them buy the drugs themselves. Don’t make me pay for it.

Posted by Ranting Right Wing Howler

Filed Under: • Democrats-Liberals-Moonbat Leftists • Economics • Social-Security •

• Comments (3)

Monday - January 24, 2005

Monday - January 24, 2005

Why Social Security Reform Will Fail

Why Social Security Reform Will Fail

Unless there is a concerted effort to undo decades of government brainwashing by campaigning to convince people their future belongs to them, any effort to privatize social security is doomed to failure.

We can start with a VERY short letter to all our congress-critters: “I demand the right to determine where my social security contributions go. It is MY money and I want to take ownership of it.” Simple as that.

But, as Neal Boortz points out at his site today, there are too many people who love the nanny state and really want nothing to do with the “freedom” that taking responsibility for their own actions will mean to them.

Since his page changes daily but the address is the same, I’ve copied it here for you to read. He started out with a discussion of President Bush’s inauguration speech focusing on freedom and continued thusly:

What is the problem with freedom? I think that the biggest problem is that people realize that along with personal freedom comes personal responsibility. To be sure, Americans will say nice things about freedom ... right up until the time that personal responsibility rears its ugly head. Freedom of speech? Sure, that takes no real effort. Freedom of religion? No problem there. It doesn’t really require you to actually do anything. Introduce responsibility and consequences for irresponsibility, and the love of freedom suddenly wanes.

I saw a good example of the limited American love affair with freedom yesterday on CNN. Three women from three generations were being interviewed; grandmother, mother and daughter. They were being questioned on President Bush’s privatization plans for Social Security. The grandmother was against it. She said that this would be like the government teaching people to gamble. She equates investing in the stock market to gambling, and has decided that it is wrong. Let the government take your money, and then dole it out to you later. Now that’s just fine.

The daughter was particularly troubling. On the one hand she said that she had no confidence at all that there were going to be any Social Security benefits for her when she reached retirement age, whatever that retirement age might be. On the other hand she said that she wasn’t in favor of privatization because she didn’t want to have to go to the trouble of making decisions on how her retirement money should be invested. She would just rather have the government do it for her.

More examples? They’re not difficult to fine. Just go to the basic levels of our society. Should you be free to negotiate with an employer on the basis of salary? No ... we need a minimum wage. Should you be free to buy a health insurance policy that doesn’t include pregnancy benefits? No .. the government stands in the way. Should you be free to chose who is going to come into your home and tell you what drapery fabric would look good with your throw pillows? No. The government tells you who you can and can’t hire for that job. Do people complain? Do they protest? Not a bit. Just accept the government controls and regulations and move on.

There is another troubling aspect of our lost love for freedom. When freedom isn’t cherished people are opposed to paying a price to make freedom secure. The United States is trying to introduce freedom into the heart of the tyrannical Arab World. As in the past, people are dying in the effort. Now we have people saying that it’s peace, not freedom that matters. That might sound good until you realize that by “peace” they simply mean the absence of armed conflict. Tyranny? Fine. Not even the most basic of freedoms? No problem ... as long as there’s peace. Today an astounding number of people, principally on the left, believe that peace without freedom is just fine, thank you very much.

Posted by Ranting Right Wing Howler

Filed Under: • Economics • Politics • Social-Security •

• Comments (8)

Thursday - January 20, 2005

Thursday - January 20, 2005

A $1000 Financial Class For Free

Unless you’ve been living in a cave or refuse to acknowledge it, social security is big news right now.

We’ve had quite a spirited discussion on this blog about it and even trapped us a moonbat in the process.

Socialists and their fawning butt-boys, the media and AARP, are dead set against privatization. Their reasons are many and varied and all wrong because they pre-suppose all Americans are as stupid as they are and do not know how to invest in the stock market or know how to manage their money. They need a Mommy Government to take care of them. Larry Elder nails it well in this piece.

No matter how you slice and dice it, it all boils down to theft of MY money from the government under the ruse that when I retire I will get some sort of “supplement” to help me out in my elder years.

Not a day passes by where I do not read some letter to the editor or some editorial where the authors wail and gnash their collective teeth and say, “But what if the stock market crashes like it did a few years ago just as you retire? What about those poor people who lose everything?”

Well, let me tell you something, Boopsie. If you are fully invested in the stock market by the time you retire, you DESERVE to be wiped out for being stupid. Because that’s exactly what you are: S-T-U-P-I-D! And Larry Elder has ID’d your ass. Not only that, you are GREEDY!

There’s a great saying on the Street: bulls make money, bears make money, PIGS get slaughtered. And if you are a pig, we will feast on your bacon.

So, does anyone believe that we would embark on such a task as privatization without some sort of education effort first? And the effort is as simple as a risk test associated with some percentage charts which track where you should have your money and in what percentages. Just like you get that little notice from the SSA telling you what you’ve paid in and what you will probably get, so the government or the companies that handle your PSAs will send you annual statements advising you of what you should be doing and what you should avoid.

Allow me to give you what I use for my own financial well-being. Remember, I retired at 45. I do not have a lot of money but I am comfortable, not extravagant. Granted, some of that is a military pension but most of it goes to an ex-spouse and the federal government in taxes. The balance is investments.

The information I am about to impart to you is worth millions but I give it to you for free. That’s what the “benevolent” in Benevolent Dictator means. However, if you feel like contributing towards the BMEWS fund (renewals are due this month and all contributions gladly accepted!!) then use our paypal link. We appreciate it.

First off, take a risk assessment test. Many are available. Fidelity has a good one as I believe so does Vanguard.

Assuming you can have moderate risk taking ability, between the ages of 18 and 40 a person should be fully invested in stocks. A good all-inclusive index fund is sufficient. The more risk you want to take, the more you should seek riskier investment instruments--individual stocks, market sectors, global stocks, margins, puts, calls, etc.

At the age of 40, the individual should then pare his stock holdings down from 100% to about 75% with the balance in a good bond fund. More risk averse investors may decide to leave everything ride or invest their bond portion into riskier corporate bonds or junk bonds.

This 75/25 mix is good for about 10 years. At age 50, the investor should do some more re-balancing. The stock portion of the portfolio should then go to around 65% with 35% in bonds.

At age 55, the percentage should change again. This time to a 50/50 mix.

By age 60, the percentages should be 25% stocks and 75% bonds. At age 62, that mix goes to 20/80.

By 65, it should be 10/90. This way, should the stock market collapse and knowing that it usually recovers within 5 years, you are never really hurt. You can draw checks from your account because your bond portfolio side will stay safer and is not subject to such wild fluctuations. Meanwhile, as the market recovers, THAT portion of your portfolio will continue to grow and make your losses disappear.

Remember, the market works in nothing else but cycles. Time will pull you out of a bad one.

Again, this is for the “social security” portion of your investment holdings. You do not want to screw with these monies too much. For your “regular” retirement portfolio and other investments, the percentages are almost similar but accept more risk since you now have one portfolio holding up the other.

Also, your percentages will vary based on whether or not you collect a retirement check which is pretty much guaranteed (teacher, military, GS employee, etc.) You can take more risk since now your retirement table has three legs (the SS leg, your retirement portfolio leg, and your pension check leg.)

It’s that simple. Lesson over. Come on, fork over some money! ![]()

Posted by Ranting Right Wing Howler

Filed Under: • Economics • Social-Security •

• Comments (12)

More On Social Security

If you think we pay too much for taxes and social security, read this article on the trials and tribulations the socialists in Germany are going through.

It’s finally dawned on them that they MUST change their welfare system, unemployment compensation system and social security system.

After all, when one of your citizens starts taking unemployment, moves to another country, claims it is more expensive to live there, demands more money, and gets it---then something REALLY is wrong! TRUE STORY as you will soon see when you click on the above link. No shit. He actually pulled it off. Got fired (or quit) moved to Florida and then compained saying he wasn’t getting enough. The German government sent him more money!!!!

As a side note, pay particular attention to the paragraphs dealing with their social security system.

Want to know the true cost of social security? Read this.

But it does not really matter since the socialists in this country, incapable of taking care of themselves and wanting a mommy government whose tit they can suck off of and who can wipe their shitty behinds because they’ve not yet learned to control the shit that spews from their asses and their mouths, won’t pay attention.

As many intelligent readers at this site know, the true issue is this: IT IS OUR FUCKING MONEY AND WE WANT CONTROL OF IT!!

I will also tell you that I would line up and eagerly volunteer to shoot anyone who decides to privatize their own contributions and because of greed or stupidity loses it all and then goes crying to government for assistance.

Pay really close attention to what the author is trying to say relative to how money increases and decreases in value as you slide the bar of “Father Time” across its face.

Here’s a taste:

The second reason $3.7 trillion is misleading is that it leaves the public with the impression that the federal government will only have to come up with $3.7 trillion over the next 75 years to keep the system solvent. Yet as the quote from the 2004 Report notes, that $3.7 trillion is the “present value.”

You smart ones will see it and understand. The dumb ones will argue with me. Sorry, I don’t “do” stupid. I won’t respond.

Posted by Ranting Right Wing Howler

Filed Under: • Politics • Social-Security •

• Comments (2)

Tuesday - January 18, 2005

Tuesday - January 18, 2005

What Needs To Happen To Social Security

This is a very complex issue but one the overhaul of which every American needs to consider. It just can not continue to operate the way it does.

For the purists who will not tolerate talk of privatization, you have to think about this: there are fewer and fewer people working for every one retiring. These workers can not support paying buttloads of money to support retirees at the current rate. Estimates are that in a few years we will only have two workers contributing for every retiree. Back in the 40’s this number was 42! FORTY FUCKING TWO!!!

Alternatives are few: do nothing and run the program into bankruptcy by 2042 (hey, I don’t give a shit, I’ll be dead)—or—reduce benefits --or—increase the age of retirement to 72, then 73, then 74, then 75—or—pay higher social security payroll taxes.

There are those who say we need to raise the payroll ceiling currently set at about $90,000. What these people seem NOT to understand is that if I make a lot more money but pay more into social security, then my social security check DAMN WELL better be higher than everyone else’s because I paid more. These moonbats who are proposing raising the ceiling do so under the assumption that payouts still stay at today’s levels. Typical socialist bastards.

THE MATH

So......what other alternatives are out there?

Privatization.

I did a quick bit of math via Excel and plotted out the life of a 20 year old earning $20,000 a year to start, averaging a 3.5% raise over his lifetime, and taking out 13% of salary for “social security.” (Note: fully privatization means that the employer who currently pays approximately 6.5% with the individual the other 6.5% to total 13%, would give that to the individual as it is his anyways!)

I factored in a “modest” growth through investments of 4% per year of these deducted monies (a 5 year CD now earns 4.5% so I am being reasonable) and at the age of 65 this person had about $650,000 in his account!!!!! Of course, by then people will be living longer, working longer, and their nest eggs will be considerably larger.

Do you realize this person could then withdraw $2700 per month and NEVER touch the principle? (of course, that assumes a 5% growth of portfolio at retirement and does not factor in inflation but STILL!!!!) All that money is HIS!!!! Or goes to HIS heirs when he dies. Our current Social Security system does not do that.

I then raised the rate of return on the “social security” withdrawal for those same 45 years to 5% and the nest egg shot up to $830,000 or almost $3500 per month!!!!

In order to simulate a “real life” scenario of individuals actually taking ownership of their lives and retirements, I assumed this fictional individual was prudent in his investment style with periodic adjustments to the portfolio based on risk analysis (basically this means that the younger you are the more risk you can subject your money to and as you grow older you remove some risk by diversifying your portfolio to bonds, CDs, cash, money market instruments incrementally.)

So I raised the growth rate to the stock market average of 9% for the first 20 years; then a 7.5% average to reflect a blend of stocks and bonds for the next 20 and a 6.5% rate to reflect more risk aversion for the last 5 years. The nest egg ballooned to almost $1.73 million dollars!!!!

Just 5% of that per year is $86,000 in retirement FOREVER!!! (over $7000 per month) The principle remains UNTOUCHED!!!

I also ran those numbers assuming someone staying in college, getting out and getting a $30,000 a year job. The only variables I changed were that starting at 24 they’d be fully invest for 20 years and then stay with a mix for 15 more years yielding 7.5% and the last 5 years at 6.5%

At only 4% for the full 40+ years they’d have $980,000 (yielding over $4000 per month)

In the variable scenario they’d end up with almost $3 million ($12,345 per month)

Go ahead, do it yourself and see. And since we almost always end up with increases in salary outstripping the nominal 3.5% I factored in, you can JUST IMAGINE what the numbers would be. As an example, I started out in 1971 earning $200 per month (yes, $200 a month!) and when I retired it was close to $4500. There is no way that $2400 per year compounded at 3.5% would ever get close to $50000+ in 26 years. So therefore I feel I am being very modest in my models. For those with drive and ambition, the amount of money they’d have to partially fund their “retirement” would balloon exponentially. Of course, this also assumes that anything they put away in this system is NOT their sole retirement. Businesses can not all of a sudden change THEIR systems just because the person privatized.

One other note, I’ve yet to be able to somewhat accurately be able to project what social security would need to pay to future retirees to resemble what they get paid now. But if my initial projections are correct, there is no doubt in my rabid mind that the system is doomed to failure---QUICK!!!

Witness how I admitted my difficulty in determining what social security would be paying workers in future dollars. But the leftist morons in this country who insist there is no crisis keep falling back on the argument that social security would stay solvent until 2042 and then would pay out 75% of what they pay now.

Did you catch that? “WHAT THEY PAY NOW?”

Have any of you readers any clue how little $16700 would be worth 40 years from today? These fucktards do not even admit that they’ve considered the fallacy of an argument that does not take into account inflation and the decrease in the dollar’s worth for the future. If you do the math based on low inflation of 2.5% and using the rule of 72, that $16700 would be the equivalent of having your check sliced to less than $700. Is that what you want?

MAKING THE CHANGE

Of course, all this change does not happen overnight. Our congress-critters need to stop abusing the social security trust fund to start with. We then need to understand that not everyone will be able to participate at these levels so some sort of “phase in” process needs to start. I look at it this way: if you are under 25 you go immediately to the private plan. Any monies contributed by you in previous years get refunded to you plus whatever amounts your employer contributed (plus interest.) Between 25 and 45 you should have the option to stay in the current system or opt out fully or partially. After 45 you stay in the system as it is today. This way no old people or those closer to retirement need to fear being left out in the cold.

Furthermore, those who opt out totally are just that---OUT!! The government will take NO RESPONSIBILTY for their retirement benefits. If they are stupid and stay fully vested in the market until 70 and then the market goes in the shitter and they get wiped out---so sorry, time to die!

Also, the government will have to assume a several trillion dollar obligation (much of it unfunded) in order to continue to pay off those still either totally in the system or partially in the system until they all die off. But that debt, like all others, will continue to decrease in value with time. After everyone in the old system is dead the debt can either be paid off slowly or just left alone because inflation makes it worth less and less every year. A similar example is taking out a mortgage for 30 years. Today the payment is high but as you get better and better paying jobs and raises, that mortgage amount stays the same yet the value of the dollar has gone down. So your $900 note is chickenfeed 29 years from now.

For those who partially opt out then you will be guaranteed a social security check commensurate with a pro-rata percentage of what you contributed and the Social Security administration would be tasked with maintaining a second set of tables simulating today’s system in order to keep percentages and payouts similar.

So there you have it. We all know social security is going to go down the tubes. The moron democrats and their stooges, the AARP, are out there beating their drums scaring everyone into thinking if we change the system they will be eating cat food and going without medication while living in refrigerator cartons.

But if you look at this realistically, can there be any way for you to STILL think we need social security in today’s form?

MORE DISCUSSION

Let’s keep going. Who said this about social security recently?

“(programs) are threatened by the looming fiscal crisis in Social Security.” There should be no new spending — or, more importantly, no tax cuts — “before we take care of the crisis in Social Security that is looming when the baby boomers retire.”

Most of you already guessed: Bill Clinton.

So why is it that asshole Harry Reid, the new minority leader of the senate, says we don’t have a social security crisis? And why is it the democrats are now piling on yapping the same thing? Where the fuck were they in 1998? What has so fundamentally changed in 6 years?

The Cato Institute back in 1998 wrote that shitbird, Clinton, agreeing with him and asking him to consider personal accounts.

Hell, Clinton even proposed some privatization himself.

But I will go out on a limb and state the only reason Clinton said what he said was to start of shitstorm of discussion amongst the partisan hacks and media to take attention off his troubles. That’s just the kind of guy he was.

The price of doing nothing is discussed here.

For more info and a lousy alternative not privatizing click here.

Here is what the President plans to do.

WHAT’S HAPPENING NOW?

It appears the bureaucrats at the Social Security administration have been told to start an education campaign about the mess Social Security is in. They are none too happy! I immediately discredited their complaints when I read this:

“Trust fund dollars should not be used to promote a political agenda,” said Dana C. Duggins, a vice president of the Social Security Council of the American Federation of Government Employees, which represents more than 50,000 of the agency’s 64,000 workers and has opposed private accounts.”

Can you believe it? The SSA has 64,000 employees!

Again, I ask the question: where were these useless fucks when Clinton was saying the system was in bad shape? Like many civil servants, these people have been feeding at the trough too long in jobs too easy collecting too much money as salary. Take away their trough!! FIRE THEM ALL!!

And don’t forget to go here to get lots more info.

Posted by Ranting Right Wing Howler

Filed Under: • Editorials • Social-Security •

• Comments (76)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.