Saturday - October 18, 2014

Saturday - October 18, 2014

cheap gas

I was going to post and say how gas here in NJ, up in Warren County, seems to be more than a dime cheaper, averaging about $2.84 (regular, cash price) with a low of $2.81.

But a quick look online and it seems my cheap corner of low fuel tax NJ isn’t cheap by any means; snooty little Westwood up in Bergen County near the NY line has gas for $2.49, 35¢ less. Wow. And that’s almost nothing: several states now have gas selling in the $2.30s bracket.

Guess that greedy Gulf station out by the highway trying to get $3.95 is in for a rude awakening. And it’s about time.

Gas prices across the U.S. are dropping fast, with the national average nearing a four-year low.

“The national average is down ten cents week-on-week. That’s a huge movement in the national average,” GasBuddy analyst Patrick DeHaan said, adding that in his five years watching gas prices, they generally move only by half of a penny or a penny a day.

...

The price drop is due to a combination of seasonal and geopolitical factors. While gas prices generally drop in the fall, as demand slows down and Americans switch over to cheaper winter gasoline, DeHaan said added to the current drop is an OPEC-fueled price war.

Lower gas prices generally encourage consumers to get out of their houses and do some fall shopping. Compared to last year, American drivers are saving $75 million each day, due to lower prices at the pump. But DeHaan said that worries over Ebola could eventually keep some shoppers home, causing gas prices to drop even further.

...

6 U.S. States with the Lowest Gas Prices

1. Missouri: $2.83/gallon

2. South Carolina: $2.93/gallon

3. Tennessee: $2.94/gallon

4. Oklahoma: $2.94/gallon

5. Minnesota: $2.95/gallon

6. Mississippi: $2.95/gallon

I have no idea why Humboldt TN, halfway between Nashville and Memphis, should have the lowest prices in the country, averaging $2.32. Tennessee state fuel tax is 39.8¢; 7¢ higher than the NJ tax. Which implies NJ gas could be selling for $2.25 if they can get the same source prices as TN. And I can’t see why not, as NJ pumps 10 times as much gas I’m sure.

Still, until I can run my old Saturn down to fumes before filling up, and then fill up the nearly 12 gallon tank for $20, then gas costs too much. That’s about $1.75/gal, a decent price under Booosh. And I want that to be all gasoline too. Let’s shitcan the idiot ethanol thing already.

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (2)

Friday - September 26, 2014

Friday - September 26, 2014

Excitement At The Pumps

Good grief.

Gasoline is selling for $2.99.9 at the no-brand station down the road here. It’s been that price for about 3 days now, and today my $20 bought me 6 2/3 gallons. Half a tank. So in my mind, gas is only twice as expensive as it ought to be.

I haven’t seen gas at this price in ages. Last Fall, just before Thanksgiving? And IIRC, it was only there for about a week, then went up again.

And I hear it might be heading your way eventually; NJ has just about the least state taxes added on to a gallon of gas, so we’re the low price leader almost always. Some states, like NY, tack on 79¢ or more. Greedy bastiges.

[ September 24, 2014 ] The price of a gallon of gasoline may soon start with a “2’’ across much the country.

Gasoline prices typically decline in autumn, and this year they are being pulled even lower by falling global oil prices. By the end of the year, up to 30 states could have an average gasoline price of less than $3 a gallon.The average in Springfield, Missouri, is already below $3, according to Tom Kloza, chief oil analyst at the Oil Price Information Service and GasBuddy.com. Several other cities are on the brink.

“And there will be more, many more,” Kloza said. Cities in high-priced states such as California and New York will not be among them, though, which will probably keep the national average above $3.

At the current national average of $3.35 a gallon, gas is a dime cheaper than a year ago at this time. The gap is 20 cents or more in seven states, including California, Kansas, South Dakota and Connecticut, according to AAA.

...

Last year, the national average fell 28 cents per gallon between Sept. 1 and Dec. 31. This year, gasoline had a head start. It entered September at its lowest level for the beginning of the month in four years - and the price of crude oil was rapidly heading lower.The drop in global crude oil prices is a surprise. Despite increasing violence and turmoil in the Middle East, the world’s most important oil-producing region, the global price of oil has fallen to $97 a barrel, close to its lowest level in more than two years.

That’s partly because new technology has allowed U.S. drillers to consistently increase production from fields in North Dakota and Texas, adding to global supplies. At the same time, world demand is not growing as much as anticipated because of slower economic growth in China and Europe.

Yeeehaa for competition and capitalism!! Woo hoo!! In your face, camel lips!!

[ November 2013 ] The last time New Jersey saw the average gas price below $3 was on Jan. 13, 2011. After that, the foundering economy, coupled with unrest overseas, helped create an especially volatile oil market. Gas prices began a seesaw pattern that steadily ticked up. It wasn’t until September that prices began a near daily drop, and that has continued ever since.

Around the country, Arkansas, Missouri, Oklahoma and Texas already have average gas prices below $3.

But even with the lower prices, volatility is a problem and analysts say the fuel system is increasingly vulnerable to short-term shocks because refiners try to keep stocks of gasoline low to save money.

So my bit of NJ has had a price dip below $3/gal starting in September 2014, one that ran a week or two in mid-November 2013, and another short relief in mid-January 2011. For the most part, plain old 87 octane “Regular” (87 used to be called “Economy") has been over $3/gallon for almost all of the Obama Regime.

But hey, remember back in 2007, when we had that summer spike, and $3/gallon gas was the end of the world? How little we knew; hardly a year later we’d do it all over again, only much harder.

[ May 2007 ] Prices break record for 10th day in a row, topping $3.20 a gallon; New Jersey only state left with an average price under $3

Gasoline prices broke a record Tuesday for the 10th day in a row as every state except for New Jersey now has an average price above the $3 a gallon mark in AAA’s daily survey.

The latest reading from the motorist group Tuesday showed the nationwide average for a gallon of regular unleaded hit $3.209 a gallon, up from $3.196 on Monday. The group’s survey of 85,000 gas stations, by far the broadest sampling of gas prices, has been showing a series of record high prices starting May 13.

...

Before this recent run of record-high gas prices, the highest price ever recorded in current dollars was $3.057 in the AAA survey, which was set Sept. 4 and Sept. 5, 2005, in the wake of Hurricane Katrina. That storm disrupted refinery operations and pipelines and caused a temporary spike, sending prices above the $3 mark for eight days.The only other time that the AAA national average has topped the $3 mark was in August 2006, after Israel invaded Lebanon and oil futures shot higher. Gas prices then reached as high as $3.036 during that 19-day spike

Yep. Then there was the nasty Spring and Summer of 2008. The speculators went wild, crude hit $145/bbl, gas prices topped out at what, $4.11? About 35¢ more per gallon than what we’ve lived with now for years. And it was the End Of The World. Because Bush was President you know, so this was the never ending catastrophe that the talking head commies in the MSM prattled on about 24 hours a day. And then, somehow, around early August the price of crude dropped. Like a bomb. And went from over $140 to about $100 per bbl in a month. And by the time of the 2008 elections, gas was selling at or below $2/gallon here in NJ. And when the Big O took power, gas was something like $1.79. And it’s never been so inexpensive since.

Remember, the price of gas is NOT news. Because. Obama. You racist.

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (2)

Thursday - August 21, 2014

Thursday - August 21, 2014

And The End Approaches, Now Even Faster

Bloody marvelous. And it’s been going on for months now.

Islamic State’s thirst for blood has the world on edge, but its equally insatiable yearning for oil could prove a “catastrophe” for the global economy if the terror organization isn’t stopped, experts say.

The jihadist group, formerly known as ISIS, now controls seven oil fields and two small refineries in northern Iraq, bringing in as much as $2 million per day by selling up to 40,000 barrels via middlemen in illicit deals. The black market oil sells for roughly $25 to $60 per barrel, compared to the current market rate of $102, according to Luay al-Khatteeb, founder and executive director of the Iraq Energy Institute. And while this is a veritable drop in the global bucket of oil production, the crude spigot will continue translating into terror funds for Islamic State militants if unchecked, al-Khatteeb and other experts told FoxNews.com.

“Unless we choke this organization’s revenues, and the areas it’s able to access revenues, it’s going to keep growing,” said Denise Natali, a senior research fellow for the Institute for National Strategic Studies. “The Iraqi government has announced it now, but this has been going on for months.”

A source close to the matter told London-based newspaper Asharq Al-Awsat that Islamic State is selling Iraqi oil to Kurdish traders in regions bordering Iraq, Iran and Syria before being shipped to Pakistan, where it’s being sold for less than half of market rates.

While production within those oil fields is globally insignificant, it does directly power the extremist group, offering the militants a degree of fiscal autonomy, according to al-Khatteeb.

“They’ve become very much self-sufficient,” he told FoxNews.com. “They control about 60 percent of Syria’s producing fields in its oil-rich eastern region. In Iraq, they control about seven oil-producing fields and two small refineries with a potential output of 80,000 barrels. And the black market is expanding into Turkey, which is becoming the main beneficiary of that market.”

Wait, so the very same Kurds that ISIS is busy shooting and beheading are the people buying up the illicit oil? Or are these Turkish Kurds, who - in a gesture of complete tribal solidarity - couldn’t give a rat’s ass about what happens to Iraqi Kurds on the other side of the mountain? But hey, all the oil - and the money - stays within the islamic world, so no harm, no foul. Right?

Funny thing ... back before Gulf War One, the hippie-dippy left was running around protesting “No blood for oil” when it came time to free Kuwait from occupation and enslavement. What will they say now, or next month, when the West will have to go in and destroy ISIS one goat humper at a time, and take back those oil fields in the process? Because if they don’t, the world will have an ever increasing, insane, psychopathic murder machine on it’s hands, funding themselves to the tune of half a billion or more per year.

Kind of makes me wonder ... do the muzzies really want to stop ISIS? Or is that just lip service to keep the stupid West sending in more aid, more supplies, and more weaponry. And they just sit back and let somebody else do the dirty jihad work for awhile. If the Caliphate wins, they win. (assuming that ISIS stops killing the locals and starts focusing on the West, as they seem to be starting to do?)

What if the entire civilized world went on a crash course to convert to natural gas, and from then on in only used petroleum to make plastics and synthetic rubber?

“Haha Infidels, the Caliphate controls all the oil in the Middle East! You will pay dearly now!!”

“Um, no thanks, sorry, we don’t want any of that stuff any more.”

Because I’m pretty sure there isn’t a single LNG plant anywhere over there. Not one. And the US, Canada, and the Soviet re-Union have oceans of the stuff. Maybe Brazil and Venezuela do too?

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices • War On Terror •

• Comments (3)

Friday - August 15, 2014

Friday - August 15, 2014

Betting The Future On A FLiNG

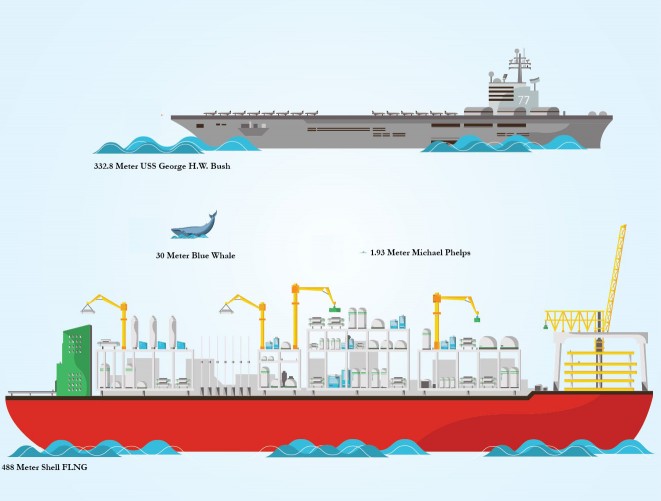

Shell Petroleum is building the largest ship the world has ever known. It’s the first of it’s kind, one of many to come, so naturally they named it the Prelude. The ship is so large that you could fit our biggest aircraft carrier inside the thing with ease. It’s so large that the construction of even little pieces of it make international news. It is so large that it’s existence will change the military strategies of nations in the area. Yet it’s massive engines will likely be used only twice. Once to sail the ship out to sea, and then 25 years later, to sail her back. Welcome to the future ... and talk about “offshoring” your assets!

The largest piece of the turret for Shell’s Prelude Floating Liquefied Natural Gas (FLNG) facility has set sail from Dubai for the Samsung Heavy Industries shipyard in Geoje, South Korea, where the facility is under construction, informs Shell.

The turret is part of a mooring system designed to ensure Prelude FLNG can operate safely in the most extreme weather conditions. At almost 100 metres high, it is the largest in the world.

The turret will run through the front of the facility and connect to giant chains that will keep it moored securely over the Prelude gas field. The turret mooring system will allow the facility to turn slowly in the wind and with currents – ensuring it can remain safely at its location through the most powerful cyclones.

“Prelude FLNG combines our many years of experience in shipping and in managing complex LNG and offshore projects. It’s great to see our innovative designs and technologies become a reality as we reach significant project milestones like this,” Matthias Bichsel, Projects & Technology Director at Shell said.

“Designed in Monaco, built in Dubai, shipped to South Korea and for use off Australia, the turret is an example of the truly global nature of this project.”

100 meters tall. And really, it’s basically just a hose swivel.

This is going to be one damn big ship. No. It is going to be the biggest thing afloat ever built by the hand of man. By far. A 600,000 ton ship. 600,000 tons!!! 1601 feet long; nearly half a kilometer; 88 meters longer than the biggest container ship. 243 feet wide; 74 meters; 3 meters wider than the wingspan of a 747. That’s a whole lot of boat!

Horry Clap!

FLNG (or FLiNG) means Floating Liquified Natural Gas. The ship is going to be a factory. It will be positioned right over the undersea gas fields, take in what the wells produce, and process that to make what we call natural gas. That gas will then be offloaded onto LNG ships and sent around the world. Prelude is expected to produce 3.6 million metric tons of LNG per year. Which means Shell is going to make billions.

Posted by Drew458

Filed Under: • Big Business • Oil, Alternative Energy, and Gas Prices • planes, trains, tanks, ships, machines, automobiles •

• Comments (2)

Wednesday - July 16, 2014

Wednesday - July 16, 2014

Pork Fight!!

How about we just cancel the dopey program and you can both go back to growing soybeans?

An ethanol plant in Nebraska corn country is pumping out fuel made from sugar beets, and corn farmers are suing to stop it – a small-town dispute that offers an unusual take on the debate over the market-distorting impact of sugar and corn subsidies.

The dispute in Aurora, population about 4,400, brings into conflict two of the largest U.S. farm programs, one promoting sugar production and the other corn-based ethanol. Aventine Renewable Energy Holdings Inc, a privately held Illinois firm, is reaping profits producing ethanol with cheap sugar, thanks to a U.S. Agriculture Department subsidy of beet sugar.

Local corn farmers, who benefit from a government rule that forces oil companies to blend ethanol into gasoline, say in court documents that Aventine’s action violates an agreement to use their grain exclusively as a feedstock for the firm’s recently reopened plant in Aurora. Aventine denies any wrongdoing, saying it has abided by its contract.

The irony of the situation is not lost on George Hohwieler, president and chief executive of the Aurora Cooperative Elevator Co. that is at loggerheads with Aventine.

“Hamilton County, Nebraska, by any measure is one of the most productive corn-producing counties in the world,” he said. “The message being sent to the marketplace is that they’re making ethanol out of sugar.”

In fact, Aventine’s use of beet sugar is the first large-scale production of sugar alcohol in Nebraska since bootleggers used boxcars of sugar to make moonshine during Prohibition in the 1920s and 1930s.

Aventine chief executive Mark Beemer said the farmers’ coop was being short sighted in suing the company. “We’ve been very blunt. This is just a very short-term pathway to get the plant open and then convert back to corn ethanol,” he said.

The rare intersection of the two farm programs in Aurora illustrates the unintended impact federal farm subsidies can have on market activity.

One such initiative, the Feedstock Flexibility Program, last year enabled buyers like Aventine to purchase below-market sugar at government auctions, then use it as feedstocks in their ethanol plants, putting the sugar in competition with corn.

Under the federal sugar program, the government guarantees minimum prices for sugar loans, paying processors 24 cents per lb for beet sugar, or 19 cents for cane sugar, if sugar prices fall below those benchmarks. The USDA then must auction the sugar for non-food purposes.

Aventine was the biggest buyer at USDA auctions last fall, purchasing some 660 million pounds of beet sugar.

Beemer said the firm earned up to 50 cents a gallon on each of the 80,000 gallons it churned out daily while burning beet sugar. If the supplies last through August, as expected, that could amount to a nearly $4 million profit for Aventine, according to a Reuters calculation.

Beemer declined to comment on the profitability of the Aurora operation.

I think it’s time to not only end this stupid ethanol program but to end price supports for just about all farm products. If we’ve got enough shale oil and gas these days to make the stuff into motor oil, then we ought to have plenty enough to make gasoline. Not to mention that everyone’s cars run better and get better mileage on pure gasoline. Or the infrastructure impact that corrosive ethanol is having. Or that the idiotic ethanol subsidy has caused a MASSIVE spike in food prices across the planet.

Stupid is as stupid does, and this program has been known to be a total loser since the very beginning. DUMP IT.

But now it’s even worse. When I see one kind of greedy grower fighting another kind of greedy grower for a bigger slice of needless government pork, egged on by another government program that not only supports prices and stifles free market trading and another that subsidizes wasting food, I want to chew lead and spit bullets. Well I would, but the EPA has forced all the lead mines to close here. We’ve got centuries worth, but we can’t mine or process any of it any longer. Thanks EPA. And don’t get me going on the whole coal fiasco either.

NO ethanol subsidy. NO price support for sugar. NO Sugar Act to eliminate international competition. NO forced below market price sales of perfectly fine but temporarily excess sugar. NONE OF IT. Greedy bastiges.

Posted by Drew458

Filed Under: • Economics • Government • Oil, Alternative Energy, and Gas Prices •

• Comments (2)

Sunday - June 01, 2014

Sunday - June 01, 2014

Porktastic

We did cheapo little rib ends on the new Weber grill tonight. Get the grill hot, then indirect heat on medium for about 90 minutes, turning them every 20 and start laying on the sauce after an hour.

Too yumm for words. And not a char spot, a burn, or a flare up to be found.

I was so happy I was going to share a picture and a rub recipe ... and then I flipped on the news, and saw that Otardo is set to do his Et tu Brute and deliver a killing blow to the American Economy tomorrow. And that ... that just sucked the fun right out of everything.

Obama to announce emissions limit on power plants

The Obama administration is set to announce a rule Monday to limit carbon emissions in thousands of fossil-fuel burning plants across the country, a cornerstone of President Obama’s climate-change agenda and his first-term promise to reduce such emissions by 17 percent by 2020.

The Environmental Protection Agency will ask existing plants to cut pollution by 30 percent by 2030, according to people familiar with the proposal who shared the details with The Associated Press on condition of anonymity, since they have not been officially released.

The draft rule, which sidesteps Congress, will go into effect in June 2016, following a one-year comment period. States will then be responsible for executing the rule with some flexibility.

They are expected to be allowed to require power plants to make changes such as switching from coal to natural gas or enact other programs to reduce demand for electricity and produce more energy from renewable sources.

They also can set up pollution-trading markets as some states already have done to offer more flexibility in how plants cut emissions.

If a state refuses to create a plan, the EPA can make its own.

Without waiting to see what Obama proposes, governors in Kansas, Kentucky, Virginia and West Virginia have already signed laws directing their environmental agencies to develop their own carbon-emission plans. Similar measures recently passed in Missouri and are pending in the Louisiana and Ohio legislatures.

On Saturday, Obama tried to bolster public support for the new rule by arguing that carbon-dioxide emissions are a nation health crisis—beyond hurting the economy and causing global warming.

“We don’t have to choose between the health of our economy and the health of our children,” Obama said in his weekly address. “As president and as a parent, I refuse to condemn our children to a planet that’s beyond fixing.”

The rule attempts to reduce greenhouse gases that Obama and supporters blame for global warming.

Among the plants that have to comply will be hundreds of coal-burning plants, which has resulted in strong opposition from the energy industry, big business and congressional Democrats and Republicans, who argue Obama’s green-energy agenda is tantamount to a “War on Coal.”

The U.S. Chamber of Commerce argues that the rule will kill jobs and close power plants across the country.

And notice how this little terrorist sets the timer on his bomb so that it doesn’t go off until he’s out of DC. So even this, one of his signature bits of legislation, won’t be his responsibility when it backfires.

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (3)

Wednesday - April 09, 2014

Wednesday - April 09, 2014

One Lump Or Two?

Speaking of natural gas and coal ...

Go figure. Ya know, I don’t think anybody really understands real world economics.

[2/14/2014] This wasn’t supposed to happen. Cheap natural gas was supposed to be the answer to our dependence on dirty old coal. But now, it seems, coal is making a comeback. The bitter winter, the coldest in 30 years, has pushed natural gas prices to some of their highest levels in four years, and that has made coal attractive to utilities again.

Electric companies are generating more than 4.5 million megawatt hours a day using coal, the most since 2011, Bloomberg reported, citing government data. As a result, coal’s share of power production rose to more than 40 percent from 39 percent last year.

Cheap and abundant natural gas supplies from the hydraulic fracturing boom had made natural gas a cheaper and cleaner alternative to coal for the past several years. Economics, though, had to catch up at some point. With demand for gas rising this winter, pushing prices as high as $5.56 per million British thermal units at the end of January, coal is looking more attractive.

The downside: the increased coal usage means U.S. carbon emissions are expected to rise this year after falling in 2011 and 2012.

Actually, what I had heard was that the price of natural gas in the US was so low, that every possible last bit of it got put on ships and sent over to Europe, where it makes a much higher profit. So when more was needed here due to the awful winter we had, there was much less of it around than what we usually had on hand before the fracking boom, so this drove the price up. Shortage during a massive supply growth. Because evil capitalist running dogs sell to the highest bidder, and the marketplace is global.

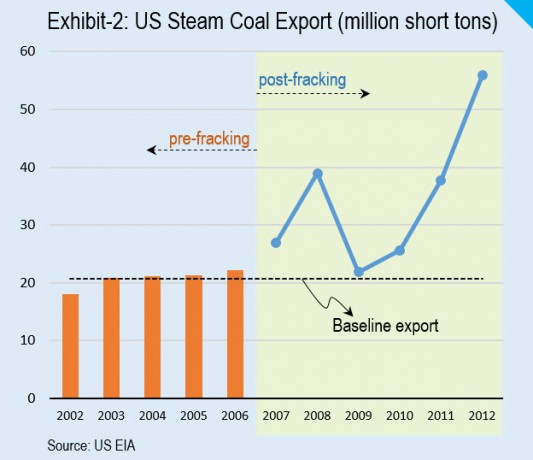

USA: Natural Gas Boom Caused More Coal Exports [March 26, 2014] Thanks to the natural gas boom, carbon dioxide emissions dropped in the United States. But those emissions savings were probably completely undone thanks to U.S. coal exports.That’s the finding from new research by CO2 Scorecard, which looked at how the U.S. coal industry increase its exports in order to deal with the rise of natural gas in the nation’s power market.

...

... the coal just went to other countries.The researchers used data from the Energy Information Agency (EIA) to tease out how much coal-fired generation was displaced by natural gas versus other sources of electricity from 2007 to 2012. They then looked at how U.S. exports of coal behaved over the same period. From 2002 through 2006, those exports remained relatively steady. But then they spiked after 2007, following the arrival of America’s natural gas boom.

...

As CO2 Scorecard notes, U.S. coal is relatively cheap on the global market. So it’s possible coal exports from other countries declined in reaction because they couldn’t compete. Unfortunately, EIA data also shows that global coal consumption rose steeply over the 2007-2012 time period, suggesting the primary effect of U.S. coal exports was to drive down the fossil fuel’s global price and encourage demand.

Don’t worry if the above doesn’t make too much sense. It’s from a progressive greenie AGW web site. To their amazement, the world is hungry for energy of whatever kind they can get; if the USA brings more natural gas to the market it gets sold and used. If we have more coal to sell they buy it and burn it right up. You’d think they know that shivering in the dark while squatting on the morae high ground is good for Planet Gaia, and we’d all be happy to suffer.

Sure, I want cheap and clean energy, just like everyone else. Which is why I’m in favor of building about 300 new nuclear reactors in our country, and pouring all kinds of stimulus cash into the power grid infrastructure, so that we can run as many things as possible on pure electricity. [sarcasm]Well, once those evil greedy capitalist monopolistic power companies cut prices down to the real bone, so that all of us 99%ers can benefit. Nationalize Now! [/sarcasm]

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (0)

A Better Oil?

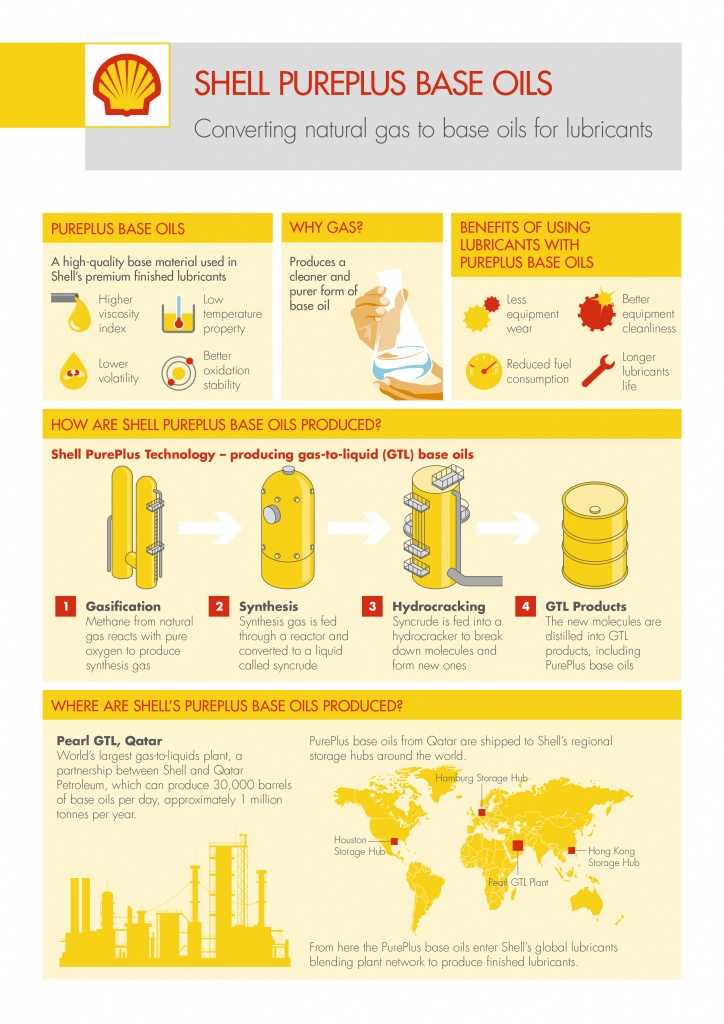

I mentioned in my 3am post that I’d seen motor oil for sale, labeled “made from natural gas”. I don’t pay attention to the petro world; for all I knew this has been around for years. Actually, it’s been around for about a month. Looks like Shell invented the technology, and the process creates an exact, pure, product. Oil of a precise certain viscosity with almost no other petroleum byproducts in it. This is amazing. And I gather the only reason I saw the “made from natural gas” tag on several different brands of motor oil is because Shell owns them all. Surprise! Less than perfect competition in the marketplace, who’da thunk?

[March 07, 2014] Shell announced today the creation of the first-of-its kind base oil made from natural gas, the cleanest burning fossil fuel. It is called Shell PurePlus(TM) Technology, a patented process of converting natural gas into a clear base oil, which is the main component of motor oils.

Shell PurePlus Technology is now being used to create motor oils that offer complete protection to motorists in the United States.

...

“Shell PurePlus Technology is the result of 40 years of innovation starting with the Shell natural-gas-to-liquids (GTL) process that dates back to the 1970s,” said Dr Richard Dixon, Shell North America Motor Oil Technology Manager.“We then took this technology and ultimately created Shell PurePlus base oil, which has been in large scale commercial development since late 2011. To our knowledge, Shell is the only manufacturer to have produced base oils from natural gas on a commercial scale and it’s exciting to pave the way for others to follow.”

Shell PurePlus Technology base oil is manufactured at the Pearl GTL facility in Ras Laffan in Qatar, a partnership between Qatar Petroleum and Shell. Shell PurePlus base oil is crystal clear due to having fewer of the impurities found in crude oil.

“Shell is unique in having this product, and they are not selling it to others, and it will make a great motor oil, there’s no doubt about it,” said Stephen Ames, managing director for SBA Consulting, which consults for the lubricants and refining industries. “Will it be better than other people’s motor oil remains to be seen.”

Shell’s base oil from natural gas is cheaper than that derived from crude, which Ames said gives the company an advantage.

“Everybody is fascinated, to be honest, at the consumer level,” said Istvan Kapitany, president of Shell Lubricants Americas. “If you look at the base oil, it looks like clear water.”

Producing clear base oil from crude is like trying to filter muddy water, Kapitany said.

“You still have impurities in it,” he said.

A clearer base oil can produce motor oil that keeps engines cleaner and running more efficiently, he said.

“It is, of course, pure and it also offers lower viscosity levels to be achieved which is, in modern engines, becoming more and more important,” Kapitany said.

...

Global demand for lubricants was 38.7 million tons in 2012, with the United States accounting for 22 percent of consumption, according to data from Kline & Company, a market intelligence firm.If the motor oil could be made using natural gas produced in the United States, there could be domestic benefits, said Daniel Whitten, spokesman for America’s Natural Gas Alliance.

Pretty awesome. This means we’ll still have oil, even if we ever run out of oil. I have no idea if they can alter the process to make gasoline or diesel fuel. Wouldn’t that rock if they could?

And now I’m wondering what kind of natural gas it takes to feed the process. Because natural gas comes in several varieties. And some kind of flammable gas can be made from coal. That one’s old school actually; “town gas” has been around a very long time as a byproduct of cooking coal into coke for the steel mills.

Posted by Drew458

Filed Under: • Amazing Science and Discoveries • Oil, Alternative Energy, and Gas Prices •

• Comments (0)

Thursday - March 20, 2014

Thursday - March 20, 2014

does not operate as advertised

Another huge waste of Stimulus “green energy” money

ST. CLOUD, Minn. – A $2.3 million federal stimulus project at the Veterans Affairs Medical Center in St. Cloud is giving green energy initiatives a bad name.

A 600-kilowatt wind turbine—some 245 foot tall—stands on the wintry VA grounds, frozen in time and temperature, essentially inoperable for the past 1 1/2 years. No one is working to fix it, though many attempts were made to repair the turbine, once billed as a model green energy project.

“The St. Cloud VA is a hospital, and our focus is on our patients and we like to think that we treat our veterans very well here,” said Barry Venable, a public affairs officer for the VA in St. Cloud. “We’re embarrassed that this turbine does not operate as advertised.”

That’s quite the about-face from the buildup in December 2009 over the announcement of the central Minnesota turbine, the lone Department of Veterans Affairs project included in the White House document touting President Obama’s executive order for federal agencies to lead the way on renewable energy.

“Throughout the Federal Government, agencies are already leading by example toward building a clean energy economy. This document outlines some examples of projects, many of which leverage Recovery Act funding, that will drive long-term savings, build local market capacity, and create new private-sector clean energy jobs,” states an administration document called “E.O. 13514: Agencies Leading by Example.”

Today, critics call the solo St. Cloud wind turbine a leading example of something else—the failure of federal stimulus spending to deliver on renewable energy initiatives.

“Here in St. Cloud’s,” Dr. Larch wrote, “I have come to understand that promises are rarely kept, that the battle isn’t so much against evil as ignorance, and that being successful can’t hold a candle to being of *use*.”

― John Irving, The Cider House Rules

[ Drew: never miss an opportunity for a St. Cloud’s quote. Especially since this wind turbine is another form of what Irving’s book was all about. Right, Homer? ]

Unlike some wind farms in Minnesota, temperature extremes do not appear to be a factor in the turbine’s problems. Name just about anything else, however, and it’s gone wrong at some point since the completion of construction in April 2011, officials say.

The VA’s lengthy fix-it list includes the hydraulic system, electrical system, the main gear box and number other parts over the past three years. A Massachusetts-based contractor installed and has overseen maintenance on the turbine, which was made in India.

[ December 14, 2011 ] For months, the VA has been working to pass the wind generator out of its commissioning phase, which started shortly after the giant turbine went operational in late March.

But a process that was expected to take only a few weeks has stretched to more than nine months after a series of mechanical problems and failed power productivity expectations remained unresolved.

As of December, the $2.3 million, 600-kilowatt turbine had been shut down for weeks as Veterans Affairs worked with contractor JK Scanlan to get the project functioning to specifications.

[ 12/14/11 ] “Folks are disappointed. It’s quite the substantial investiment that the government made on behalf of the people and to not see it running is disappointing. We share that sentiment.”

Venable said no timetable is set for when the 107-ton turbine would be running at full efficiency, but talks continue toward setting the problem once and for all.

“We’re in discussion with the contractor and the contracting authorities. The key point here is that it was contracted by an outside agency, not us, and so, we’re having to work through intermediaries. But we’re in discussions with the contractor and working hard to resolve the issues,” Venable said.

Working hard. Right. Discussions with the contractor, uh huh. As in, Yellow, this is Mujibar, how may I be of helping you?” So, at best, this thing ran for a couple of months in early Fall 2011. Since then, it’s been offline for repairs almost continuously, and by August 2012 everyone had just given up on it. ie, all the money had been spent. Since then, it’s been left to rot. Way to go Obama; thanks for saving the planet.

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (0)

Wednesday - October 30, 2013

Wednesday - October 30, 2013

Ozymandius, With Carcinogens

gee ... how unexpected

President Obama touted Abound in a July 3, 2010 announcement of a $2 billion “investment” in green energy projects.

“The second company is Abound Solar Manufacturing, which will manufacture advanced solar panels at two new plants, creating more than 2,000 construction jobs and 1,500 permanent jobs,” Obama said [and what a lying mother fucker he is]. “A Colorado plant is already underway, and an Indiana plant will be built in what’s now an empty Chrysler factory. When fully operational, these plants will produce millions of state-of-the-art solar panels each year.”

But less than two years later, the company laid off half of its 400 workers, and then, in the summer of 2012, filed for bankruptcy. It became the third clean-energy company to seek bankruptcy protection after receiving a loan from the Energy Department under the economic stimulus law. California solar panel maker Solyndra and Beacon Power, a Massachusetts energy-storage firm, also declared bankruptcy. Solyndra received a $528 million federal loan, while Beacon Power got a $43 million loan guarantee.

Colorado-based solar company that got hundreds of millions of dollars in federal loan guarantees before going belly-up didn’t just empty taxpayers’ wallets - it left behind a toxic mess of carcinogens, broken glass and contaminated water, according to a new report.

The Abound Solar plant, which got $400 million in federal loan guarantees in 2010, when the Obama administration sought to use stimulus funds to promote green energy, filed for bankruptcy two years later. Now its Longmont, Colo., facility sits unoccupied, its 37,000 square feet littered with hazardous waste, broken glass and contaminated water. The Northern Colorado Business Report estimates it will cost up to $3.7 million to clean and repair the building so it can again be leased.

“If a coal, oil or gas company pulled something like that the EPA would send out SWAT teams and the U.S. Marshals to track down the offenders, bankrupt or not.”

- National Legal and Policy Center, a think tank

Posted by Drew458

Filed Under: • Obama, The One • Oil, Alternative Energy, and Gas Prices •

• Comments (2)

Thursday - September 19, 2013

Thursday - September 19, 2013

Dead Or Crippled, As Promised

Because America has a coal supply good for more than 500 years ... so let’s not use it ever again. That’s the way to attain energy independence. Along with no new nukes, no fracking, no Keystone XL, and who really knows how many dead or inactive wind turbines. Is it El Residente’s goal to dig us so deep into the Pit we’ll never get out? Sure seems that way sometimes. Often. Every damn day as a a matter of fact.

New clean-energy rules pushed through by the Obama administration are raising concerns that they could cripple the coal industry—and may require power plants to use technology so risky that even the president’s former top energy official once warned it could “kill.”

The EPA, by Friday, is expected to release a new proposal to set the first-ever carbon dioxide limits for new power plants.

To meet those emissions caps, power plants would likely have to use what is known as “carbon-capture technology,” which involves burying the carbon underground.

The technology, which is still under development, remains expensive and not commercially available. But there are lingering safety risks.

Their idea is to capture all the CO2 and store it in underground tanks. Because, OMG, don’t give it to any plants or anything, that could benefit from it and absorb it. Nope, just store it up and create a deadly hazard, just waiting for a bit of mismanagement, rot, or lax attention.

Not the sharpest pencils in the bin, even at $35 a pop.

But we need to act now!!. To fight the naturally occurring Climate Change, which has been going on, probably cyclically, for billions of years!

One somewhat safer idea is to lock up the carbon chemically, but no real details are given in this article. Hey, why not make calcium carbonate? Is that hard to do? Take some of the excess government purchased milk, power the process with government purchased solar energy, or heat things up with government purchased ethanol, and bind up thousands, millions, of tons of carbon dioxide. And then ... since this is the stuff that clam shells are made of ... start ramping up clam, oyster, and mussel beds like nobody’s business. And restock the bays and estuaries everywhere. Not only would we get free Raw Bar for everyone, all those bivalves would actually clean up the water. Win win for everybody! Woo hoo!!*

[ * This probably won’t actually work. You need an extraordinarily large source of pure calcium to make up calcium carbonate, CaCO3. Which is otherwise known as limestone, chalk, or clam shells. And it’s pointless to derive the calcium from other sources where it’s already bound up with carbon dioxide.

3 Ca + 6 CO2 + energy ---> 3 Ca + 6 C + 12 O ---> 3 CaCO3 + 3 C + 3 O ---> 3CaCO3 + 3CO. Oops. CO is carbon monoxide, a poison gas.

6 Ca + 6CO2 + 3 O2 + energy ---> 6 CaCO3. This is better, but you can see that it needs extra oxygen. In other words, making calcium carbonate from calcium and carbon dioxide is a rolling process that depletes oxygen from the air. I think. I haven’t balanced a chemical equation since high school.

And, once you make all the stuff, how you feed it to the clams is beyond me. ]

Posted by Drew458

Filed Under: • Obama, The One • Oil, Alternative Energy, and Gas Prices •

• Comments (2)

Friday - August 09, 2013

Friday - August 09, 2013

EPA Still Dreaming, But More Realistically

Farmers still raking in the profits over worst scam in history, while your food bill continues to skyrocket

The Environmental Protection Agency will require oil refiners to blend 16.55 billion gallons of renewable fuels into the nation’s gasoline supply this year as part of its efforts to spur new fuel technology and decrease fossil fuel dependence.

Nearly eight months past the legal due date, the EPA announced its yearly blending targets under the Renewable Fuel Standard (RFS) on Tuesday. Renewable fuel associations applauded the announcement, but the oil and gas industry criticized the agency for continuing to push a “broken” system.

The EPA’s blending requirements include 6 million gallons of the cellulosic biofuel, which is made from woodchips. That number is down from the 14 million gallons called for in January.

The cellulosic biofuel requirement has angered the oil industry for years because, until this year, there was no commercial production of the advanced fuel in the country.

The EPA targets will require a total of 36 billion gallons of biofuel to be blended by 2022.

Republican lawmakers in Congress have also targeted the RFS system, saying it artificially inflates prices for corn and increases costs for livestock facilities.

“RFS announcement fails to provide immediate relief for livestock/food producers, small biz & consumers,” Rep. Bob Goodlatte (R., Va.) tweeted Tuesday. “It’s time to repeal the RFS.”

The industry has also warned that the requirements are forcing refiners close to a “blend wall,” the point where cars cannot handle the level of ethanol or it is undesirable for consumers.

This gasohol crap is just the pits. Stupid stupid stupid. Not only does it jack up the price of gas, it significantly lowers the MPG of all vehicles using it. You can’t fool science: alcohol has less energy than gasoline, so any blended mix requires more to make the same amount of power. Period. My car gets 2-3mpg more on those increasingly rare occasions when I can find some actual real gasoline to put in the tank.

And since we now seem to have a huge abundance of frakkable shale oil, what’ the damn point? Yeah, I blame Bush for this BS. And I blame Obongo for keeping it going, along with every pansy-ass dickhead in DC. Kill the program. Period. Kill the subsidy. Period. Farmers growing too much corn? Turn it into masa flour and use that for foreign aid. Screw sending the poor and starving’s dictators billions in cash that they’ll only spend on Ray-Bans and Paris apartments, send them food. Nothing but food. And maybe some water filtration systems. Maybe.

I wonder if (hahahahaha, “if") those TWO wood chip stills running will be able to turn out those 6 million gallons.

KiOR’s biorefinery in Columbus, Mississippi started commercial production in March using wood chips to produce cellulosic fuels, and Ineos just announced on July 31 that their Indian River BioEnergy plant in Florida has begun operations to make biofuels from plant waste. Both of these are now operating at full commercial scale. Whether they’re making money yet, we don’t know, but the fact that they’re producing large volumes of cellulosic biofuels may be a historic turning point. These developments are important steps towards developing a real advanced biofuel industry that can help move us toward a point where we have other options for how to fuel our cars and trucks.

Production goals for both these plants are rather optimistic at this point. And, just like windmills and solar panels, I wonder if either could survive an hour without massive subsidies and tax breaks.

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (1)

Tuesday - May 07, 2013

Tuesday - May 07, 2013

Getting screwed, gradually

Recent History: 4 years ago, gas was $1.79;

this was the lowest cost point under Obama; the short-term price dropped to

ONLY 44¢/gallon more than under Bush the previous fall

It only stayed that low for a couple days. The crude price then was actually a bit lower than the crude price from the previous November, when gas was 10¢ less per gallon, at $1.69.

Yes, before electing Teh Won, in the early fall of 2008 gasoline was selling for $1.35/gallon. After the election the price shot up to $1.69.

Here in NJ in May 2013, gas here is still “low” as $3.19, down from over $3.69 during the winter.

Posted by Drew458

Filed Under: • Obama, The One • Oil, Alternative Energy, and Gas Prices •

• Comments (2)

Tuesday - February 12, 2013

Tuesday - February 12, 2013

Tell Me What I Don’t Know

Gas prices hit a historic high

Gas prices hit a national average of $3.59 Monday – the highest ever for a Feb. 11.A combination of high crude prices, refinery shutdowns, and early speculation has sent gas prices soaring to seasonal highs earlier than usual this year, with no signs of prices at the pump falling until spring, according to recent estimates.

Gas prices have climbed every day for the past 25 days, reaching a national average of $3.59 per gallon Monday, the most expensive national average ever for Feb. 11, according to AAA.

During just the past two weeks, average prices have climbed almost 25 cents, the biggest jump in gas prices in almost a year.

“This is a very early rise,” says Tom Kloza, chief oil analyst at the Oil Price Information Service. “January has tended to be a quiet month through the years, but the rally really began in earnest around Jan. 15.”

One thing I’d like to know is why the blend prices jump the way they do. These days, 87 octane gas is called “regular”, but it used to be called #!$* “economy” when I was younger. And the gas that we’re getting is at least 10% ethanol, which artificially boosts the octane rating while at the same time providing less energy to power your engine. So 87 octane is more like 83 octane. In other words, it’s Turd World Goat Pee. But the blend prices jump 20 to 30 cents per gallon going from 87 to 89, a delta of 2 octane points, while only jumping 10 cents from 89 to 93, a delta of 4 points. And without that ethanol and today’s modern downsized terminology, “super premium” would be called “regular”.

So we’re paying a lot more, for a lot less. I feel a little bit sad for folks who have cars with high performance engines that require actual 93 octane gas to run their best ... and I have no idea how anybody can keep those old 60s and 70s high compression V8 engines running. I could have sworn those engines needed 100-104 octane gas, and leaded to boot. That kind of stuff costs $23/gal these days. Even 100 octane avgas is over $6/gal, and that’s a tad illegal to use in your street car.

Posted by Drew458

Filed Under: • Oil, Alternative Energy, and Gas Prices •

• Comments (8)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.