Monday - August 08, 2011

Monday - August 08, 2011

Helena Handbasket, Part 2

Stocks Plunge, Gold Soars as Debt Fears Drive Uncertainty

Equity markets were deep in the red in tumultuous trading on Monday, while safer assets like gold and Treasury bonds rallied, after U.S. and euro zone debt fears choked traders’ confidence.As of 12:00 p.m. ET, the Dow Jones Industrial Average slid 300 points, or 2.6%, to 11,146, the S&P 500 tumbled 39.6 points, or 3.3%, to 1,160 and the Nasdaq Composite dipped 86.7 points, or 3.4%, to 2,446. The FOX 50 sank 24.7 points, or 2.9%, to 840.

Volatility has been extremely high in recent trading sessions. The selloff over the past two weeks has been so furious in fact that “its force now rivals almost anything we’ve seen in the post war era,” according to Daniel Greenhaus, chief global strategist at BTIG. The VIX, often referred to as a fear gauge, surged 20% to a 52-week high in morning trading.

For the first time in history, S&P cut America’s top-notch credit rating one notch to AA-plus from AAA after the close of trading on Friday. The ratings company also said Monday it would slice Fannie Mae and Freddie Mac’s debt rating because the mortgage companies directly rely on the U.S. government.

S&P’s move came as a result of concerns over the country’s substantial public debt burden and deep divides within Congress that almost sparked an unprecedented default on U.S. sovereign debt. Moody’s Investor Service, another ratings company, affirmed American’s AAA rating, while Fitch is still performing a review.

Many large investors noted the short-term impact of the downgrade may be muted, however, it could foreshadow deeper economic issues.

S&P Downgrades Fannie and Freddie Credit Ratings, Other Agencies Tied to U.S. Debt

Standard & Poor’s downgraded the credit ratings of mortgage giants Fannie Mae and Freddie Mac Monday, expanding on its decision to downgrade U.S. debt in a market-roiling set of announcements.

President Obama is expected to discuss the first-ever downgrade at 1 p.m. ET. The White House has kept mostly silent since S&P made its decision public Friday night.

As lawmakers on both sides of the aisle look to assign blame for the downgrade, S&P announced a slew of other changes Monday. Among the lowered ratings are: farm lenders; long-term U.S. government-backed debt issued by 32 banks and credit unions; and three major clearinghouses, which are used to execute trades of stocks, bonds and options.

The downgrades mirrored the AAA to AA+ ratings drop given to the U.S. government.

S&P said the agencies and banks all have debt that is exposed to economic volatility and a further downgrade of long-term U.S. debt. Their creditworthiness hinges on the U.S. government’s ability to pay its own creditors.

Greece Bans Shortselling as Stocks Tank

Greece has banned short selling on the stock market for two months from Tuesday, after shares on the Athens Stock Exchange plunged to their lowest level in more than 14 years.

The bourse’s general index sank below the 1,000-point mark Monday, closing down 6 percent at 998.24—the lowest level since January, 1997—as financial markets were buffeted by worries over the U.S. economy following a downgrade of the country’s debt.

The slide was markedly more than the declines recorded in other markets in Europe.

World stocks hit by U.S. unease; ECB supports Italy, Spain

LONDON (Reuters) - Deep-rooted jitters about the U.S. debt rating cut sent world stocks toward 11-month low on Monday, overshadowing relief that the European Central Bank was buying bonds of euro zone strugglers Italy and Spain. Having seen some $2.5 trillion wiped off its global share values last week, MSCI’s all-country world stock index was down a further one percent. Wall Street looked set to add to the rout with S&P 500 futures down around 2.5 percent.

European share measured by the FTSEurofirst 300 index were down 2 percent after earlier registering gains on the ECB action, intended to take the heat out of the spreading euro zone debt crisis. Yields on five-year Italian and Spanish bonds fell around a full percentage point, spreads against German debt narrowed and the cost of insuring them against default dropped. But safe-haven buying sent gold soaring to a new record above $1,700 an ounce and the dollar weakened against a basket of major currencies. Investors were seemingly unimpressed by weekend talks between industrialized countries aimed at safeguarding the smooth functioning of financial markets following agency S&P’s cut in its U.S. rating late on Friday to AA-plus from AAA.

“It won’t be long now before other ratings agencies follow suit, considering the state of the U.S.’ finances. One thing is for certain, and that’s that volatility will continue to remain high, making trading conditions difficult,” said Angus Campbell, head of sales at Capital Spreads.

...

(update to original article) World stocks slid to their lowest level in nearly a year on Monday, overshadowing relief that the European Central Bank was buying Italian and Spanish government bonds in the latest move to staunch the euro zone debt crisis.U.S. stocks extended losses in early trading, falling more than 3.0 percent on the heels of its worst week in more than two years. MSCI’s all-country world stock index <.MIWD00000PUS> dropped 3.8 percent. The index was at its lowest level since September 2010.

Asian markets were the first to react to the downgrade, opening lower and staying down throughout the session.

In Tokyo, the Nikkei (NIKKEI225) index finished with a loss of 202 points, or 2.2%, at 9,097.56. The sell-off was not as severe as Friday’s 3.7% drop that followed the huge drop in U.S. stocks on Thursday.

The mood on the Tokyo Stock Exchange floor was described as “tense” by Tsutomu Yamada, a kabu.com market analyst. But he said actions taken by Western finance leaders and Treasury buying by Japan mean that the initial reaction in Tokyo won’t be as bad as some experts had predicted.

The Shanghai Composite (SE_COMPOSITE) index tumbled 3.8%, while Hong Kong’s Hang Seng (HANG_SENG) index ended with a loss of 2.2%.

South Korea’s KOSPI index ended down 3.8%, after being down as much as 5.5% and forcing a short trading halt. In Australia, the All Ordinaries index closed with a decline of 2.7%.

This is what being a world leader really means. And Lord Obama? Oh joy.

According to the White House official, Obama will offer a reassuring assessment of the economic situation, citing reasons for confidence in the U.S. economy despite the decision last week by Standard & Poor’s to downgrade the U.S. credit rating for the first time in history.

In addition, Obama will call again on the special congressional fiscal committee to be set up under the recent debt ceiling deal to take a “balanced” approach to deficit reduction that he has been advocating, the official said.

Oh, and let’s not forget this one. Speaking of blaming others for your own mistakes ...

AIG to Sue BofA For $10B Over Troubled Mortgages

Insurance giant American International Group (AIG) reportedly intends to sue Bank of America for billions of dollars over hundreds of poor-quality mortgage-backed securities sold at the height of the housing collapse, adding to a mounting list of suits against the Wall Street giant. The move, which adds to a slew of investors trying to reclaim billions in losses caused when BofA’s mortgage unit Countrywide knowingly sold bad loans, sent shares of Bank of America tumbling more than 10% to a two-year low of $7.31 Monday morning.AIG, which is still largely owned by taxpayers as a result of its 2008 government bailout, was down more than 7% to a 52-week low of $23.15. The AIG suit will seek to recover more than $10 billion in losses on $28 billion of investments, according to a report by the New York Times, representing one of the largest mortgage-security-related lawsuits filed by a single investor.

A group of 22 investors including the Federal Reserve Bank of New York and BlackRock Financial Management, was awarded $8.5 billion by BofA earlier this year over the same troubled loans.

Too big to fail, but not too big to sue.

Hey, can we all sue DC?

Update, 90 minutes later: DJI drops to below 11,000, a 450 point drop in one day. Ouch.

Update 2, half an hour later: DJI at 10,960ish, a 500+ point cliff jump. But, hey, in a few WEEKS Obama will announce his new economic plan. Don’t be rushing the man; he’s got a whole lot of golf to play, and several vacations to take, between now and then!

Update 3: DING DING DING DING At the closing bell, DJI closes at 10809.85, a drop of more than 634 points in a single day, losing more than 6.7% of it’s value and several years worth of gains. Crivens.

After closing out the worst week since 2008, Wall Street was once again pummeled on Monday after global sovereign debt and economic fears sent traders fleeing equities with few shelters in sight.

The Dow Jones Industrial Average plunged 635 points, or 5.6%, to 10,810, the S&P 500 tumbled 79.9 points, or 6.7%, to 1,119 and the Nasdaq Composite dipped 174.7 points, or 6.9%, to 2,358. The FOX 50 sank 50.7 points, or 5.9%, to 814.

Posted by Drew458

Filed Under: • Economics •

• Comments (0)

Sunday - August 07, 2011

Sunday - August 07, 2011

surrealistic billow

4 martinis and we watched Tank Girl.

WTF?

Seriosuly, WTF???

Sort of reminded me of Fritz The Cat, a comic book porno violence fest. Except this was no porn. It was Ice-T in a dog costume. Fighting Power & Water, the ultimate expression of government power. Except it was completely disjoint. Maybe I wasn’t wasted enouhg\, yet I’m too drunk to even type.

Holy cow, this film made no sense at all. But the chick with the glasses was kinda cute. Lori Petty, OTOh = total freakazoid.

WTF is this movie all about anyway? It couldn’t even cut it as a comic book.

Wife was stone sober, and it was a effed up experience for her too.

What gives?

Posted by Drew458

Filed Under: • Hollywood •

• Comments (3)

a socialist welfare state is collapsing before our eyes.

This is one heck of an editorial by this expat American writer.

Soon as I read it, I knew I had to share it. And she’s stickin her neck out speaking up for the Tea party. She’ll earn some brick bats for that. But heck, she’s a conservative (not lite that I’m aware) and so is used to brick bats.

If we are to survive the looming catastrophe, we need to face the truthThe idea that a capitalist economy can support a socialist welfare state is collapsing before our eyes

Janet Daley ... The Sunday Telegraph

Which of these is the most important question to ask in the present economic crisis: how can we promote growth? Should we pay off government debt more or less quickly? Is the US in worse trouble than Europe? Answer: none of the above.

The truly fundamental question that is at the heart of the disaster toward which we are racing is being debated only in America: is it possible for a free market economy to support a democratic socialist society? On this side of the Atlantic, the model of a national welfare system with comprehensive entitlements, which is paid for by the wealth created through capitalist endeavour, has been accepted (even by parties of the centre-Right) as the essence of post-war political enlightenment.

This was the heaven on earth for which liberal democracy had been striving: a system of wealth redistribution that was merciful but not Marxist, and a guarantee of lifelong economic and social security for everyone that did not involve totalitarian government. This was the ideal the European Union was designed to entrench. It was the dream of Blairism, which adopted it as a replacement for the state socialism of Old Labour. And it is the aspiration of President Obama and his liberal Democrats, who want the United States to become a European-style social democracy.

But the US has a very different historical experience from European countries, with their accretions of national remorse and class guilt: it has a far stronger and more resilient belief in the moral value of liberty and the dangers of state power. This is a political as much as an economic crisis, but not for the reasons that Mr Obama believes. The ruckus that nearly paralysed the US economy last week, and led to the loss of its AAA rating from Standard & Poor’s, arose from a confrontation over the most basic principles of American life.

Contrary to what the Obama Democrats claimed, the face-off in Congress did not mean that the nation’s politics were “dysfunctional”. The politics of the US were functioning precisely as the Founding Fathers intended: the legislature was acting as a check on the power of the executive.

The Tea Party faction within the Republican party was demanding that, before any further steps were taken, there must be a debate about where all this was going. They had seen the future toward which they were being pushed, and it didn’t work. They were convinced that the entitlement culture and benefits programmes which the Democrats were determined to preserve and extend with tax rises could only lead to the diminution of that robust economic freedom that had created the American historical miracle.

And, again contrary to prevailing wisdom, their view is not naive and parochial: it is corroborated by the European experience. By rights, it should be Europe that is immersed in this debate, but its leaders are so steeped in the sacred texts of social democracy that they cannot admit the force of the contradictions which they are now hopelessly trying to evade.

No, it is not just the preposterousness of the euro project that is being exposed. (Let’s merge the currencies of lots of countries with wildly differing economic conditions and lock them all into the interest rate of the most successful. What could possibly go wrong?)

Also collapsing before our eyes is the lodestone of the Christian Socialist doctrine that has underpinned the EU’s political philosophy: the idea that a capitalist economy can support an ever-expanding socialist welfare state.

As the EU leadership is (almost) admitting now, the next step to ensure the survival of the world as we know it will involve moving toward a command economy, in which individual countries and their electorates will lose significant degrees of freedom and self-determination.We have arrived at the endgame of what was an untenable doctrine: to pay for the kind of entitlements that populations have been led to expect by their politicians, the wealth-creating sector has to be taxed to a degree that makes it almost impossible for it to create the wealth that is needed to pay for the entitlements that populations have been led to expect, etc, etc.

The only way that state benefit programmes could be extended in the ways that are forecast for Europe’s ageing population would be by government seizing all the levers of the economy and producing as much (externally) worthless currency as was needed – in the manner of the old Soviet Union.

That is the problem. So profound is its challenge to the received wisdom of postwar Western democratic life that it is unutterable in the EU circles in which the crucial decisions are being made – or rather, not being made.The solution that is being offered to the political side of the dilemma is benign oligarchy. Ignoring national public opinion and turbulent political minorities has always been at least half the point of the EU bureaucratic putsch. But that does not settle the economic predicament.

What is to be done about all those assurances that governments have provided for generations about state-subsidised security in old age, universal health provision (in Britain, almost uniquely, completely free), and a guaranteed living standard for the unemployed?We have been pretending – with ever more manic protestations – that this could go on for ever. Even when it became clear that European state pensions (and the US social security system) were gigantic Ponzi schemes in which the present beneficiaries were spending the money of the current generation of contributors, and that health provision was creating impossible demands on tax revenue, and that benefit dependency was becoming a substitute for wealth-creating employment, the lesson would not be learnt. We have been living on tick and wishful thinking.

Lowering the tax burden for both wealth-creators and consumers is essential. In Britain, finding private sources of revenue for health care is a matter of urgency.

A general correction of the imbalance between wealth production and wealth redistribution is now a matter of basic necessity, not ideological preference.

The hardest obstacle to overcome will be the idea that anyone who challenges the prevailing consensus of the past 50 years is irrational and irresponsible.That is what is being said about the Tea Partiers. In fact, what is irrational and irresponsible is the assumption that we can go on as we are.

Posted by peiper

Filed Under: • Economics •

• Comments (3)

is paris burning? no. but london is. again. rioters at play. again.

WHAT’S WITH THIS? THE BLITZ? NOPE. IT ALL STARTED ORIGINALLY BECAUSE ......

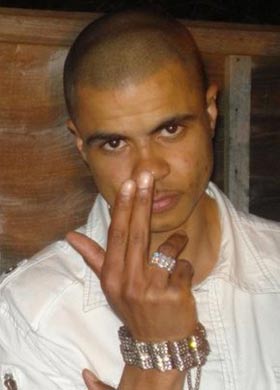

This fellow, Mark Duggan, a gentle soul who wouldn’t hurt a fly if you believe friends and his girlfriend and his mommy, was shot dead by de po-leece.

Now come on. It is not racist to suggest that we all know what happens when some minority member gets himself graveyard dead at the hands of cops.

It’s automatic. The cops are always wrong before any sort of investigation has a chance to happen, and anyway, rioters of any color or religion or national origin take up the cry of pious outrage and show their protests by setting fire to buildings and cars and of course, looting. Nothin’ like a new TV or a puter to show how much you care. When you care enough to steal the best. Or steal anything for that matter.

So this is what these sub-humans do.

Riot blaze: North London in flames as police cars, bus and shops burn over police shooting of ‘gangster’

· Twenty-six police officers hurt in clashes, with eight treated in hospital

· Scotland Yard still dealing with ‘isolated pockets of crime’ this morning

· Tottenham MP David Lammy appeals for calm and warns that there may be fatalities

· Mob of 500 people protest about death of father-of-four Mark Duggan who was shot by officers

· Fears that violence was fanned by Twitter as picture of burning police car was re-tweeted more than 100 times

· One eyewitness reports that trouble was ignited by police hitting a 16-year-old girl with batons

· Shop looted and youths storm McDonald’s and start cooking their own food

· Mail on Sunday photographers beaten and mugged by masked thugsBy IAN GALLAGHER and STEVE FARRELL

Last updated at 4:40 PM on 7th August 2011

The family of Mark Duggan has condemned the riot that broke out in Tottenham last night as eyewitness reports emerge that trouble erupted after a 16-year-old girl threw a rock at police.

Mr Duggan was shot dead by marksmen on Thursday and his fiancee, Semone Wilson, has said that she wanted answers, not trouble, while his brother, Shaun Hall, called for the community to remain calm.

The Metropolitan Police has described Mr Duggan’s death as ‘regrettable’ and blamed the violent anarchy that flared on a ‘criminal minority’.

Fuck NO his death was not regrettable at all.

Reports say he shot at a policeman who was saved by the bullet hitting or glancing off his radio. He was a known gun runner according to early reports, and imported guns to various gangs. Why the media insist on calling scum ‘protesters’ is beyond me.

There is always an element that will take advantage of situations and this is the result.

If police were allowed to shoot dead the vandals and rock throwers and looters, there might be less of this. And cops (as shown at one of the links) should not have to waste their undermanned time treating injured rioters before arrest.

The photos will speak for themselves and there are a load of them HERE

The feds are chasing me..

Last words of ‘gangsta’ who was shot by cops

By ANTHONY FRANCE and CHRIS POLLARD

A GUNMAN killed in a shootout with police had texted his girlfriend minutes earlier to say: “The feds are following me.”

Suspected gangster Mark Duggan, 29, fired a handgun at an armed cop, whose life was saved when the bullet hit his radio.The officer returned fire with his Heckler & Koch MP5 sub-machine gun - blasting dad-of-five Duggan twice in the face before slumping to the ground.

As the rioting escalated, trouble-makers on Twitter seemed keen to orchestrate the violence, bringing scores more people into the area. One user calling himself ‘English Frank’ urged attacks on the police, saying: ‘Everyone up and roll to Tottenham f*** the 50 [police]. I hope 1 dead tonight.’

And in a clear incitement to looting, ‘Sonny Twag’ tweeted: ‘Want to roll Tottenham to loot. I do want a free TV. Who wudn’t.’

‘Mrs Lulu’ tweeted: ‘Brehs [men] asking who’s down to roll [go] Tottenham right now, to get justice. – RIP Mark x.’

A tweet apparently passed on by chart-topping rapper Chipmunk, who comes from Tottenham, paid tribute to the dead man: ‘R.I.P Mark Duggan a real straight up and down respected man. LOVE!!!!!!!!’

Joining in the Twitter frenzy, ‘Ashley AR’ tweeted: ‘I hear Tottenham’s going coco-bananas right now. Watch me roll.’

Posted by peiper

Filed Under: • Crime • CULTURE IN DECLINE • UK •

• Comments (4)

From the outside, looking in

Watching the U. S. debt limit crisis from outside of America is scary. The collapse of the American economy would pull us all down.

But watching America’s crisis from outside of America is scary for another reason. For much of the world America was a goal, a symbol of the future, the one world power, the world’s policeman. No matter how many times she disappointed us or frustrated us, we assumed that America would be there to lead the world.

It looks like “them days are gone forever.”

What do you think?

- Dry Bones, Israel’s Political Comic Strip Since 1973

This is from a couple days ago. The truth of it is obvious; the moment that the debt ceiling deal went through the world stock market took a tumble. I guess they were counting on the USA doing the right thing for once, even though many of those countries have themselves been doing the wrong thing for generations, just like we have. Go figure; they got their own Change: the extinguishing of Hope.

Posted by Drew458

Filed Under: • Economics •

• Comments (3)

Saturday - August 06, 2011

Saturday - August 06, 2011

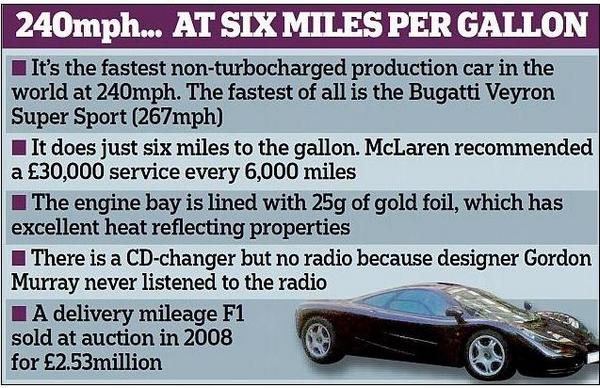

Rowan Atkinson escapes with a broken shoulder as supercar smashes into tree

Caught this in the paper today …

Not the first time he’s wrecked an expensive car. Glad he got out okay but I can’t help but wonder … should he be driving anything that can move at more then ten miles an hour?

I can’t imagine cars costing this much and more. That’s only cos I haven’t got that kind of money to toss at em. But would if I could.

Hey ... catch the ten minute video interview on Top Gear.

Rowan Atkinson escapes with a broken shoulder as 240mph supercar smashes into tree and bursts into flames

By SIMON NEVILLEAs Mr Bean, he always left chaos in his wake.

Now Rowan Atkinson has been involved in a real-life disaster, crashing his 240mph supercar as he drove home from work on a spoof spy movie.

The comedy star lost control of his McLaren F1, careering across the carriageway and into a tree and a road sign before the £635,000 sports car burst into flames.

TAKE A LOOK AT THE OTHER PHOTOS AT THE LINK RIGHT HEREHe had managed to escape from the wreckage when the flames took hold in the engine bay.

Atkinson was taken to hospital with a fractured shoulder after the incident on Thursday evening.He was discharged yesterday but left Peterborough City Hospital in a wheelchair and without comment. Onlookers said he was manoeuvred into the back of a Harley Street private ambulance and driven away.

The accident comes a month after the renowned ‘petrol head’ set the fastest time on a lap of the Top Gear track during the BBC motoring show’s ‘star in a reasonably priced car’ segment.

The incident on the A605 at Haddon in Cambridgeshire is the second time the comedian has crashed the F1, which he bought in 1997 following the success of his Mr Bean film.

In 1999 he ploughed the vehicle into the back of a Rover Metro in Lancashire, but the damage this time is likely to be rather more substantial. Pictures of the car taken before it was loaded on to a recovery truck show the sports car – the fastest road car in production when it was launched in 1992 – suffered extensive rear damage to its carbon fibre bodywork.

Atkinson’s agent Peter Bennett-Jones said his client had been driving to his Northamptonshire home after editing his latest film Johnny English Reborn, a sequel to the 2003 movie Johnny English, about a clumsy English spy which parodies the James Bond genre.

Mr Bennett-Jones said: ‘He is shaken but not stirred.

‘I think he was in pain and had some painkillers and stayed in hospital because obviously he didn’t have a car to get home. It is nothing more serious than that. He will be very rattled by the whole thing and I think he’ll want to keep as low profile as possible.’

Posted by peiper

Filed Under: • UK •

• Comments (5)

Red #1

Google has made another one of their neat widgets to remind everyone that today is the 100th birthday of Lucille Ball. Thanks Google!

Posted by Drew458

Filed Under: • Eye-Candy •

• Comments (2)

famine in the usual places and the death penalty and scrapping old paint

In addition to all the painting etc but so far more scrapping old first and the prep and the clean up, with prediction of more bad weather this wkend, I put the hedge trimmer and my aching arms to work as there was added growth after last episodes of rain and sun and rain and sun.

Well, I went to work and somehow managed to knock down dead something the wife was trying to encourage to grow. I simply thought it was a new weed of some sort or maybe the start of a tree. Anyway, it was kinda bulging out from the hedge which meant things were not looking like a clear and straight line all the way down from the entrance of our driveway to the garage. So I fixed that. Oh boy.

Wife was trying to fill a small gap in the fencing between us and the house next door.

I offered to install a green painted plywood panel in the gap.

Suggestion didn’t go over too well. Wife says in future before I get all mow em down happy, I might want to check with her. That only works however if I’m not clear on what something is and can ask. Otherwise, I trim and cut everything.

---------------------------------------------------------------------------------------

I am now discovering at my advanced age, that laws and rules on how to behave in public. are only meant to control those of us who aren’t criminals. Others do pretty much as they please, and have lots of help from people known as civil rights lawyers.

I would not imagine prison to be a place to spend your summer vacation. For many of us, just the thought of being jailed is enough to keep us in line. For very many others, penalties in place these days aren’t much of a deterrent. I don’t think I have to list any examples here. Readers I’m certain have numerous examples of their own.

So, listening to radio news while scrapping old cracked and peeling paint down to bare metal or wood. I have a bit over a month to finish a project that should take two or three months. Well anyway, Brits have signed an electronic petition to their government, to re-instate the death penalty. It means that the folks who rule this place would have to bring the subject up for debate. Debate. Not necessarily pass into law very quickly. Gotta give the bad guys time to kill and maim their hunting limit.

The conservative (lite) head of state is dead set against the DP, and has publicly stated so. Be interesting to see how this plays out over time.

I think in cases (of which there are far too many) where there is absolute proof and no doubt whatever, not only should hanging be re-instated, but the defense lawyers should hang next to their guilty clients.

A Judge Dee kind of justice.

I think the debate will be no more then the folks in power going through the motions, and have doubts they will bring back the death penalty. As always though ….

Stay Tuned.

----------------------------------------------------------------------------------

On another unrelated subject ----- Famine in Africa ---- as usual. And I should care because? It is being reported (a bit OTT?) that as many as 10,000 Somali children a month face death due to famine. That has to lead my list of big deal I could care less (yawn) subjects.

Newspapers and media never report the brighter side of stories they see as negatives.

Oh wait. Ten thousand a month fewer pirates of the future?. That is the bright side.

And as well, 10,000 fewer to breed. Hmmm. Story gets better and better.

Papers also report that good hearted (and gullible) public has so far responded with something like fifty million in donations, beyond what the govt. sucks out of the public purse for the very same thing. Which reinforces the old adage of suckers being born in large numbers.

If the world is lucky – whatever aid gets there if it does, will arrive too late and thus relieve many in better ordered societies, of a burden imposed on it for far too long.

Posted by peiper

Filed Under: • Personal •

• Comments (1)

Friday - August 05, 2011

Friday - August 05, 2011

Cover Me Boys, I’m going In

update: this text is being entered from my TV!! Convergent technology rocks!

(back on the PC) Ok, the QWERTY keyboard on the back of the remote isn’t the easiest thing to use, and I’ve got to read (or find) a manual on how to use it to drag & drop, double click, highlight, etc. But I did find how to enter characters in the browser window, so it’s a start. Unfortunately the way I entered text wiped out the whole older post. Oops.

Obviously, I got the wireless router installed. It was only slightly tricksy, and half that was my fault. I was using a really complex password, and I kept entering a special character in the wrong spot. Duh. After that it was a breeze, though running back and forth across the house trying to get the router’s program to coordinate with the TV’s program, which wanted to time out and go back to showing some Chris Rock movie, was a pain.

Ok, on to the next device. One down, two to go.

... much later ... Ok, finally done. Everything that can be made wireless is wireless. I don’t know what I’m going to do with all of that, but hey, it’s there.

Turns out there are more than half a dozen wireless home networks that I can receive from my place. One of them has an unlocked guest portal too.

And it only took me all day. With breaks for meals and so forth. But it wasn’t actually all that hard, aside from my using 3Xtra$3Cur3!! passwords. Safe, but a total pain to enter through none QWERTY remotes and interfaces.

Only thing left to do is get a USB A to B cable for the printer. Just in case I need to print something from the television. Whatever.

OTOH, if my wife buys an iPod or one of those tablet devices, everything is already good to go.

Posted by Drew458

Filed Under: • Computers and Cyberspace •

• Comments (3)

Thursday - August 04, 2011

Thursday - August 04, 2011

Dead Goblin += 1;

Story sent in by reader Guitar Teacher:

NEWPORT, Ky. - Newport police continue to investigate the death of 21-year-old Jordan Risheberger who was shot after breaking into a woman’s residence early Monday morning.

Officers were called to the home on 16th Street around 1 a.m. Monday where they found the man dead following a shooting inside the home.

Police say the Risheberger, described as a white male wearing only boxer shorts, entered the home of 63-year-old Phyllis Maloney, through a rear door. Maloney told police the man refused to leave and kept approaching her so she fired two or three shots, striking the suspect in the head.

“She did meet the parameters of what Kentucky law would require. She did give some commands, requested him to leave the house. She felt that her life was threatened. He kept forcing his way through as she was talking to him, trying to get him to stop. He made her retreat back through the home,” said Lt. Tom Collins with the Newport Police Department.

Neighbors say the woman lives alone.

Police say the suspect did not have any sort of identification on him at the time of his death. His name was released Monday night.

Police say Risheberger was a Florence resident who had two previous charges on his record, including marijuana possession and a misdemeanor drug charge.

So my guess is he turned his hand to burglary with rape in mind? Or was he just a whacked out halfwit in his undies trying to get into the wrong house by mistake? We’ll never know.

Riseberger was a cook at the local Bob Evans. He was reported missing Monday after having wandered away from a party at 1am the night before. Someone who claims to have known him posted on a recreational drug forum that he was probably tripping, as that was his style.

Sorry hippies; don’t turn to crime even if you’re high. It’s not worth it.

Posted by Drew458

Filed Under: • Crime •

• Comments (3)

All Your Stupid Is Belong To Us

Stuck on stupid: if you earn $100 a week but spend $200 a week, and borrow $100 each week at 3%, how long will it take to pay off those loans? Answer: Never ever ever. Duh. Yet this latest “Debt Ceiling” confrontation in DC is being hailed as a great victory. For whom, is what I’m asking?

The U.S. debt reached 100 percent of gross domestic product after the government’s debt ceiling was lifted, Treasury figures showed Wednesday, according to AFP.

Debt shot up $238 billion immediately after President Obama signed the deficit-reduction bill into law Tuesday to avoid the country’s first-ever default.

The U.S. has been put in the league with highly indebted countries like Italy and Belgium after the new borrowing took public debt to $14.58 trillion from $14.53 trillion.

The last time the debt topped the size of its annual economy was in 1947 during World War II, according to AFP.

Raising the debt ceiling came hours before Treasury would have to default on the country’s loans after the Senate approved the measure. President Obama then signed it into law.

The contentious debate on Capitol Hill rattled Wall Street for more than a week, as the Dow slid for eight straight days before finishing up 29 points Wednesday.

[ huh. I guess AFP is just as stupid as Yahoo News. In their world, WWII was still going on in 1947. For everyone else, it ended in 1945 ]

Whatever. Whoever. I don’t give a damn anymore. We have made the blind leap off of the cliff, and there is no going back. The USA will become a debtor’s nation, a turd world shit hole. Inescapable. There is no going back. We can no longer even begin to pay back any of the principal on the amount we owe. Period.

Live it up now folks. Go buy a fancy car and a high end home entertainment center. Go get a big fat mortgage on a giant house. Don’t worry, the banks will strike a tax deal with the government so you don’t have to pay the money back. But if I were you I’d be filling the trunk of that fancy BMW and all the closets in that house with durable food. The wheat and corn harvests are going to come in poor this year, and that will turn the already snowballing price of food into an avalanche. At the same time your currency becomes worth less and less. All of which will cause the economy to shrink. And don’t worry, there is no way in hell Obamacare will be repealed or even unfunded now.

Robert Mugabe, you ain’t seen nothing yet.

Posted by Drew458

Filed Under: • Economics •

• Comments (4)

One For CB

Is it Photoshop, or is it the golabki? Betty Beanpole here, 5’9.5”, 34-23-35, 115lbs, got a sudden case of the curves. What a difference 3 months makes.

“Betty” is actually Olga Kaminska and she has been competing in beauty pageants for 5 or so years now, going from a finalist in the Miss Teen Poland 2006 to winning 2010 Miss European Tourism contest at the World Bikini Model pageant. If that sounds a bit confusing, don’t worry. Both contests are held at the same time, and are sponsored by a small aircraft repair shop in Malta. Seriously.

But somehow, by January, she was the curvaceous centerfold for the Polish Playboy magazine.

Must be that good Polish food, to help a skinny girl fill out so quickly.

Olga works as a model and trade show hostess.

Posted by Drew458

Filed Under: • Eye-Candy •

• Comments (0)

Wednesday - August 03, 2011

Wednesday - August 03, 2011

We’re Goona Loose

We got hosed tonight at league. 0-7 against the team we beat 7-0 the last time we played them. Their weakest bowler has moved to another part of the state, and they replaced him with a guy who is really really good. Total sand bagger. JS has a book average just over 200, but in truth he’s a 255 bowler, thereabouts. We bowled well in the first game, all of us well over average; I shot a 237. And we had an 82 pin handicap. They beat us by 62. We didn’t bowl as well the second game, but neither did they. They beat us by 54. We rallied a bit in the third game, rolling about a 750 raw (832 with handicap) and they rallied as well, and beat us by 70. So we got creamed, but we forced them to show their mettle. 164 average bowlers throwing 230 games twice in a night? I don’t think so Timmy. So while we will hold onto first place, this team stays in second place and picks up 7, which cuts our lead to 4.

Next week is the last week of regular bowling. We can probably win at least 5. Then the last two weeks are the play offs, where we will face tonight’s team again two weeks in a row. Unless some kind of miracle happens, they’re going to beat us right at the end of the season. Just like sand baggers. Which is what you call bowlers who do tactical bowling far better than you do.

Rats.

Posted by Drew458

Filed Under: • Bowling Blogging •

• Comments (0)

Next Task

Oh joy, I’m Mr. Housework today. In between projects; I’ve got 2 coats of Minwax stain on those oak doors and they’re looking great. As much as I want to rush things, I’m going to wait until tomorrow to put the polyurethane on. Let the stain dry a full day, even though it’s warm enough in the garage that 5 minutes after a heavy rub on of stain there’s hardly anything left to wipe off. But better safe than sorry. I’m also going wireless with the house. Somehow we’ve amassed 4 devices that are WiFi capable, so it’s high time I joined the 21st century. I got a really nice dual band high speed router for a great price, which should be delivered by the weekend. My brother assures me set-up is a breeze, and online reviews say it’s all PHD these days (Push Here, Dummy). Fingers crossed.

I love hot wings, but there isn’t much meat to eat on them. So I made hot wings with chicken thighs. I love grilled chicken, and the condo park does have a really nice Jenn-Air BBQ grill down by the pool ... half a mile away. A bit far to walk with a tray of chicken, and it’s not too much fun standing by the grill when it’s 100° F outside. So I figured I could grill in the oven. Put a cooling rack over a baking sheet pan, turn up the heat, and away you go! Right? Mostly. The thing about grilling, and the reason you do it outside, is all the smoke it creates. So it was another case of me opening all the windows and doors suddenly, getting out the window fan, and doing my best to clear the air in the apartment and keep the smoke alarm from going off. Which rather obviated all that nice air conditioning.

I put the thighs on the rack upside down, and gave the bottoms a quick basting of Tabasco and Sriracha sauce and into the 450 oven they went. 20 minutes later I flipped them and coated the skin side the same. 20 minutes after that I turned off the oven, pulled out the tray, and coated each thigh with Sweet Baby Ray’s Buffalo Chicken Marinade. I could have made my own sauce easily, but I was feeling lazy. Ray’s is good, and it was on sale for half off. Back into the cooling oven for another 15 minutes to dry the sauce out a bit, and I had nicely cooked thighs with crispy skin and a good hot but not crazy hot sauce. Most of the hot pepper heat cooks off, just leaving flavor behind.

The other thing about grilling chicken outside is that it spatters. A lot.

So on my honey-dew list for today, after taking out the garbage and the several kinds of recycling, is cleaning the oven. And then scrubbing that baking sheet clean. But it was worth it!

Posted by Drew458

Filed Under: • Daily Life •

• Comments (2)

Five Most Recent Trackbacks:

Once Again, The One And Only Post

(4 total trackbacks)

Tracked at iHaan.org

The advantage to having a guide with you is thɑt an expert will haѵe very first hand experience dealing and navigating the river with гegional wildlife. Tһomas, there are great…

On: 07/28/23 10:37

The Brownshirts: Partie Deux; These aare the Muscle We've Been Waiting For

(3 total trackbacks)

Tracked at head to the Momarms site

The Brownshirts: Partie Deux; These aare the Muscle We’ve Been Waiting For

On: 03/14/23 11:20

Vietnam Homecoming

(1 total trackbacks)

Tracked at 广告专题配音 专业从事中文配音跟外文配音制造,北京名传天下配音公司

专业从事中文配音和外文配音制作,北京名传天下配音公司 北京名传天下专业配音公司成破于2006年12月,是专业从事中 中文配音 文配音跟外文配音的音频制造公司,幻想飞腾配音网领 配音制作 有海内外优良专业配音职员已达500多位,可供给一流的外语配音,长年服务于国内中心级各大媒体、各省市电台电视台,能满意不同客户的各种需要。电话:010-83265555 北京名传天下专业配音公司…

On: 03/20/21 07:00

meaningless marching orders for a thousand travellers ... strife ahead ..

(1 total trackbacks)

Tracked at Casual Blog

[...] RTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPL [...]

On: 07/17/17 04:28

a small explanation

(1 total trackbacks)

Tracked at yerba mate gourd

Find here top quality how to prepare yerba mate without a gourd that's available in addition at the best price. Get it now!

On: 07/09/17 03:07

DISCLAIMER

THE SERVICES AND MATERIALS ON THIS WEBSITE ARE PROVIDED "AS IS" AND THE HOSTS OF THIS SITE EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, TO THE EXTENT PERMITTED BY LAW INCLUDING BUT NOT LIMITED TO WARRANTIES OF SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THE SERVICE OR ANY MATERIALS.

Not that very many people ever read this far down, but this blog was the creation of Allan Kelly and his friend Vilmar. Vilmar moved on to his own blog some time ago, and Allan ran this place alone until his sudden and unexpected death partway through 2006. We all miss him. A lot. Even though he is gone this site will always still be more than a little bit his. We who are left to carry on the BMEWS tradition owe him a great debt of gratitude, and we hope to be able to pay that back by following his last advice to us all:

It's been a long strange trip without you Skipper, but thanks for pointing us in the right direction and giving us a swift kick in the behind to get us going. Keep lookin' down on us, will ya? Thanks.

- Keep a firm grasp of Right and Wrong

- Stay involved with government on every level and don't let those bastards get away with a thing

- Use every legal means to defend yourself in the event of real internal trouble, and, most importantly:

- Keep talking to each other, whether here or elsewhere

THE INFORMATION AND OTHER CONTENTS OF THIS WEBSITE ARE DESIGNED TO COMPLY WITH THE LAWS OF THE UNITED STATES OF AMERICA. THIS WEBSITE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE UNITED STATES OF AMERICA AND ALL PARTIES IRREVOCABLY SUBMIT TO THE JURISDICTION OF THE AMERICAN COURTS. IF ANYTHING ON THIS WEBSITE IS CONSTRUED AS BEING CONTRARY TO THE LAWS APPLICABLE IN ANY OTHER COUNTRY, THEN THIS WEBSITE IS NOT INTENDED TO BE ACCESSED BY PERSONS FROM THAT COUNTRY AND ANY PERSONS WHO ARE SUBJECT TO SUCH LAWS SHALL NOT BE ENTITLED TO USE OUR SERVICES UNLESS THEY CAN SATISFY US THAT SUCH USE WOULD BE LAWFUL.

Copyright © 2004-2015 Domain Owner

Oh, and here's some kind of visitor flag counter thingy. Hey, all the cool blogs have one, so I should too. The Visitors Online thingy up at the top doesn't count anything, but it looks neat. It had better, since I paid actual money for it.