Wednesday - June 22, 2011

Wednesday - June 22, 2011

Kill The Economy, Win A Prize!

JPMorgan Chase & Co. has agreed to pay $153.6 million to settle civil fraud charges that it misled buyers of complex mortgage investments just as the housing market was collapsing.

J.P. Morgan Securities, a division of the powerful Wall Street bank, failed to tell investors that a hedge fund helped select the investment portfolio and then bet that the portfolio would fail, the Securities and Exchange Commission said.

The settlement announced Tuesday is one of the most significant legal actions targeting Wall Street’s role in the 2008 financial crisis. It comes a year after Goldman Sachs & Co. paid $550 million to settle similar charges.

Still, the settlement amounts to less than 1 percent of the bank’s 2010 net income of $17.4 billion—or less than what JPMorgan earns in one week.

JPMorgan neither admitted nor denied wrongdoing under the settlement. The bank released a statement saying it lost nearly $900 million on the investment. It also noted that it reviewed similar mortgage investments and voluntarily paid $56 million to compensate some investors in those deals.

The bank agreed to settle the charges two weeks after Jamie Dimon, CEO of JPMorgan Chase & Co., complained to Federal Reserve Chairman Ben Bernanke that new financial regulations designed to prevent another financial crisis were too burdensome on banks.

Magnetar wasn’t charged in the SEC action. SEC enforcement chief Robert Khuzami said the hedge fund “was not responsible for those disclosures to investors.” But he said such deals “remain a high priority for the SEC.”

Magnetar essentially made a $600 million bet that the investments would fail once the deal closed in May 2007, the SEC said. Just one month earlier, JPMorgan had launched a “frantic global sales effort” going beyond its traditional customers to sell mortgage securities, according to the agency’s suit.

Khuzami said the JPMorgan case, at its core, is about getting investors truthful information about their investment options.

“The appropriate disclosures would have been to inform investors that an entity with economic interests adverse to their own was involved in selecting the portfolio,” he said.

The penalty is the biggest since Goldman Sachs & Co. settled civil fraud charges last summer. The $550 million that Goldman paid was the largest penalty against a Wall Street firm in SEC history. The Goldman settlement amounted to less than 5 percent of Goldman’s 2009 net income of $12.2 billion after payment of dividends to preferred shareholders—or a little more than two weeks of net income.

Goldman was accused of steering investors toward mortgage investments without telling the buyers that the securities had been crafted with input from a client that was betting on them to fail.

Not even a slap on the wrist. In most other parts of the world, these guys would have been shot.

Posted by Drew458

Filed Under: • Economics • Finance and Investing •

• Comments (0)

Saturday - January 15, 2011

Saturday - January 15, 2011

the russians are coming?

I’m not terribly well versed on these things BUT ...

according to the radio, BT owns large energy holdings in the USA.

So ....

With the Russians now having a stake in BP for a sizable amount of cash ....

Does that now mean the Russians also will have a hold of any sort in the US?

BP gives 5% stake to state-owned Russian oil firm as they reveal plans to drill Arctic

By Rupert Steiner and Simon Neville

BP signed a major deal last night that will see the Russian government own a chunk of Britain’s biggest oil firm.

It sold 5 per cent of its shares – worth £5billion – to Russia’s state-owned energy firm Rosneft. Both companies have also agreed to co-operate in drilling for oil reserves in the Arctic.

The historic share-swap deal could open up lucrative revenue streams for BP, which is the third largest energy firm in the world.

But it also raises fresh concerns about the take-over of UK firms by foreign companies – including those, like Rosneft, that are effectively a branch of an overseas government.

Questions will also be asked about the security of Britain’s energy supplies, given Russia’s history of playing politics with oil and other resources.

Posted by peiper

Filed Under: • Big Business • Finance and Investing • Oil, Alternative Energy, and Gas Prices • USA •

• Comments (0)

Thursday - January 06, 2011

Thursday - January 06, 2011

New Ann

Now that a new Congress is in session, with promises of starting investigations into this, that, and the other, Ann Coulter opines that the housing mortgage/financial crisis is the thing that really warrants investigation. Especially since all the information is already out in the open, the pieces are already fit together, and all it would take would be some honest work and good press. Yeah, right.

The housing bubble was caused by the democraps, working over nearly 20 years in a seemingly deliberate attempt to destroy the economy. Well gosh Ann, no kidding.

Go, read about the 9,000 pound gorilla in the room that nobody can see, even years after the fact. And don’t forget that all those policies ARE STILL IN EFFECT.

Posted by Drew458

Filed Under: • Finance and Investing • Politically-Incorrect •

• Comments (2)

Sunday - June 06, 2010

Sunday - June 06, 2010

Put ‘em on commission

Yes, as usual I’m late to the party. I only discovered Jackie Mason since he’s been a contributing commentator on WorldNetDaily.

I know, I’m showing my age. Mr. Mason did this routine during the Reagan Administration. But his solution is timeless, timely, and something we citizens/voters should consider.

Posted by Christopher

Filed Under: • Finance and Investing • Humor •

• Comments (2)

Tuesday - March 02, 2010

Tuesday - March 02, 2010

better banking?

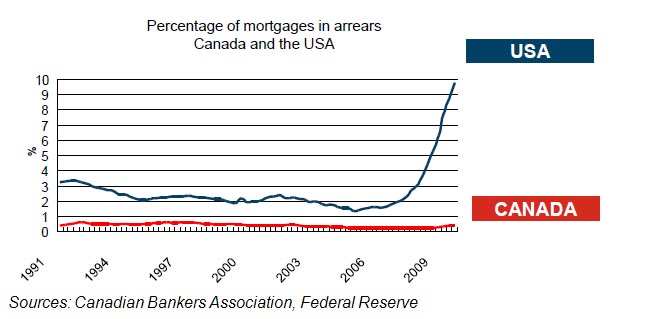

A couple folks sent me this link, which I saw out at Insty yesterday. It seems Canada’s banks are in great shape, and they weren’t damaged by the “housing crisis” at all. Because they do things differently in Canada. Stronger rules and regulations, no tax write-off for interest, and NO POLITICS involved in the lending process. And, while I have no proof of it at all, I’ve always had the feeling that they have far fewer layabouts than we do. A much smaller permanent victim class.

It’s late, so here’s the link. Interesting short read. What’s the catch? I think there is one, but I can’t quite figure it out right now.

Posted by Drew458

Filed Under: • Finance and Investing • International •

• Comments (3)

Thursday - February 25, 2010

Thursday - February 25, 2010

Greek deputy PM’s extraordinary attack on Germany over debt crisis. It’s the Nazis fault.

I guess it isn’t funny and some are saying that the euro could fall if Germany doesn’t help to prop up the Greeks and see em through this disaster.

I haven’t done a lot of reading on this and don’t know what all the ramifications would be. It’s surely nothing to bother the US, or might it?

Anyone with knowledge on this topic, welcome please. I’d really like to understand it better. I find things like this quite interesting, especially living so close to things.

You might want to see the comments at the end of the article at the MAIL. Very interesting. Also, I happen to think while reading this earlier today, isn’t it nice for a change, going from it’s Bush fault to , It’s the Nazis fault.

‘The Nazis took our gold, they should at least thank us’: Greek deputy PM’s extraordinary attack on Germany over debt crisis

By MAIL FOREIGN SERVICENazi theft of Greek gold during the Second World War is to blame for the country’s faltering finances, Athens claimed yesterday.

It came as new protests about the economy turned violent.

Greece said the real culprit for its problems were the Nazis, whose occupation lasted from 1941 to 1945.

‘They took away the Greek gold that was at the Bank of Greece, they took away the Greek money and they never gave it back,’ said Deputy prime minister Theodoros Pangalos.

‘I don’t say they have to give back the money necessarily but they have at least to say “thanks”.’

Germany had failed to offer enough compensation for the economic impact of the Nazi occupation, he added.

Germany swiftly rejected the accusation, saying it paid £50million in compensation by 1960 and more to forced labourers of the Nazi regime.

The economy was crippled, as foreign trade was suspended, agricultural output ground to a halt, and the treasury had to loan Germany money.

The EU has asked Greece to explain reports that it engaged in derivatives trades with U.S. investment banks that may have allowed it to mask the size of its debt and deficit from authorities ahead of its entry into the euro zone.

But Mr Pangalos said Italy did more than Greece to mask the state of its finances to secure euro zone entry.

Posted by peiper

Filed Under: • Economics • Finance and Investing • International •

• Comments (6)

Tuesday - February 09, 2010

Tuesday - February 09, 2010

THERE ARE 8 BILLION, COUNT EM, EIGHT BILLION SHORT SELLERS ON THE EURO …..

Do you suppose some folks just happen to know something?

H/T Rich K for emailing me the article from the Telegraph.

I read papers but ... (Drew, where do I get a shamed face avitar for this?) [ Drew: um, like ![]() this? ] I hardly ever read the financials. It’s my wife who reads the business section.

this? ] I hardly ever read the financials. It’s my wife who reads the business section.

She it is who informed me about the short sellers.

This is some serious stuff I guess. ?? What the hell do I know? What? Me Worry?

I just need to know how the Q’s are running (QQQQ) the tech index. Buy at the lo and sell later. Or use em for covered calls. Outside of that, I didn’t even know there was a banking crises till I read it on BMEWS one day. lol.

OTOH ..... What Rich sent sure did stir up things a bit. Everything is so connected. But guess what? It was the same in the 1920s.

SUPER book called LORDS of FINANCE. Very fast read and not overly tech heavy.

And BTW ... oh boy do we know about margin calls. Been there and don’t ever want to revisit that country.

Greek Ouzo crisis escalates into global margin call as confidence ebbsFor the third time in 18 months the global financial system risks spinning out of control unless political leaders take immediate and radical action.

By Ambrose Evans-PritchardFlow data shows an abrupt withdrawal of German and Asian capital from Club Med debt markets. The EU’s refusal to offer Greece anything beyond stern words and a one-month deadline for harsher austerity – while admirable in one sense – is to misjudge how fast confidence is ebbing. Greece’s drama has already metastasised into a wider systemic crisis. The world risks a replay of the Lehman collapse if this runs unchecked, this time involving sovereign dominoes.

Barclays Capital says the net external liabilities of Greece are 87pc of GDP, or €208bn (£182bn). Spain is worse at 91pc (€950bn), and Portugal worse yet at 108pc (€177bn); Ireland is 68pc (€123bn), Italy is 23pc, (€347bn). Add East Europe’s bubble and foreign debts top €2 trillion.

The scale matches America’s sub-prime/Alt-A adventure and assorted CDOs and SIVS of the Greenspan fling. The parallels are closer than Europe cares to admit. Just as Benelux funds and German Landesbanken bought subprime debt for high yield with AAA gloss, they bought Spanish Cedulas because these too had a safe gloss – even though Spain’s property boom broke world records. They thought EMU had eliminated risk: it merely switched exchange risk into credit risk.

THE REST OF THE ARTICLE IS HERE

AND THERE’S THIS BIT FROM ANOTHER PAGE , SAME PAPER.

Naturally, I see the name Soros and it’s akin to waving a Nazi flag at a BarMitzvah.

First the hedge fund manager, Jim Rogers, co-founder with George Soros of the Quantum Fund, says “sell any sterling you might have. It’s finished”. Then along comes another veteran of the hedge fund scene, Bill Gross of Pimco, to insist that “the UK is a must avoid. Its gilts are resting on a bed of nitroglycerine”.

Posted by peiper

Filed Under: • Finance and Investing • UK •

• Comments (4)

Tuesday - January 12, 2010

Tuesday - January 12, 2010

A MOST EXPENSIVE PARTY LAUNCH. BUT THE PARTY’S OVER.

I don’t suppose many of you have followed this story much if at all. Being somewhat closer to this, Dubai has figured in the news here quite often since this SPECTACULAR opening of the resort for billionaires. We’ve been buried in beautiful photos of the place and at the beginning there were all these very positive comments and promises for the bright future ahead.

Well, Aladdin’s lamp has gone darkish as the place has all but gone bust. Empty and decaying (already) apt. complexes, restaurants that either never opened as scheduled or if they did have now closed. Nowadays the photos we see of this grandiose dream are sadly not so forward looking and the future does indeed look grim. The developers had hoped that one of the rich Arab countries might shovel in some needed cash, and they did indeed get some from one of the Arab states. I forgot which one.

Dubai is a place where a person goes to jail for an offense like a bounced check. They are very serious about that.

Photos we see now show expensive cars simply left in the street to collect dust as the owners have walked away, broke. They have left homes and apts the same way. Simply abandoned and very many have had to sneak out of the country. Not that they were involved in any criminal activity mind you. But they found the bubble had burst and their funds were either non existent or near to being so. They could no longer pay the staggering bills and faced jail, and so left. Many others have stayed trying as best they can to salvage something. The people one really has to feel sorry for, are the many who were recruited to work there as waiters and maids and low level jobs, who came from foreign countries and are now at the mercy of ppl who don’t have a large supply of that. While the money wasn’t huge by our standards, it was by the standards of the countries they were recruited from.

Until today, I hadn’t seen this 2008 video. In ‘08 I was busy 27/7 helping the wife with a bed ridden elderly mother and I guess I missed a lot.

Better late then never though because this really is a sight to see. Notice the cost of the party. They didn’t.

Dubai resort The Atlantis stages most expensive launch party ever

The global recession may be biting, but try telling that to the Hollywood celebrities and billionaire business moguls who attended the opening of Dubai’s latest luxury resort, The Atlantis.

By Anita Singh, Showbusiness Editor

Published: 4:07PM GMT 20 Nov 2008More than 2,000 guests attended the event on the man-made Palm Jumeirah island in the Persian Gulf. Robert De Niro, Janet Jackson, Denzel Washington and Lindsay Lohan were among them, while the British contingent included the Duchess of York, Sir Richard Branson, Dame Shirley Bassey, retail boss Sir Philip Green, television presenter Trinny Woodall and the singer Lily Allen.

They feasted on lobster and Middle Eastern mezze and the Veuve Clicquot champagne flowed freely, although the presence of Sheikh Mohammed bin Rashid Al Maktoum, the ruler of Dubai, and a sizeable number of other Muslim guests ensured that the drinks bill was relatively modest.

Security at the party was so tight that a two-mile exclusion zone was thrown around the island.

Kylie Minogue performed on stage for a reported £1.5 million fee but the real entertainment of the night was provided by the pyrotechnics. One million fireworks – almost 10 times the scale of the Beijing Olympics opening ceremony – lit up the Palm, with the organisers claiming the display was visible from space.

Even in Dubai, a part of the world renowned for excess, there had never been a party like it.

“We built something that’s quite extraordinary. We’ve got to tell the world about it,” said Sol Kerzner, the South African billionaire hotelier and casino tycoon.

The 1,539-room Atlantis took two years to build and cost £1 billion. Mr Kerzner admitted that the global economic downturn would have an effect on business.

“We are in a challenging time. The economy is basically in a recession and we have to adjust to the changing circumstances. We have to be careful with our cost levels” he said, although he did not believe he had splashed out too much on his guests: “I didn’t lay on private jets. They either came in their own private jets or by regular airline.”

Colin Cowie, the party planner, likened the logistics of organising the beachside party to the Normandy landings. He added: “People say, ‘How do you have a party like this in these economic times?’ But the funds were allocated a year ago, and you have to dream big to get a big result.”

From The Times

November 28, 2009The spectre of “Financial Crisis 2” continued to loom over global markets yesterday after Dubai’s revelation that it may not be able to meet its debt obligations.

Stock markets in Asia and the United States fell sharply while the dollar and Japanese yen rose as investors shifted their money to their perceived safety.

UK banks were also revealed to be the biggest lenders to the United Arab Emirates, which includes Dubai, with more than $50 billion owed by the Gulf state’s residents.

In another blow to the beleaguered UK banking sector, the Royal Bank of Scotland emerged as the largest single loan-arranger to Dubai World, the state-owned conglomerate that sparked this latest financial crisis when it sought a standstill on its debt repayments on Wednesday.

Related Links

RBS, which is owned by British taxpayers, has arranged loans worth up to $2.3 billion to Dubai World.The Financial Services Authority, the regulator, is understood to have sought assurances from banks that their exposure to Dubai will not threaten their financial strength. The FSA said it would continue to keep a close eye on the situation.

Dubai World, which owns a range of assets including the Turnberry golf club in southwest Scotland, sparked panic when it asked for the debt standstill. The company has liabilities of $60 billion and its Nakheel property division, which built the Palm Jumeirah development where the footballers David Beckham and Michael Owen own houses, was due to repay a $3.5 billion bond next month.

The standstill has raised the prospect that Dubai World and, by extension, the government of Dubai might default on their debt.

Here’s a link for a lot of other links on the subject. Makes for some fascinating reading.

notice the dates on these two stories. didn’t take long.

Posted by peiper

Filed Under: • Big Business • Economics • Finance and Investing • International • Middle-East •

• Comments (2)

Thursday - December 31, 2009

Thursday - December 31, 2009

Nasty Deal for GMAC

This doesn’t seem to be much of a news item, but the federal government just injected another pile of cash into GMAC, and then took it over. So the feds own yet another bank/lending institution now.

GMAC to Get Another $3.5B in Aid From Treasury

A GMAC spokeswoman declined to comment on any potential government action but said, “GMAC has been conducting a strategic review of its business and evaluating options to address the challenges in its mortgage operation.” The spokeswoman said GMAC wants to prepare itself to repay the U.S. government.

The willingness by the U.S. Treasury to deepen taxpayer exposure to GMAC reflects the troubled company’s importance to the revival of the auto industry. The company was told to raise additional capital as part of government-led stress tests of large banks conducted earlier this year. The tests were to determine whether firms would need more capital to continue lending if the economy deteriorated in 2009 and 2010.

GMAC has only filled a portion of its capital hole and, unlike other banks that participated in the stress tests, has been unable to attract much capital from private investors. The Treasury said earlier this year that it would make as much money available to GMAC as needed to fill its capital hole and projected the firm would need another government infusion of as much as $5.6 billion.

GMAC’s capital needs have turned out to be somewhat less than originally envisioned, in part because impact from the bankruptcies of General Motors Corp. and Chrysler Corp. was not as severe as federal regulators originally projected.

Ok, here’s the part that I don’t get, the part that rather looks like arm twisting thuggery to me. But what do I know, right? Before this latest cash infusion, Uncle Sugar had fattened up GMAC’s coffers to the tune of 12.5 billion. For this gift of our money, the feds took 35% ownership. Basic math: $12.5B / 35% = $357,142,857.14 for every percent ownership. Now the feds are going to drop in another lump sum, a relatively “piddling” little $5.6 billion, and then they’ll own 56%? Less than half as much infusion but way more than half as much new ownership? Only $266,666,666.67 per percent? Huh? That doesn’t seem right. It’s not like the feds bought up most of the outstanding stock shares that had fallen in value, is it? This doesn’t seem right to me. But then, the federal government owning both the means of production and the banking industry doesn’t seem right either. I’m just one of those simple minded Conservatives.

Auto finance company GMAC got a new majority owner late Wednesday when the federal government announced it was assuming a 56 percent stake in the company with $3.8 billion in aid.

It was the third bailout for GMAC, which had previously received $12.5 billion in direct federal aid and other support. The government already had a 35 percent stake in the company. GMAC had requested an additional $5.6 billion in federal aid in November.

The Treasury Department announced that it also would hold about $14 billion in loans the bank may eventually have to replay. The government will appoint four of GMAC’s nine directors.

GMAC is the primary lender for dealers of General Motors and Chrysler vehicles. It converted to a bank holding company last year to qualify for federal bailout funds.

Posted by Drew458

Filed Under: • Finance and Investing • Government •

• Comments (2)

Saturday - December 05, 2009

Saturday - December 05, 2009

The French, in the person of Mr. Sarkozy, have managed to anger the Brits this past week.

Just so you know, Sarko is referring to London when he says “city.”

Woo-Hoo and another Hoo. That caused a bit of a flap this week I must say. Whatcha gonna do? Brits and French have this love/hate thing. But really, Brits do not I don’t think, actually dislike the French. I may be wrong on that score. I think they laugh at em a lot though and the French know it.

War has not been declared.

We are in charge now, Sarkozy tells the City

Francis Elliott, Suzy Jagger, Martin Waller and David Charter

The TimesAlistair Darling has delivered a blunt warning to the EU’s new French finance chief against meddling with the City of London.

As Nicolas Sarkozy gloated over impending curbs on the City, the Chancellor said that such moves would drive financial services out of Europe.

The French President’s glee at the appointment of Michel Barnier as Commissioner for the Single Market took on an edge of menace when he said that unfettered City practices must end.

“Do you know what it means for me to see for the first time in 50 years a French European commissioner in charge of the internal market, including financial services, including the City [of London]?” he said yesterday.

One of the very bothersome things about the new French EU finance chief is .... he is very left wing and much given to govt. control.

He hasn’t been very big on capitalism either, and has made no bones about that in the past.

The Brits I think were hoping to get that post btw. At some point in time, either the EU will solidify and RULE supreme, or else collapse in upon itself.

“I want the world to see the victory of the European model, which has nothing to do with the excesses of financial capitalism,” he said.

His implicit threat was just what Downing Street had feared when Mr Barnier, formerly an agriculture minister, was given the portfolio last week.

Mr Darling, writing in The Times , said that it would be a “recipe for confusion” if firms were supervised by the EU as well as national watchdogs and that Britain would not accept new laws that could lead to taxpayers picking up the bill for bailouts ordered by Brussels.

He rejects claims that the economic crisis was the fault of the “Anglo-Saxon” model, pointing out that French and German banks were among the biggest creditors of the failed US insurance giant AIG.

Terry Smith, a prominent banker, said that the threat of increased regulation was already threatening the City’s future.

“I’ve never seen so much work going on by companies, individuals and teams of people to evaluate relocation out of the UK,” he said.

SOMETHIN TELLS ME THAT THIS IS THE ONLY SARKOZY THE BRITS WANT TO SEE FOR AWHILE! LOL

Posted by peiper

Filed Under: • Economics • EUro-peons • Eye-Candy • Finance and Investing • FRANCE • International • UK •

• Comments (0)

Wednesday - June 24, 2009

Wednesday - June 24, 2009

Hedge fund managers betting Twitter will give them an edge in rapid trading.

I don’t think I have ever posted anything from the financial pages before.

I know I should keep up with things but to tell you the truth, I just don’t read the financial pages too often. In fact, hardly ever.

Wasn’t always thus. I used to faithfully read the IBD, my first port of call in finance and stocks etc. It was always a pretty good source too.

And of course the WSJ. As time went on and after we moved here though, I seemed to lose interest and there has been so many other things to occupy my time, I just ignore it now.

However, my wife reads the financial pages here every day, and she brought this story to my attention.

I deemed it interesting enough to share and hope you find it so too. I don’t wanna bore anyone. Sometimes it’s hard to know exactly where the line is when I choose a story to share. Kinda like pot luck and hope for the best.

Anyway ... whodda thought that the CIA would be in Venture Capital?

Hedge fund managers are turning to Twitter in an attempt to steal a march on their rivals.

By Richard Tyler, Enterprise Editor

Finance page, The telegraphTraders are using software developed by US-based technology StreamBase to monitor “tweets” for price sensitive information.

The software plugs into Algorithm-based automated trading platforms that have been used by traders for years. But rather than searching Reuters or Bloomberg the software now scans Twitter.com.

Streambase – whose client base includes Royal Bank of Canada and London-based hedge fund BlueCrest Capital Management – was commissioned to develop the software by several “unnamed” clients.

The software allows traders to take into account “event-based” information published on Twitter in their automated equity, bond and foreign exchange trading.

The company, whose investors include Inqtel, Central Intelligence Agency’s venture capital arm, claims it could give traders an edge when deciding whether to trade on breaking news, like terrorist attacks and natural disasters, rather than waiting for the information to be filtered through providers like Reuters Thomson or Bloomberg.

Nasir Zubairi, a former product manager for algorithmic trading and foreign exchange e-commerce at Royal Bank of Scotland, said the City would be looking at websites like Twitter.com as a useful market information “broadcast tool”.

“Markets tend to buy on rumour and sell on facts,” he said.

Not just markets either. Anyone speculating and or investing should be buying on rumor and selling on facts.

Learned that at Wade Cooke’s knee. In a manner of speaking.

Oh hey, speaking of books, (well I am now) if you have any interest in the markets, even just a little bit, grab hold of a book if still in print called,

The Wall Street Money Machine. True, its outta date by now but even so the information in that book is still very good.

Posted by peiper

Filed Under: • Finance and Investing •

• Comments (0)

Monday - May 04, 2009

Monday - May 04, 2009

Berlusconi demands an apology AFTER wife says she’s had it and wants divorce.

Now this guy I want ya to know and I believe you already do, is Italy’s top guy. He’s their president, their leader, they’re jealous.

Oh before I forget.

UPDATE May 4th.

Mrs. Berlusconi has today filed for divorce and could get half his 4 BILLION dollar fortune. Hey, they’ve been married 19 years. If he was gonna mess around, the least he could have done was be considerate enough not to embarrass his wife so publicly for so long.

Hot blooded Latins. Hmmm. Wonder if the guys extend that excuse to their women?

‘Shameless’ Silvio Berlusconi buys 18-year-old model a gold necklace for her birthday and calls himself ‘her little daddy teacher’

By Nick Pisa

Last updated at 11:49 PM on 29th April 2009You would think that Silvio Berlusconi’s wife would be thrilled that her busy husband found time to attend an 18th birthday party.

Well she wasn’t - because the party was for someone else’s pretty young daughter.Mr Berlusconi’s long-suffering wife, Veronica Lario, lashed out after his appearance was gleefully reported in the Italian press.

She said in an email to Italy’s national news agency ANSA: ‘That really surprised me because he has never come to the 18th birthday parties of any of our children despite being invited.’

Veronia criticised Berlusconi in an email to an Italian press agency.

The Italian prime minister, 72, has three grown-up children with Mrs Lario - Barbara, Eleonora and Luigi - and two from a previous marriage.

But he also sees himself as ‘little daddy’ to blonde teenager Noemi Letizia, the daughter of a business associate.

He was the surprise guest of honour at her recent 18th party in Naples, and gave her a necklace and signed photograph of himself.Yesterday Miss Letizia was interviewed by several Italian newspapers and said: ‘It was a lovely surprise to see the man I call Papi (daddy) at my party.

‘I call him Papi but of course he is second to my father. He gave me a lovely necklace as a present.’Mr Berlusconi said he wanted ‘youthful new faces’ as candidates for June’s European elections.

He named four targets, none of whom has any political experience: soap actress Camilla Ferranti, 30; TV star Eleonora Gaggioli, 29; ex-Big Brother contestant Angela Sozio, 31; and former Miss Italy candidate Barbera Matera, 28.In her email Mrs Lario said: ‘Someone wrote that all this is to sustain the enjoyment of the Emperor.

‘I agree with this - what has emerged is shameful trash, all in the name of power.‘I want it to be made clear that my children and I are victims of this situation and do not agree with it, we have to put up with it and suffer with it.

‘Fortunately for some time now we have had women in politics and business - in the past we had (Margaret) Thatcher and now we have (Angela) Merkel - that is to say women can be involved in politics.‘Women today are and can be beautiful and the fact that there are beautiful women in politics is not a merit or a demerit.’

It is the second time that she has made a public statement on her husband’s antics.Two years ago she demanded - and got - a public apology after he told one actress he would wed her if he wasn’t already married and then told another he would run away with her.

Berlusconi babe: Eleonora Gaggioli has been lined up as a prospective candidate for the European electionsBerlusconi demands an apology from his wife as he admits: Our marriage is over

By NICK PISA

Last updated at 4:55 PM on 04th May 2009Silvio Berlusconi has no plans to seek a reconciliation with his wife and has demanded an apology from the former actress for comments she made.

The Italian prime minister’s wife Veronica said over the weekend she planned to file for divorce, days after publicly criticising Berlusconi’s selection of pretty young women to run in European elections.

Posted by peiper

Filed Under: • Celebrities • Eye-Candy • Finance and Investing •

• Comments (2)

Wednesday - March 11, 2009

Wednesday - March 11, 2009

Why we got off the gold standard

Because there simply isn’t enough gold. Or silver. Or platinum. Or all of them combined. And there never was, even if you could gather every bit ever smelted. There is far more money in various accounts than there is money coined, and there is more money coined than there are precious metals to support them. The mints can only print money. Capitalism creates money, and the mints can’t even come close to keeping up.

So what supports the world’s currencies? Faith. And dreams. And the promise of Free Beer Tomorrow, but Tomorrow never comes. And if enough people share a dream then everyone is afraid to wake up. So don’t look too too closely at the man behind the curtain.

At times I find myself thinking that our money ought to be backed by precious metals. Usually those times are when I see that the price of something I want to buy has gone up, the value of gold has gone up, but the value of my money has gone down. That’s rather irritating. But what if it were? What if we still based our money on silver and gold? I know, let’s play with some math and a bit of history ...

sterling silver is 92.5% silver, 7.5% copper. Pure silver is just too soft to use for coinage. So is pure gold. But sterling silver is much tougher. Think of it as 22 carat silver.

A Troy ounce weighs 480 grains. 12 Troy ounces = 1 Troy pound, or 5760 grains.

[ An Avoirdupois ounce weighs 437.5 grains, 16 oz = 1lb or 7000 grains. This is the basis for American weights, even though precious metals use the Troy system. So yes, a pound of feathers actually does weigh more than a pound of gold, because they use different weighing systems. Grains are grains regardless of the weighing system. ]

In the money system started by England’s Henry II (d 1189), an old English penny had a pennyweight of silver in it, 24 grains. 20 pennies was a shilling, 1 Troy ounce. 12 shillings made a pound. Of Silver. One Pound, Sterling. Pretty subtle name, what what?

Today, silver is selling for $12.80 per troy ounce. Gold is right around $910 per troy ounce. Copper is selling for $1.612 per Avoirdupois pound.

$12.80/480= $0.026667 per grain.

480*0.925 = 444 grains, value of that much silver in a Troy ounce of sterling silver = $11.840148

$1.612/7000 = $0.000230 per grain

480*0.075 = 36 grains, value of that much copper in a Troy ounce of sterling silver = $0.00828

One Troy ounce of sterling silver, ie one Shilling = $11.84828.

Thus one pound sterling silver, 12 Troy ounces = $142.181136.

Add in a tiny amount of value for the making of the alloy itself.

One British Pound Sterling, £1, based on the precious metals standard, ought to be worth $142.25, not the $1.39 it’s going for today.

But the UK would need several mountains of gold, silver, and platinum to back it up; a standard American ton of 2000 pounds (Avoirdupois) is a mere 2430.5556 Troy pounds; even at gold price of $910/Troy ounce a US ton of gold is only worth $26,541,666.67. So Bill Gates and his $13 billion fortune are worth 490 US tons of the stuff, about 1/3 of worldwide annual total gold production. But that’s the real point: if currencies were based on precious metals, the world economy could only grow by the amount of them smelted per year. For gold, that’s about 50 million ounces: $46 billion, which is a drop in the bucket of international finance.

Speaking of mountains of precious metals ...

1 Troy oz = 373.2417216 grams

density of gold = 19.3 gm/cc

volume of 1 Toz gold = 19.338949cc

volume of 1 US ton of gold = 564079.246907cc, = 19.92027 cubic feet, a cube 2.710806 feet per side (a hair over 2 feet 8 1/2 inches). Your basic $26 million, 2000lb side table.

100’x100’x100’ = 1 million cubic feet, which holds 50,200.1279 US tons of gold, worth $1,322,457,662,471.44; a bit less than 1 1/3 trillion dollars. This is almost twice as much gold than has ever been mined in all of human history. But it’s far less than Obama’s Stimulus Package plus Bush’s Bank Bailout combined. There simply is not that much gold to go around, there never was, and there probably never will be.

The Stimulus Package plus the Bank Bailout plus this new Federal Budget plus the existing National Debt adds up to about $16 trillion, which is a gold brick 100’x100’x1025’. If you had a box that size you could hide an ocean liner inside.

A few weeks ago Peiper sent me a book called The Moneymaker. It’s the story of John Law, a Scotsman from 300 years ago who managed to put France on a paper currency money system, because there wasn’t enough metal coinage in circulation. This worked great for a while, and the economy of France bloomed. But nobody listened to him when he said that the brakes should be kept on; he never wanted to print more than 4 times as much paper cash as the banks had gold on hand to cover. Plus he got involved in a major Ponzi scheme called the Mississippi Company, and while it made him and many other people a vast fortune, when that bubble broke it crashed the economy and madness ensued for a while. And the paper money went belly up as well. And the banks. And then the dear little froggies spent the rest of Law’s life getting even with him, in the nastiest ways imaginable, as only true liberals can. Because they had all been greedy, and had lost out when the bubble burst, so it was all Law’s fault. It’s a great little book, and large parts of it seem to be a warning that is still applicable today.

Of course, I couldn’t get past the title without thinking of Terry Pratchett’s recent novel Making Money. It’s nearly the same story, but turned inside out because it’s Pratchett after all. Somewhat reformed con man Moist Van Lipwig puts the city on a fiat currency because there isn’t enough money in circulation, and then it turns out that there isn’t even any gold when there should have been. Except in the end there is, but it’s the kind of gold that really works for you, providing you know the secret. And the Glooper is bi-directional. And the promise of the old currency under the gold standard was great: We promise that this paper dollar is worth a dollar in gold, as long as you promise never to try to make that exchange. Perfection!

Both are very good reads, highly recommended. But both show that to become modern and to grow, any economy has to be based on the productivity and worth of the citizenry. It is a dream, and none of us can wake up, because that would crash the house of cards. Perhaps we should try a currency based on things of real worth, like food. Which would make the US, Canada, Australia, and Argentina the richest nations in the world. But you couldn’t really save it - not enough Mason jars by far - although you could always trade in your paper dollar for a dollar’s worth of food. We call that act “going to the grocery store”.

Posted by Drew458

Filed Under: • Finance and Investing • Inflation and High Prices •

• Comments (5)

Tuesday - February 17, 2009

Tuesday - February 17, 2009

Welcome To Hell

Gold 969.9

Crude 35.04

S&P 789.17

GM needs another $2 BILLION right now, and $16.5 BILLION to stay afloat for the rest of the year. GM plans to close 5 plants and lay off 37,000 employees this year.

SEC charges Robert Allen Stanford of Stanford Investments with fraud over $8 BILLION scam for selling CDs with false return rates; the money was stolen from other funds.

Russain Market tumbles 9.7% in half a day; trading suspended.

Obama signs “stimulus” bill, goes back to campaigning. Forever.

Less than a month into office, President Barack Obama is trying to recapture the energy and common-man feel of the campaign trail to ease the harder task of governing. He’s adopting the “permanent campaign” as a major tool for how he conducts his presidency, ditching Washington for the road, early and often.

Expect worse tomorrow.

Posted by Drew458

Filed Under: • Economics • Finance and Investing • Government •

• Comments (3)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.