Tuesday - May 20, 2014

Tuesday - May 20, 2014

I found them!

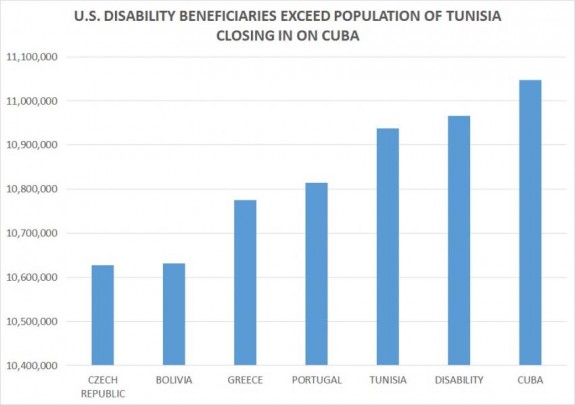

Wonder where all the missing unemployed folks have gone? I found them! They’re all on disability these days!

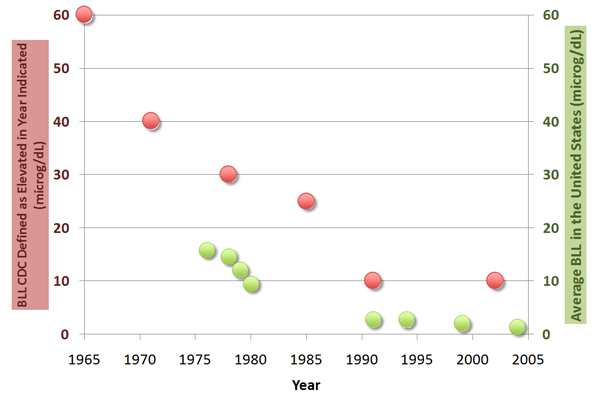

The total number of disability beneficiaries in the United States rose from 10,981,423 in March to 10,996,447 in April, setting a new all-time record, according to newly released data from the Social Security Administration.

The number of Americans receiving disability benefits continues to exceed the populations of Greece, Tunisia and Portugal, and is approaching the population of Cuba, which according to the CIA World Factbook is 11,047,251.

The 10,996,447 total disability beneficiaries includes 8,942,232 disabled workers, 153,475 spouses of disabled workers, and 1,900,740 children of disabled workers.

None of those individual categories of beneficiaries set a record in April, but the combination of all three was the highest it has ever been in the history of the disability program.

The number of disabled workers peaked at 8,942,584 in December—with 352 more workers receiving disability than in April.

This is completely unexpected! [/sarc]

Posted by Drew458

Filed Under: • Economics •

• Comments (3)

Friday - January 10, 2014

Friday - January 10, 2014

Now That’s Completely Unexpected News. Not.

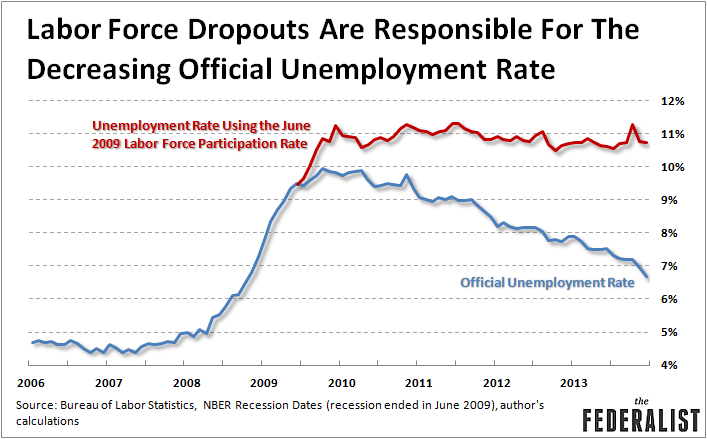

UPDATE: A nutshell in a nutshell: one graph that says it all:

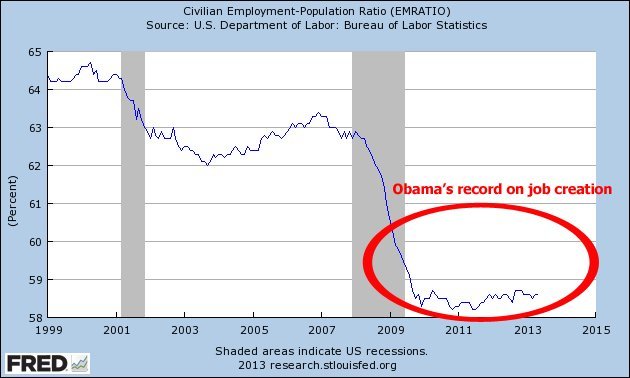

Two salient points to the above graph: 1) unemployment shot up the moment Obama was elected; 2) re-employment has flatlined, period. Plus or Minus about a quarter of a percent for more than 4 years. Dead, just like the “recovery” and the economy.

Want to make it look even worse? Take all the new government employees out of the equation. While in theory those people are working, the raw truth is that they are “earning” money borrowed from China at high interest. So they are not really contributing to GDP and are (or will eventually be) a drain on taxpayers. If there was a way to factor “underemployment” into the picture (those forced to take much lower paying jobs, even part time ones) the situation would be even meaner. 14%? 17%? I have no way of telling. But things are pretty bad and they don’t seem to be getting better.

![]()

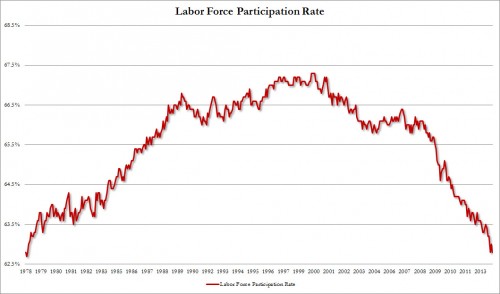

Curious why despite the huge miss in payrolls the unemployment rate tumbled from 7.0% to 6.7%? The reason is because in December the civilian labor force did what it usually does in the New Normal: it dropped from 155.3 million to 154.9 million, which means the labor participation rate just dropped to a fresh 35 year low, hitting levels not seen since 1978, at 62.8% down from 63.0%.

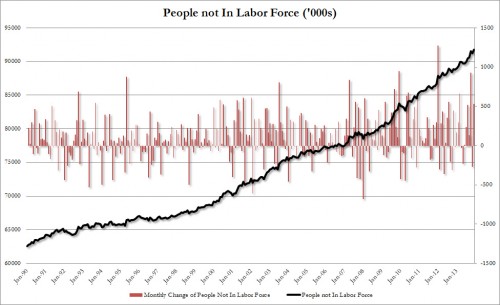

Americans not in the labor force exploded higher by 535,000 to a new all time high 91.8 million

The jobless, laborless recovery continues to steam on.

In the late 70’s, women were just beginning to enter the corporate world, along with many other traditionally male work environments. The overall economy was probably only a quarter to a third the size of today’s. Not to mention how much smaller the overall population was.

Notice on the first graph that for a given time period on the early part, at least double - sometimes nearly triple - as many people lost jobs in an equal time period in the later part of the graph. Such curves would be mitigated by taking population size and age into consideration (eg growing population plus retiring Baby Boomers), but that would only slow the growth rate linearly; the “twice as many now” trend is still there.

Posted by Drew458

Filed Under: • Economics •

• Comments (2)

Thursday - January 02, 2014

Thursday - January 02, 2014

time to read and think

President Obama’s Kansas speech is a remarkable document. In calling for more government controls, more taxation, more collectivism, he has two paragraphs that give the show away. Take a look at them.

there is a certain crowd in Washington who, for the last few decades, have said, let’s respond to this economic challenge with the same old tune. “The market will take care of everything,” they tell us. If we just cut more regulations and cut more taxes–especially for the wealthy–our economy will grow stronger. Sure, they say, there will be winners and losers. But if the winners do really well, then jobs and prosperity will eventually trickle down to everybody else. And, they argue, even if prosperity doesn’t trickle down, well, that’s the price of liberty.

Now, it’s a simple theory. And we have to admit, it’s one that speaks to our rugged individualism and our healthy skepticism of too much government. That’s in America’s DNA. And that theory fits well on a bumper sticker. (Laughter.) But here’s the problem: It doesn’t work. It has never worked. (Applause.) It didn’t work when it was tried in the decade before the Great Depression. It’s not what led to the incredible postwar booms of the ’50s and ’60s. And it didn’t work when we tried it during the last decade. (Applause.) I mean, understand, it’s not as if we haven’t tried this theory.

[ readical capitalism: ] That’s the political philosophy on which Obama is trying to hang the blame for the recent financial crisis and every other social ill. But ask yourself, are we few radical capitalists in charge? Have radical capitalists been in charge at any time in the last, oh, say 100 years?

I pick 100 years deliberately, because it was exactly 100 years ago that a gigantic anti-capitalist measure was put into effect: the Federal Reserve System. For 100 years, government, not the free market, has controlled money and banking. How’s that worked out? How’s the value of the dollar held up since 1913? Is it worth one-fiftieth of its value then or only one-one-hundredth? You be the judge. How did the dollar hold up over the 100 years before this government take-over of money and banking? It actually gained slightly in value.

Laissez-faire hasn’t existed since the Sherman Antitrust Act of 1890.

The philosophy of individualism and the politics of laissez-faire would mean government spending of about one-tenth its present level. It would also mean an end to all regulatory agencies: no SEC, FDA, NLRB, FAA, OSHA, EPA, FTC, ATF, CFTC, FHA, FCC–to name just some of the better known of the 430 agencies listed in the federal register.

Even you, dear reader, are probably wondering how on earth anyone could challenge things like Social Security, government schools, and the FDA. But that’s not the point. The point is: these statist, anti-capitalist programs exist and have existed for about a century. The point is: Obama is pretending that the Progressive Era, the New Deal, and the Great Society were repealed, so that he can blame the financial crisis on capitalism. He’s pretending that George Bush was George Washington.

The question is: in the messy mixture of government controls and remnants of capitalism, which element caused the Great Depression and the recent financial crisis?

By raising that question, we uncover the fundamental: the meaning of capitalism and the meaning of government controls. Capitalism means freedom. Government means force.

Suddenly, the whole issue comes into focus: Obama is saying that freedom leads to poverty and force leads to wealth. He’s saying: “Look, we tried leaving you free to live your own life, and that didn’t work. You have to be forced, you have to have your earnings seized by the state, you have to work under our directions–under penalty of fines or imprisonment. You don’t deserve to be free.”

As a bit of ugly irony, this is precisely what former white slave-owners said after the Civil War: “The black man can’t handle freedom; we have to force him for his own good.” The innovation of the Left is to extend that viewpoint to all races.

Read the whole thing and think things through.

Yes, we have something I guess you could call “tempered capitalism” these days. “Well regulated” in a meaning that no militia ever dreamed of. Quite the reverse actually. Forbes magazine argues for less regulation. Obama argues for more. Can we get by with no regulation at all? Where do you stand?

Posted by Drew458

Filed Under: • Economics •

• Comments (7)

Tuesday - December 03, 2013

Tuesday - December 03, 2013

Arbitrage Sux. Or is it just banks?

I did what I could to spend all my Bahamian currency in the Bahamas, but as luck would have it, buried deep in my wallet was an extra $21 in island money. Hey, no worries, I’ll just take it down to my local bank and deposit it in my account. After all, they bill themselves as “America’s most convenient bank”, and the Bahamian Dollar has been 1:1 with the US Dollar since “new money” came around in the mid-sixties.

Wrong. Not only could I not deposit it, I had to go see some desk monkey to do an exchange. Still, no worries, right? Friendliest and most convenient bank, yadda yadda. Wrong. I sit down at his desk and tell him I had a small amount of foreign currency left over from my vacation, a whole B$21, and that I’d like to exchange it, knowing that it’s tied directly to our currency.

He pulls up the appropriate program. Click, click, click ... wait. Wait. Wait. Click click. “How much was it?” Twenty one dollars. Click click. Wait. Click. “Ok, I can give you $10.50 for it.” Excuse me, what? “Well, your B$21 is only worth US$15.75, and then there’s a transaction fee of $5.25.” Um, no, the Bahamian dollar is one to one with the US dollar. One of ours is worth one of theirs; one of theirs is worth one of ours. “No, your B$21 is only worth $15.75.”

Like hell. I’ll eat the loss and hang the money on the wall as a souvenir before I’ll knuckle under to that rip-off. Funny how the banks there are only too happy to have my US cash.

Friggin arbitrage.

How about “vacation friendly” banking? Come back with less than $75 in foreign money, and the bank will take it for face value and a $3 fee? How about a percentage fee that caps at $10 for large cash exchanges, and goes to 0 for amounts under $50? My bank wants $17.50 to convert less than $250, and they apply a usurious discount rate. Bastiges.

How about, if US banks aren’t willing to do currency exchange, then setting up a money changer booth in the Inbound side of our major airports? Pay 2% or $2, whichever is greater, and get it done before you clear customs.

Man oh man. Once upon a time, somebody took a whip to these money changers. I can understand why.

Next time, should there ever be a next time, I’ll make sure to spend ever last dinar, E - C dollar, or Franc I have on me. What a rip.

Posted by Drew458

Filed Under: • Economics •

• Comments (5)

Saturday - November 02, 2013

Saturday - November 02, 2013

a cathedral of books

One of the comments asks, “What would God say?”

Clever line.

Anyway .... saw this yesterday, not one of my better days and haven’t posted. But share it now.

This really is quite spectacular.

It was a 15th century cathedral in the Netherlands.

Lots of churches here have been converted to private homes and put to other uses outside religion.

Scary when you think, churches are slim to empty and closing, but the mosques are not only full, but a few churches have been sold to the rop and have been converted into mosques.

Perfect for bibliophiles! 15th Century cathedral is transformed into a book shopArchitects convert stunning medieval Broerenkerk cathedral in Zwolle, Netherlands, into modern book shop

Work on the Gothic building was allowed on strict condition the church could be returned to previous condition

Original stained glass window, pipe organ and decor retained in the radical redesign

By Tom Gardner

For ardent bibliophiles, a shopping trip to this book shop must be close to a spiritual experience.

Broerenkerk, the famed 15th century Dominican church in Zwolle, Netherlands, has been transformed into a stunning modern book store.

Architects BK. Architecten were allowed to radically redesign the interior of the 547-year-old Gothic building on the strict condition they left the original features, such as the pipe organ, stained glass windows and decor intact.

Posted by peiper

Filed Under: • Architecture • Economics •

• Comments (2)

Wednesday - October 30, 2013

Wednesday - October 30, 2013

Get The Lead Out

There. That tells the whole story in the headlines I think. Nice and fast.

[October 2010] Herculaneum Missouri - Doe Run Co. will close its lead smelter in Herculaneum in three years and will pay $65 million to correct violations of environmental laws at 10 of its lead processing facilities in southeast Missouri, the company and the U.S. Environmental Protection Agency said Friday.

Environmentalists, who have called attention to the dangers of lead poisoning, heralded the news while local officials worried what the future holds for Herculaneum, the Jefferson County town that has relied on the smelter for jobs and tax money for more than 100 years.

The company said it will end operations at the lead smelter, the only primary lead smelter in the United States, by Dec. 31, 2013.

...

Doe Run must establish financial assurance trust funds, at an estimated cost of $28 million to $33 million, for the cleanup of Herculaneum and other active or former mining and milling facilities, the EPA said.In addition, the company must pay a $7 million civil penalty for violating a series of environmental laws. Doe Run said half of that will go to schools in Iron, Reynolds, Jefferson and Washington counties.

...

270 people work at the Herculaneum plant, many of whom could retain jobs if the new plant goes there. If it doesn’t, Pyatt said, only a few employees will remain to carry out duties such as supervising remediation in Herculaneum.Pyatt said local officials have been lobbying hard to keep the company in Herculanuem.

“They really want to keep the jobs and the tax base there,” Pyatt said. It’s not surprising — the plant paid $933,000 last year in property taxes.

So the evil polluting smelter, that’s been there since teh end of the Civil War, employs the whole town and pays most of the taxes, has to be punished and driven out of business. Gee, I wonder what happened next?

[2012] For 25 years, the smelter didn’t meet federal air standards for lead, and now, after decades of battling government regulators and angry parents, Doe Run is leaving town at the end of next year.

The battles over contamination turned this town on its head, pitting neighbor against neighbor, uprooting and bulldozing the center of town. It all culminated in a storm of lawsuits: one of them—against the Environmental Protection Agency -- forced the federal government to revise the national air pollution standard for lead, tightening it by a factor of ten.

Now, unable to meet the tough new standard, Doe Run is finally closing the plant: the last primary lead smelter in the United States will be dismantled at the end of next year. In June, Doe Run made it final – the company won’t be rebuilding in Herculaneum with a new cleaner plant, as they had earlier planned on. That would be “an unacceptable financial risk.”

So the town, it’s greedy lawyers, and the corruptocrat bastards at the EPA put the screws to Doe Run so bad that they said to hell with it, and shut things down. And don’t you just bloody LOVE how the company’s suit against the government’s singling them out for persecution FORCED the EPA to make the lead pollution rules TEN TIMES more onerous? Forced them! Twisted their arms to make them come up with new regs impossible for anyone to comply with. Rather similar to Obama and his quest to kill the coal industry.

And now? Well ... the laws of unintended consequences being what they are ...

About 145 employees of the Doe Run lead smelter have learned they will lose their jobs at the end of December because of the plant’s closure, the Doe Run Co. said Wednesday. An additional 73 contractor jobs also will be eliminated.

The EPA says the company decided to close its plant instead of installing pollution control technologies.

City Administrator Jim Kasten said Friday he was worried about potential job losses and the crushing financial blow, especially to the school district, that the company’s departure would cause.

“This is a big deal, and how we’re going to counteract these things, I don’t know at this point,” he said.

Doe Run contributes 11 percent of the local revenue for the Dunklin School District, which includes Herculaneum, said Superintendent Stan Stratton.

The loss of that income would “force a heavier burden on our taxpayers,” Stratton said. The district’s annual budget, including state and federal money, is about $13 million.

The effects go further. Doe Run uses about half the water the city contracts to buy. Kasten estimated that when smelting stops, the average household’s water bill would increase by $30 to $40 a month.

“If Doe Run’s not buying it, someone’s got to,” Kasten said.

So the town will soon be pretty much out of business, with a whole domino cascade of missing taxes and absent money spreading the poverty far and wide. But those empty homes and businesses will have less pollution!

And as for sportsmen ... hunters and shooters ... not to mention any business in the nation that uses solder in its electronics ... or X-ray shielding ... or anything lead has always been used for ... possibly a national security issue (and now we know why DHS bought up all those billions of rounds! And why the military came up with “green” bullets with tungsten cores, because reducing pollution in the middle of a war is so so important, right??) ...

Doe Run made significant efforts to reduce lead emissions from the smelter, but in 2008 the federal Environmental Protection Agency issued new National Ambient Air Quality Standards for lead that were 10 times tighter than the previous standard. Given the new lead air quality standard, Doe Run made the decision to close the Herculaneum smelter.

Whatever the EPA’s motivation when creating the new lead air quality standard, increasingly restrictive regulation of lead is likely to affect the production and cost of traditional ammunition. Just this month, California Governor Jerry Brown signed into law a bill that will ban lead ammunition for all hunting in California. The Center for Biological Diversity has tried multiple times to get similar regulations at the federal level by trying, and repeatedly failing, to get the EPA to regulate conventional ammunition under the Toxic Substances Control Act.

At this time, it’s unclear if Doe Run or another company will open a new lead smelter in the United States that can meet the more stringent lead air quality standards by using more modern smelting methods. What is clear is that after the Herculaneum smelter closes its doors in December, entirely domestic manufacture of conventional ammunition, from raw ore to finished cartridge, will be impossible.

Posted by Drew458

Filed Under: • Economics • Environment • Government •

• Comments (1)

Friday - October 25, 2013

Friday - October 25, 2013

More Magic Numbers

September saw the U.S. economy add just 148,000 jobs, significantly worse than expected, according to a report delayed more than two weeks by the government shutdown.

The unemployment rate unexpectedly fell to 7.2 percent, the lowest since November 2008, as the labor-force participation rate held near 35-year lows, according to the Bureau of Labor Statistics.

Private payroll creation stood at just 122,000, with state and local governments adding 28,000 positions and the federal government cutting by 6,000.

Economists had been expecting 180,000 new positions and a steady jobless rate.

“This kind of report adds to the sense of foreboding about our economy,” said Claire McKenna, policy analyst at the National Employment Law Project.

No, really? News like this is so ... so ... unexpected.

Financial markets greeted the report with enthusiasm though, boosting stock futures on expectations that monetary stimulus will remain in place.

Well screw you too. At this point, the disconnect between Wall Street and the actual economy is so vast that the DJI should never even be mentioned when talking about jobs or the economy. They’re off in their own little predatory world, hoping for the day when every company has just one employee, and all the profits get mailed out to the few remaining shareholders. Screw everyone else.

Posted by Drew458

Filed Under: • Economics •

• Comments (1)

Monday - October 07, 2013

Monday - October 07, 2013

And now, the backfire begins

Nobody. The federal government has been a bloated puss-pig of a jobs program for special people for ages, and now that the feds are stamping their tiny little jackbooted feet, we’re beginning to see just how little many of those agencies and their employees contribute. Zilch. Buh-bye!!

Fiscal hawks say the silver lining to the partial government shutdown, which is entering its second week of scaled-back services, could be the picture of government waste it paints for taxpayers.

A look through the shutdown contingency plans of the federal government shows some little-known commissions and agencies—like the U.S. Commission of Fine Arts and the U.S. Interagency Council on Homelessness—don’t have anybody reporting for work during the partial shutdown.

The ability of the government to run without any of the people from any of these agencies on the clock is prompting some watchdog groups to question why, then, do the agencies need to exist in the first place?

“Think of all the money we could save as a nation,” Judicial Watch said in an Oct. 7 post. “Besides bringing attention to these largely unheard of agencies, the shutdown – caused by Congress’s inability to agree on a funding bill – is also shedding light on just how bloated the federal government is, with an astounding workforce that’s seen nearly 800,000 furloughed this week.”

Snip snip. Cut cut. Chop chop. As any “kitchen table economist” can tell you, one way to balance the budget is to spend less. Lots less. I think it’s high time we trimmed a million worthless workers from the federal government, and while we’re at it, lets trim another million more from the state governments. The never-ending free ride to Candyland is over, thank you very much. The rest of us can get by just fine without them.

Posted by Drew458

Filed Under: • Economics • Government •

• Comments (2)

Saturday - August 03, 2013

Saturday - August 03, 2013

Get Rich Quick Scheme Not For Me

I was approached yesterday by an old friend who has become a sudden, rabid believer in the secondary energy supplier sales machine called Ignite. Ignite is the sales arm for a Texas based energy provider called Stream Energy. In states that have not be deregulated, local gas and electric companies enjoy territorial monopolies. You get service from them, or you don’t get service at all. A number of states have deregulated at this point, NJ among them. You can now sign up for an alternate service provider, which can save you money. Sometimes. Generally you still get a bill from the old power company, which owns the pipes and the wires; they now split the bill into a generation part and a delivery part. You still have to use their gas pipes and their wires to get your energy, so the theoretical savings are in the generation part. And you can save hundreds of dollars on your energy bills. I use one, and the savings are real.

There are more than 75 alternate providers operating in NJ. Alternate provider energy is not a scam. You can save considerable money. Sometimes. Almost all of these companies give you a discount of several cents per Kwh (or cubic foot or whatever for gas) compared to your original provider. Some make you sign a contract for a couple years. Some promise a very low rate to begin with, with an adjustable rate later on, rather like an APR mortgage ... and we all know how dangerous that can be IF you don’t get out of it soon enough. Caveat emptor.

But for the most part, these alternate providers are on the up and up. “Energy” is pretty much a commodity, so they “buy” in bulk at wholesale, then “sell” to you a little every month at a competitive rate. It’s legit; this is how many of the late 90s phone companies made fortunes in the long distance market. They bought a few zillion minutes from AT&T, sold them to customers at a big discount, and made money. The problem for AT&T was that they had so much overhead (huge staff, giant computer systems, etc) that they couldn’t/wouldn’t match those rates, and eventually went under, being out-competed by other little companies selling their own product. This is not going to happen to the big power companies. Their infrastructure is leaner and simpler than what Ma Bell had, and most of them have modernized and minimized along with everyone else. Which is something AT&T would not/could not do. Plus they still get a slice of the pie from the delivery charges, so don’t fear that Con Ed is going under any time soon. Not going to happen.

BUT. Nearly all these secondary providers get new customers by advertising. Billboards, mailers, web sites. Stream, through it’s Ignite marketing arm, works differently. They use “multi level marketing”, MLM, where sales associates use a word of mouth campaign to sign up new customers. MLM has a dark side and is commonly known as a pyramid ploy or a Ponzi scheme. Technically those terms only apply if there is no end product for sale; I’m sure that Bernie Madhoff can explain this in detail from his prison cell. They are completely legal when and end product is for sale, as in this case. Energy.

BUT. These same sales associates spend as much, or far more, time recruiting new sales associates to “spread the word” as they do getting people to sign up to get their energy from this secondary provider company. And the part that makes my eyes cross is that you have to buy in to become one. Riight. They charge you more than $325 for the right to become one of their worker bees. And you get no territory, no sales area, that is exclusively yours. But it’s so easy! Just switch over your own house and convince a few friends and family members to do that too, and you’ve earned your initial investment back. In less than a day! I sat and watched the digital presentation, heard all about how “regular folks just like me” are making tens of thousands of dollars per week, how this was a “ground floor” opportunity, yadda yadda. And every time I asked about that the discount rate was I got cut off and told that it didn’t matter, that I was “stuck in the weeds” and not seeing the forest for the trees. I spent an hour an a half watching the videos, looking at the web pages, hearing about all the fantastic success stories. And I decided this was not for me.

Oh, I could become a believer. I could. IF. I accept that this is a legitimate business model; it isn’t a Ponzi scheme, a pyramid ploy, because there is an actual end product for sale. So it’s not just a shell game. But the emphasis seemed to be 95% on the shells, and only 5% on the hidden pea under one of them. Seriously, I must have heard “energy, schmemergy” 30 times. As if it didn’t matter. Heck, I was told a dozen times that it didn’t matter at all.

No. It does matter. Just about every one of those secondary providers here in NJ will sell you electricity for about a nickel less per Kwh than the big boys charge. And just about every one of those providers offers you a rate that is at best only a few hundredths of a cent less than that nickel discount. In other words, even the secondary providers are a commodity. So why bother? Oh, I should transfer to Stream to a)help a buddy out, b) get in on this life changing opportunity myself, and c) stick it to big business who doesn’t care about me. Hey, you know what? I like our power company. The power here is pretty darn reliable, and when it isn’t they have crews out working hard day and night to fix things. Yeah, they charge a bit much, but I’ve already signed up with another secondary provider, 2 year contract I think, and I’m getting that nickel discount. So not only is there no financial incentive for me to switch from my current secondary to this one, I couldn’t do it for another year even if I wanted to.

So, why didn’t I want to become one of their salesmen, and get in on this “ground floor opportunity” to get rich myself? Well, NJ has been deregulated for several years now. Stream/Ignite has been working in NJ for nearly two years. To be a successful salesman, they want you to complete the “3 and 10” sales model in 30 days: sign up 10 people as customers, and also sign up 3 new people as salesmen. And then the money will just start flowing in automatically. And the more new sales folks you get on board, the more impressive your job title becomes, the bigger your slice of pie grows, and the faster your race to fame and fortune. By merely passing along the good word to your friends and by helping other folks get on board this solid gold train to the promised land.

Hmm. A year has 365 days. That’s 12 30 day periods. If I join in, and make my “3 and 10”, and every new salesperson I sign up does the same ... in one year that’s 3^12 new salesmen. 531,441 to be exact. And 5,344,100 new customers. In just one year. All of them under my own personal hierarchy. Fantastic!! Cha-ching $$$!!! Except that a) NJ has a population of 8.9 million living in 3.4 million households, b) Ignite has already been playing here for nearly two years (3^24=282 billion, 35 times more than the earth’s population), and c) since the salesmen aren’t territorially limited, and since Stream Energy already has several hundred thousand sales people ... you do the math. Sure, you can probably make a little money doing this. But I would be flat out amazed if it amounted to more than a couple thousand dollars per year, no matter how much effort you put in. This isn’t the ground floor. It’s the 3000th floor. The market is super saturated with sales chumps already.

This is a great marketing effort for Stream Energy. They get themselves a gigantic sales force at almost no cost to themselves. Not a cent spent on any traditional advertising. And many/all/most/lots of their sales people are also willing to pay $25/mo for access to the company web page with all it’s sales secrets and motivational videos, and to get their very own boilerplate promotional web page too! So Stream has a nice fat cash cow there as well. Outstanding. And it isn’t actually a con. No, because some very select few are getting rich here. And hope and greed are the best motivators out there.

It isn’t a real shell game, but it can’t be anything other than mostly a shell game. Not for me, I’ll pass.

Posted by Drew458

Filed Under: • Big Business • Economics •

• Comments (3)

Wednesday - July 31, 2013

Wednesday - July 31, 2013

No wonder the economy sux

Wow. Economy Racing Along at 1.7 percent (after government “adjustment")

U.S. economic growth accelerated in the April-June quarter to a seasonally adjusted annual rate of 1.7 percent, as businesses spent more and the federal government cut less.

The Commerce Department says growth improved from a sluggish 1.1 percent rate in the January-March quarter, which was revised from an initial 1.8 percent rate. The pickup in growth was surprising as most economists predicted a far weaker second quarter.

Gee, ya think the economic mentat at 1600 Pennsy has anything to do with that?

The New York Times reports that President Obama is reviving an old proposal to lower the corporate tax rate from 35 percent to 28 percent (and 25 percent for manufacturers). Obama’s push to lower the corporate tax rate to 28 percent comes less than a year after he raised the top individual income tax rate, paid by many small businesses, to 39.6 percent.

In a speech delivered Tuesday afternoon, Obama did not explain why he thinks it’s a sound economic idea to raise the top marginal tax rate on small businesses but lower it for corporations.

Because, after all, it’s small businesses that create the majority of jobs in this country. So soak them 40%. And don’t forget - they pay taxes off the top, whereas corporations pay taxes off the bottom. Plus corporations have access to all sorts of big dollar tax breaks us mere mortals can’t even dream of. So lower their tax rate to “incentivise” (gak I hate that “word") them to not offshore more jobs.

What a dope. And we’ll be paying for his stupid for decades and decades.

PS - the stock market is on fire today, the DJI shooting up at least 110 points so far. Which just shows you how great the reality disconnect is between the market and the real world. The Dow Jones has almost nothing to do with the health of the economy.

Posted by Drew458

Filed Under: • Economics • Obama, The One •

• Comments (3)

Thursday - July 11, 2013

Thursday - July 11, 2013

a ray stevens video

I have always been a huge fan of this guy. So why am I two years late in finding this?

Note to Peiper ... see the box that says, ‘subscribe’? Well doh.

Better late then never. And to think I used to earn my living by playing his records, among others. The late and much lamented better days past.

Posted by peiper

Filed Under: • Economics • Humor •

• Comments (1)

Saturday - July 06, 2013

Saturday - July 06, 2013

Net Jobs “Created Or Saved”: Less Than Zero

Trillion dollar stimulus might have reduced unemployment by 0.1% - 0.4%: effectively nothing, just hundreds of millions pissed away.

Since January 2009, when Barack Obama was inaugurated as president, the United States has seen 54 straight months with the unemployment rate at 7.5 percent or higher, which is the longest stretch of unemployment at or above that rate since 1948, when the Bureau of Labor Statistics started calculating the national unemployment rate.

Today, BLS reported that the seasonally adjusted national unemployment rate for June was 7.6 percent, the same it was in May.

In December 2008, the month after Obama was first elected and the month before he was inaugurated, unemployment was 7.3 percent. In January 2009, it climbed to 7.8 percent. In February, the month Obama signed what the Congressional Budget Office would later determine was an $830 billion economic stimulus law, the unemployment rate climbed to 8.3 percent.

In the Obama era, the unemployment rate peaked at 10.0 percent in October 2010. It did not dip below 9 percent until October 2011, when it hit 8.9 percent. From August to September 2012, it dropped from 8.1 percent to 7.8 percent—the first time during Obama’s tenure it went under 8 percent.

Since then, the lowest it has gone has been 7.5 percent—the rate it hit in April. But after April, it ticked back up to 7.6 percent in May and stayed at 7.6 percent in June.

And all this time, the labor force has been shrinking every month. The 7.6% rate you hear is the most tweaked and bullshitted number on the planet. As the graph above shows, given the same size labor force as in 2008, real unemployment is probably at least 10%. It is probably not possible to figure out the impact of the “I used to have a good job, but ...” folks who now work for peanuts either full time or part time. Under Obama, who has spent his entire regime doing NOTHING about actually getting the economy fired up again - hell, he’s spent years doing his level best to RUIN it - middle class America has shrunk vastly. The “Net Jobs LOST or DEGRADED” rate might be somewhere around 15%. I see an awful lot of closed shops around me, and I bet you do too.

Read more at the link if you want. You already have figured out just how prescient those bumper stickers from 2007 were that read One Big Ass Mistake America. And we’ve 3 more years to go, with no real Conservative leader on the horizon.

Oh, and here’s more: only 47% of US adults have a full time job.

Posted by Drew458

Filed Under: • Economics • Obama, The One •

• Comments (2)

Thursday - May 16, 2013

Thursday - May 16, 2013

Who Writes These Headlines?

Looks Like Drew Works For Fox News.

Yeah, I wish.

And owing to a sudden bout of ... symptoms ... I seem to be having today, this story sort of “hits home”. Or somewhere not too far from my heart.

Aren’t there any of those Zimbabwe Trillion Dollar bank notes left? A few thousand tons of them ought to help, right?

First milk, butter, coffee and cornmeal ran short. Now Venezuela is running out of the most basic of necessities — toilet paper.

Blaming political opponents for the shortfall, as it does for other shortages, the embattled socialist government says it will import 50 million rolls to boost supplies.

That was little comfort to consumers struggling to find toilet paper on Wednesday.

“This is the last straw,” said Manuel Fagundes, a shopper hunting for tissue in downtown Caracas. “I’m 71 years old and this is the first time I’ve seen this.”

One supermarket visited by The Associated Press in the capital on Wednesday was out of toilet paper. Another had just received a fresh batch, and it quickly filled up with shoppers as the word spread.

“I’ve been looking for it for two weeks,” said Cristina Ramos. “I was told that they had some here and now I’m in line.”

Economists say Venezuela’s shortages stem from price controls meant to make basic goods available to the poorest parts of society and the government’s controls on foreign currency.

“State-controlled prices — prices that are set below market-clearing price — always result in shortages. The shortage problem will only get worse, as it did over the years in the Soviet Union,” said Steve Hanke, professor of economics at Johns Hopkins University.

Yup, that’s the ivory tower way of saying that fascism doesn’t work. Imagine that; an ivory tower boy knocking one of the pillars of socialism. Golly.

Posted by Drew458

Filed Under: • Economics • Latin-America •

• Comments (2)

Monday - April 29, 2013

Monday - April 29, 2013

Mother Nature Is Not Helping

Another 2 week old news story I just learned about today.

Outside Salt Lake City, Utah. The Bingham Canyon Mine is an open pit mine, the largest in the world. It is more than 3 miles across and nearly a mile deep.

The landslide went off at about 9:30 in the evening on Wednesday, April 11. It was expected: like most modern mines, Bingham has redundant sensor systems (radar, laser, seismic, GPS) that measure ground movement down to the millimeter and give plenty of warning when a collapse is imminent. The mine was evacuated about 12 hours before the landslide, and nobody was hurt.

But the scale of the landslide was a surprise. Approximately 165 million tons of rock shifted, causing a highly localized earthquake measuring 5.1 Richter. It damaged or destroyed roads, power lines, and other infrastructure, and a number of the giant shovels and dump trucks that move ore and waste rock out of the pit.

[April 13] BINGHAM CANYON — Limited mining activity has resumed at Kennecott’s Bingham Canyon Mine, three days after a massive landslide.

But company officials say the activity is in an area that wasn’t effected by the slide, called “the cornerstone,” and has nothing to do with the actual mining of ore.

Rio Tinto’s Kenecott Utah Copper spokesman Justin Jones said mining of “waste rock” resumed about 1 a.m. Saturday in the southeastern part of the mine. This is rock that is cleared that has no value, to get to the ground that contains ore, he said. It marks the first activity in the mine since the slide Wednesday night.

The massive slide registered as a magnitude 2.4 shake at the University of Utah seismograph station. Pictures taken from KSL Chopper 5 have amazed viewers and readers. But the slide’s exact dimensions had not yet been determined.

On Saturday, Jones said crews still were not allowed to get to the mine floor. The Mine Safety and Health Administration has ordered work in that area stopped until further notice. Jones hoped that crews would be able to get to bottom of the pit by next week.

No further movement of the mine had been recorded as of Saturday.

“It is essential for us to get back to work and get up and running as soon as possible,” Jones said.

Some slope movement had been detected two weeks earlier, enough to cancel the visitor’s season.

The good news, which may or may not last, is that the price of copper has not spiked.

165 million tons of rockfall. The biggest dumptrucks there can carry 400 tons. It’s going to take a long, long time to get this mine cleaned up and back to full operational capacity. Maybe they’ll just start a new pit altogether ... although it’s my understanding that the ore vein is way down at the bottom. This one mine supplies 17% of all the copper in the whole country.

more pics:

http://www.ksl.com/?sid=24748916&nid=460#1

http://www.flickr.com/photos/riotinto-kennecottutahcopper/sets/72157633216160914/with/8637646879/

more coverage:

http://www.kutv.com/news/top-stories/stories/vid_4525.shtml

http://www.reuters.com/article/2013/04/14/rio-utah-slide-idUSL2N0D10HM20130414

http://fox13now.com/2013/04/23/residents-concerned-about-bingham-mine-access-road/

Posted by Drew458

Filed Under: • Economics • Guns and Gun Control •

• Comments (2)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.